The secondaries market in investment provides liquidity by allowing investors to buy and sell pre-existing stakes in private equity funds, offering flexibility and reduced risk compared to primary fund commitments. Infrastructure funds focus on long-term investments in physical assets such as transportation, energy, and utilities, delivering stable cash flows and inflation protection. Discover how these investment options compare in risk, return, and portfolio diversification strategies.

Why it is important

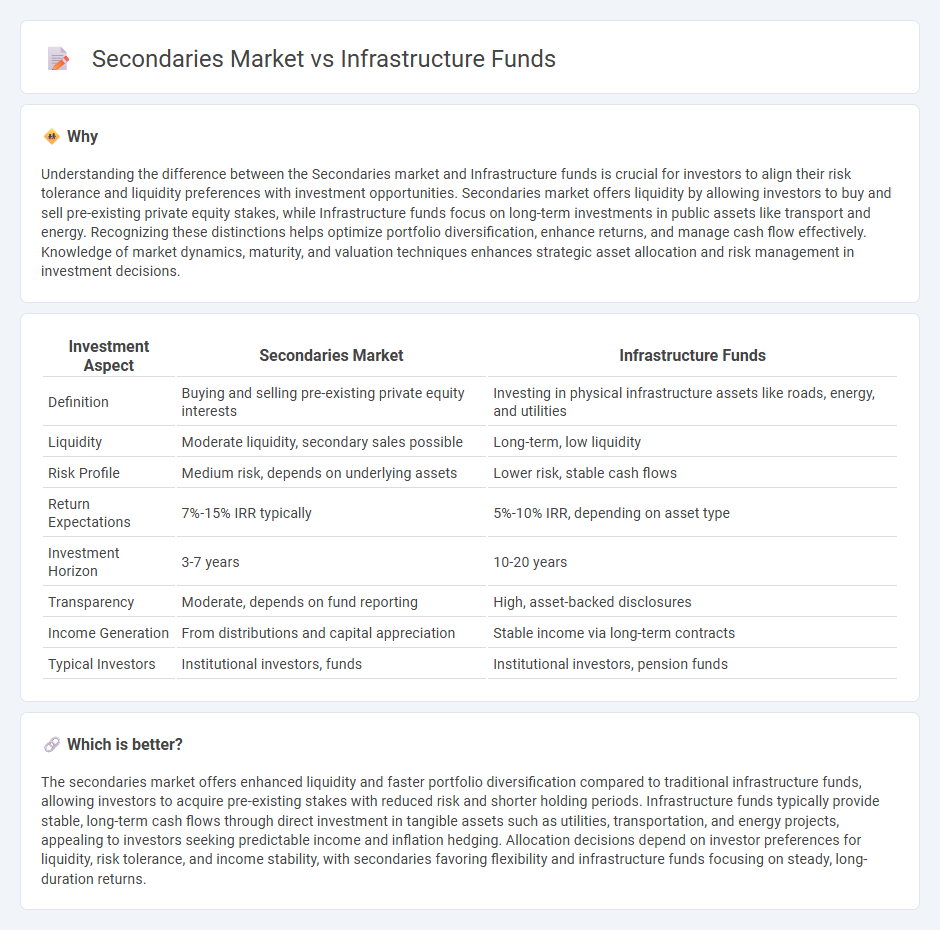

Understanding the difference between the Secondaries market and Infrastructure funds is crucial for investors to align their risk tolerance and liquidity preferences with investment opportunities. Secondaries market offers liquidity by allowing investors to buy and sell pre-existing private equity stakes, while Infrastructure funds focus on long-term investments in public assets like transport and energy. Recognizing these distinctions helps optimize portfolio diversification, enhance returns, and manage cash flow effectively. Knowledge of market dynamics, maturity, and valuation techniques enhances strategic asset allocation and risk management in investment decisions.

Comparison Table

| Investment Aspect | Secondaries Market | Infrastructure Funds |

|---|---|---|

| Definition | Buying and selling pre-existing private equity interests | Investing in physical infrastructure assets like roads, energy, and utilities |

| Liquidity | Moderate liquidity, secondary sales possible | Long-term, low liquidity |

| Risk Profile | Medium risk, depends on underlying assets | Lower risk, stable cash flows |

| Return Expectations | 7%-15% IRR typically | 5%-10% IRR, depending on asset type |

| Investment Horizon | 3-7 years | 10-20 years |

| Transparency | Moderate, depends on fund reporting | High, asset-backed disclosures |

| Income Generation | From distributions and capital appreciation | Stable income via long-term contracts |

| Typical Investors | Institutional investors, funds | Institutional investors, pension funds |

Which is better?

The secondaries market offers enhanced liquidity and faster portfolio diversification compared to traditional infrastructure funds, allowing investors to acquire pre-existing stakes with reduced risk and shorter holding periods. Infrastructure funds typically provide stable, long-term cash flows through direct investment in tangible assets such as utilities, transportation, and energy projects, appealing to investors seeking predictable income and inflation hedging. Allocation decisions depend on investor preferences for liquidity, risk tolerance, and income stability, with secondaries favoring flexibility and infrastructure funds focusing on steady, long-duration returns.

Connection

The secondaries market enhances liquidity for infrastructure funds by enabling the buying and selling of pre-existing stakes in infrastructure assets, thereby improving capital recycling and investor exit opportunities. Infrastructure funds benefit from secondary transactions as they attract more investors willing to participate in long-term projects due to the availability of secondary market options. This dynamic fosters efficient capital allocation and risk management within the infrastructure investment ecosystem.

Key Terms

Asset Class

Infrastructure funds primarily invest in long-term physical assets such as transportation, energy, and utilities, offering stable cash flows and inflation protection. The secondaries market involves the buying and selling of pre-existing infrastructure fund interests, providing liquidity and potential for discounted entry into mature assets with reduced risk. Explore further to understand the strategic benefits and risk profiles of each asset class in infrastructure investment.

Liquidity

Infrastructure funds typically have longer lock-up periods and limited liquidity, as capital is committed for large-scale, long-term projects. In contrast, the secondaries market offers greater flexibility and quicker access to cash by allowing investors to buy and sell existing fund interests. Explore how liquidity dynamics influence investment strategies in these two domains.

Valuation

Infrastructure funds typically value assets based on projected cash flows, long-term contracts, and inflation-linked revenue streams, reflecting stable, income-generating projects. In contrast, the secondaries market often applies discounts to net asset value (NAV) to account for liquidity, market demand, and transaction timing, leading to potentially more attractive entry points. Explore the nuances of valuation methodologies further to optimize investment strategies in both sectors.

Source and External Links

Infrastructure fund - Wikipedia - An infrastructure fund is a privately offered or publicly listed fund that invests directly or indirectly in infrastructure and associated industries such as power plants, transportation systems, and communications; it is projected that $1.87 trillion will be dedicated to infrastructure investments by 2026.

Brookfield Global Listed Infrastructure Fund - This fund seeks total return through growth of capital and current income by investing primarily in publicly traded infrastructure companies and notes associated risks including high leverage and regulatory costs.

Largest Infrastructure Fund Managers | Infrastructure Investor 100 - Brookfield Asset Management is the largest infrastructure fund manager with over $103 billion raised, followed by Global Infrastructure Partners, KKR, and Macquarie Asset Management among the top global managers.

dowidth.com

dowidth.com