Music royalties provide a unique investment opportunity by generating passive income through licensing fees and streaming revenue, offering diversification from traditional assets. Exchange-traded funds (ETFs) allow investors to gain exposure to a broad range of stocks or bonds with lower fees and high liquidity, suitable for diversified portfolio growth. Explore the benefits and risks of both to optimize your investment strategy.

Why it is important

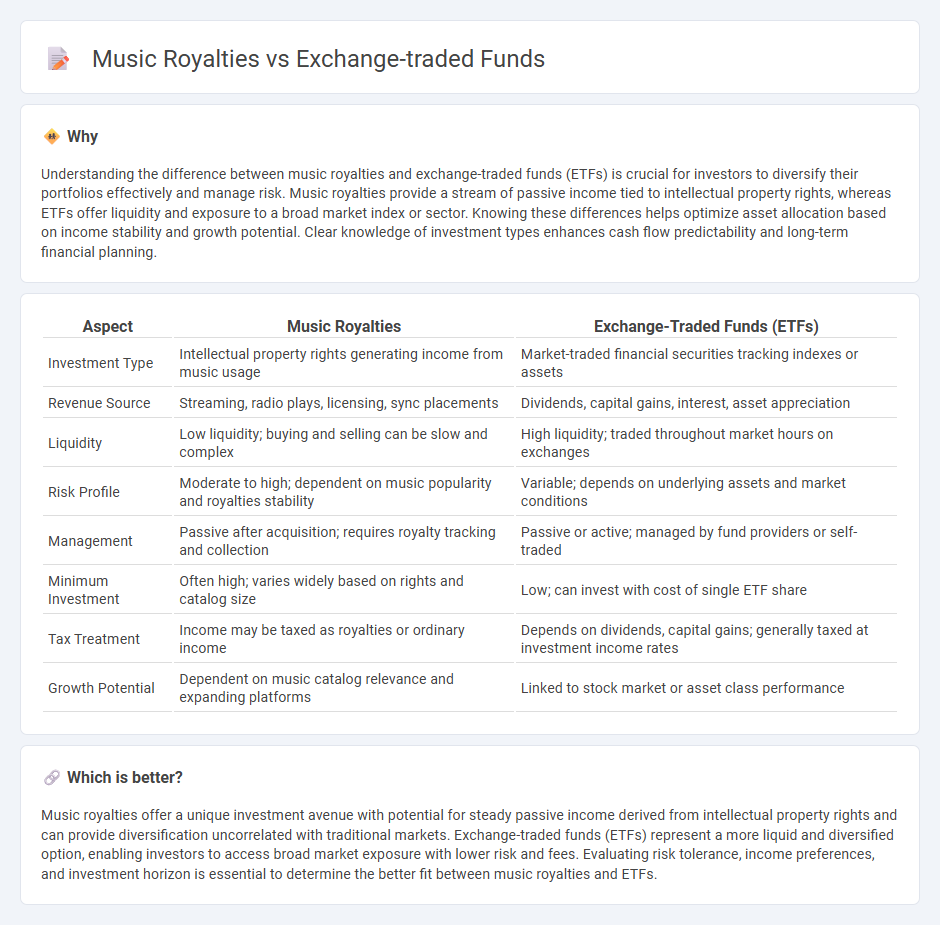

Understanding the difference between music royalties and exchange-traded funds (ETFs) is crucial for investors to diversify their portfolios effectively and manage risk. Music royalties provide a stream of passive income tied to intellectual property rights, whereas ETFs offer liquidity and exposure to a broad market index or sector. Knowing these differences helps optimize asset allocation based on income stability and growth potential. Clear knowledge of investment types enhances cash flow predictability and long-term financial planning.

Comparison Table

| Aspect | Music Royalties | Exchange-Traded Funds (ETFs) |

|---|---|---|

| Investment Type | Intellectual property rights generating income from music usage | Market-traded financial securities tracking indexes or assets |

| Revenue Source | Streaming, radio plays, licensing, sync placements | Dividends, capital gains, interest, asset appreciation |

| Liquidity | Low liquidity; buying and selling can be slow and complex | High liquidity; traded throughout market hours on exchanges |

| Risk Profile | Moderate to high; dependent on music popularity and royalties stability | Variable; depends on underlying assets and market conditions |

| Management | Passive after acquisition; requires royalty tracking and collection | Passive or active; managed by fund providers or self-traded |

| Minimum Investment | Often high; varies widely based on rights and catalog size | Low; can invest with cost of single ETF share |

| Tax Treatment | Income may be taxed as royalties or ordinary income | Depends on dividends, capital gains; generally taxed at investment income rates |

| Growth Potential | Dependent on music catalog relevance and expanding platforms | Linked to stock market or asset class performance |

Which is better?

Music royalties offer a unique investment avenue with potential for steady passive income derived from intellectual property rights and can provide diversification uncorrelated with traditional markets. Exchange-traded funds (ETFs) represent a more liquid and diversified option, enabling investors to access broad market exposure with lower risk and fees. Evaluating risk tolerance, income preferences, and investment horizon is essential to determine the better fit between music royalties and ETFs.

Connection

Music royalties provide a unique income stream that can be securitized and traded through exchange-traded funds (ETFs), allowing investors to access diversified revenue from copyrighted music assets. ETFs specializing in music royalties pool earnings from various artists and catalogues, offering exposure to the music industry's cash flows without direct ownership. This investment strategy blends entertainment economics with financial markets, leveraging the steady royalty payments as an alternative asset class within exchange-traded funds.

Key Terms

Liquidity

Exchange-traded funds (ETFs) offer high liquidity with shares traded on stock exchanges, allowing investors to buy and sell quickly at market prices. Music royalties, by contrast, are less liquid assets, often requiring longer periods to sell and complex transactions due to copyright and licensing considerations. Explore further to understand how these liquidity differences impact investment strategies and portfolio diversification.

Diversification

Exchange-traded funds (ETFs) provide diversification by allowing investors to buy a single security that tracks a broad index, spreading risk across multiple asset classes and sectors. In contrast, music royalties offer diversification through exposure to intangible assets and income streams derived from intellectual property rights across various genres and artists. Discover how combining ETFs with music royalties can optimize your investment portfolio's diversification strategy.

Income stream

Exchange-traded funds (ETFs) provide diversified income streams through dividends and interest from a broad portfolio of assets, offering liquidity and relatively stable cash flow. Music royalties generate income based on the performance and licensing of copyrighted works, often delivering higher yields but with greater variability and less liquidity. Explore the unique income opportunities and risks associated with each asset class to determine the best fit for your financial goals.

Source and External Links

What is an ETF (Exchange-Traded Fund)? - Charles Schwab - ETFs combine the trading flexibility of stocks with the diversification benefits of mutual funds, allowing investors to buy and sell bundles of assets throughout the trading day, often with lower costs and greater tax efficiency than mutual funds.

Exchange-traded fund - Wikipedia - ETFs are investment funds traded on stock exchanges that differ from mutual funds by their intra-day tradability, greater transparency, lower fees, and tax efficiency, often tracking indexes or baskets of securities.

Exchange-Traded Funds and Products | FINRA.org - ETFs, the most common exchange-traded products (ETPs), are pooled investment funds that provide exposure to a basket of assets, traded like stocks on exchanges with their risks, fees, and objectives disclosed in prospectuses.

dowidth.com

dowidth.com