Luxury handbag investment offers high-end brands like Hermes and Chanel, which consistently appreciate due to limited production and enduring fashion appeal. Precious metals such as gold and silver provide stability and hedge against inflation, with a long history as reliable stores of value. Explore the unique benefits and risks of each investment to make informed financial decisions.

Why it is important

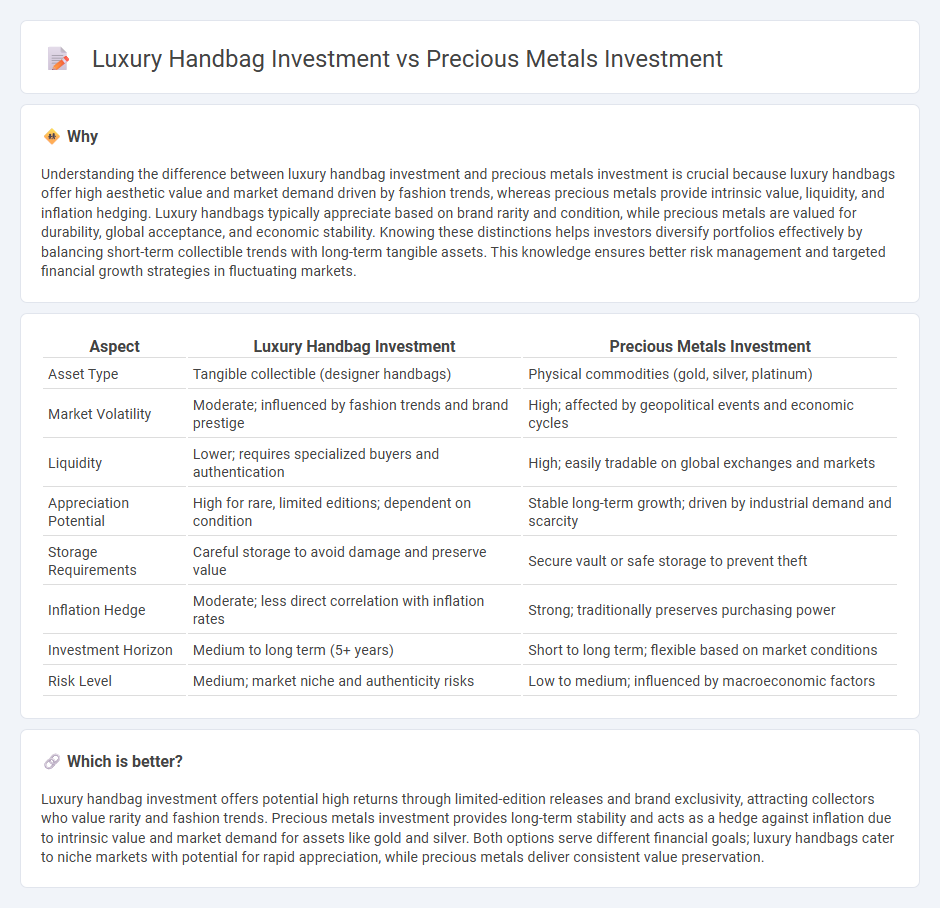

Understanding the difference between luxury handbag investment and precious metals investment is crucial because luxury handbags offer high aesthetic value and market demand driven by fashion trends, whereas precious metals provide intrinsic value, liquidity, and inflation hedging. Luxury handbags typically appreciate based on brand rarity and condition, while precious metals are valued for durability, global acceptance, and economic stability. Knowing these distinctions helps investors diversify portfolios effectively by balancing short-term collectible trends with long-term tangible assets. This knowledge ensures better risk management and targeted financial growth strategies in fluctuating markets.

Comparison Table

| Aspect | Luxury Handbag Investment | Precious Metals Investment |

|---|---|---|

| Asset Type | Tangible collectible (designer handbags) | Physical commodities (gold, silver, platinum) |

| Market Volatility | Moderate; influenced by fashion trends and brand prestige | High; affected by geopolitical events and economic cycles |

| Liquidity | Lower; requires specialized buyers and authentication | High; easily tradable on global exchanges and markets |

| Appreciation Potential | High for rare, limited editions; dependent on condition | Stable long-term growth; driven by industrial demand and scarcity |

| Storage Requirements | Careful storage to avoid damage and preserve value | Secure vault or safe storage to prevent theft |

| Inflation Hedge | Moderate; less direct correlation with inflation rates | Strong; traditionally preserves purchasing power |

| Investment Horizon | Medium to long term (5+ years) | Short to long term; flexible based on market conditions |

| Risk Level | Medium; market niche and authenticity risks | Low to medium; influenced by macroeconomic factors |

Which is better?

Luxury handbag investment offers potential high returns through limited-edition releases and brand exclusivity, attracting collectors who value rarity and fashion trends. Precious metals investment provides long-term stability and acts as a hedge against inflation due to intrinsic value and market demand for assets like gold and silver. Both options serve different financial goals; luxury handbags cater to niche markets with potential for rapid appreciation, while precious metals deliver consistent value preservation.

Connection

Luxury handbag investment and precious metals investment both serve as tangible asset classes that offer portfolio diversification and hedge against inflation. High-demand luxury handbags, like limited-edition models from Chanel or Hermes, retain or appreciate in value similarly to gold and silver due to their scarcity and brand prestige. Both investments benefit from market liquidity and global demand, making them viable options for long-term wealth preservation.

Key Terms

**Precious metals investment:**

Investing in precious metals like gold, silver, and platinum offers long-term wealth preservation and acts as a hedge against inflation and economic uncertainty. These metals have intrinsic value, are globally recognized, and provide liquidity in volatile markets. Explore the benefits and risks of precious metals investment to make informed financial decisions.

Spot Price

Spot prices of precious metals like gold and silver provide transparent, real-time market values reflecting global supply and demand, making them a reliable metric for investors. Luxury handbags, while influenced by brand prestige and rarity, lack a standardized spot price and often exhibit price volatility dependent on trends and collector interest. Explore deeper insights into how spot price dynamics impact investment strategies in both sectors.

Purity

Precious metals investment centers on purity standards, with gold often measured in karats (24K being pure gold) and silver rated by fineness (e.g., 999 representing 99.9% purity). Luxury handbag investment values authenticity and craftsmanship, where limited editions and brand reputation influence worth more than material purity. Discover the key factors that differentiate these investments and optimize your portfolio decision.

Source and External Links

Investing in Precious Metals: A Guide for Beginners - This guide provides an overview of precious metals investing, including methods such as buying bullion and investing in mining company stocks.

Seven things to consider when investing in precious metals - This article discusses the reasons to invest in precious metals, such as diversification and stability during economic downturns.

Gold, Silver, Platinum, and Palladium Trading - Fidelity offers investors the opportunity to purchase precious metals as part of a diversification strategy, which can help protect against economic uncertainty and inflation.

dowidth.com

dowidth.com