Wine investing platforms offer unique opportunities by allowing investors to access a tangible asset with historical appreciation potential, often correlating with rare vintages and global demand. Gold and precious metals platforms provide a more liquid, historically stable investment, backed by intrinsic value and widespread market acceptance. Explore these platforms to determine which asset class aligns best with your portfolio goals and risk tolerance.

Why it is important

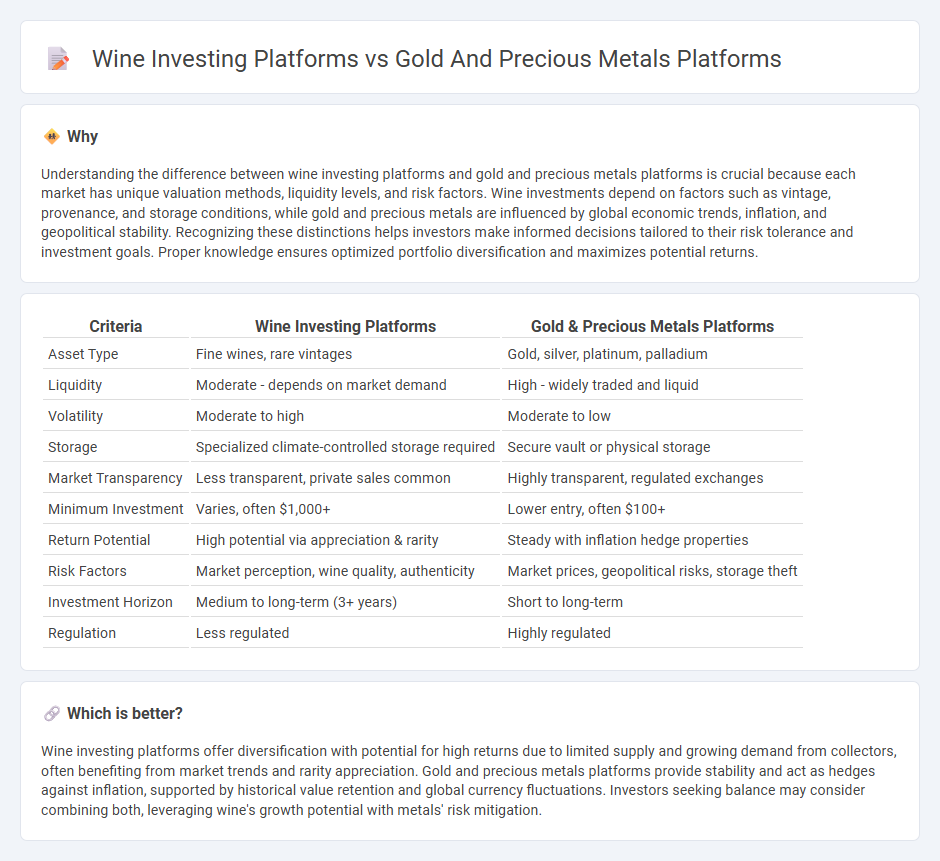

Understanding the difference between wine investing platforms and gold and precious metals platforms is crucial because each market has unique valuation methods, liquidity levels, and risk factors. Wine investments depend on factors such as vintage, provenance, and storage conditions, while gold and precious metals are influenced by global economic trends, inflation, and geopolitical stability. Recognizing these distinctions helps investors make informed decisions tailored to their risk tolerance and investment goals. Proper knowledge ensures optimized portfolio diversification and maximizes potential returns.

Comparison Table

| Criteria | Wine Investing Platforms | Gold & Precious Metals Platforms |

|---|---|---|

| Asset Type | Fine wines, rare vintages | Gold, silver, platinum, palladium |

| Liquidity | Moderate - depends on market demand | High - widely traded and liquid |

| Volatility | Moderate to high | Moderate to low |

| Storage | Specialized climate-controlled storage required | Secure vault or physical storage |

| Market Transparency | Less transparent, private sales common | Highly transparent, regulated exchanges |

| Minimum Investment | Varies, often $1,000+ | Lower entry, often $100+ |

| Return Potential | High potential via appreciation & rarity | Steady with inflation hedge properties |

| Risk Factors | Market perception, wine quality, authenticity | Market prices, geopolitical risks, storage theft |

| Investment Horizon | Medium to long-term (3+ years) | Short to long-term |

| Regulation | Less regulated | Highly regulated |

Which is better?

Wine investing platforms offer diversification with potential for high returns due to limited supply and growing demand from collectors, often benefiting from market trends and rarity appreciation. Gold and precious metals platforms provide stability and act as hedges against inflation, supported by historical value retention and global currency fluctuations. Investors seeking balance may consider combining both, leveraging wine's growth potential with metals' risk mitigation.

Connection

Wine investing platforms and gold and precious metals platforms both offer alternative asset classes that provide portfolio diversification and serve as hedges against inflation. These platforms leverage digital marketplaces to enable fractional ownership and increase accessibility to historically exclusive investments. Market trends in luxury goods and precious commodities often correlate, reflecting investor sentiment toward tangible assets during economic uncertainty.

Key Terms

Liquidity

Gold and precious metals platforms often provide higher liquidity due to established global markets and real-time trading options, enabling quicker asset conversion into cash. In contrast, wine investing platforms tend to have lower liquidity, as the market relies more on niche collectors and auctions with longer sales cycles. Explore detailed comparisons to understand how liquidity impacts your investment decisions.

Storage and Custody

Gold and precious metals investing platforms often emphasize secure vault storage with insured custody solutions, ensuring physical asset protection through third-party custodians worldwide. Wine investing platforms typically focus on climate-controlled storage facilities with provenance tracking to maintain quality and authenticity over time. Explore more about the differences in storage and custody practices between these unique investment types.

Authenticity Verification

Gold and precious metals platforms prioritize authenticity verification through advanced assay tests, serial number tracking, and blockchain certificates to ensure the provenance and purity of assets. Wine investing platforms rely on expert appraisal, provenance documentation, and tamper-evident seals to guarantee the authenticity and quality of rare vintages. Explore in-depth comparisons to understand how each platform secures investment integrity effectively.

Source and External Links

GBI: Physical Precious Metals for Wealth Management - A platform integrated with major wealth management firms, offering real-time trading and secure storage of physical precious metals for institutional customers and investors.

BullionVault: Buy Gold, Silver and Platinum Bullion Online - The world's largest online bullion market, enabling users to buy, sell, and store physical gold, silver, platinum, and palladium 24/7 at near wholesale prices with vaults in major financial centers.

APMEX: Precious Metals Dealer | Buy Gold and Silver - A reputable precious metals dealer providing a wide selection of gold, silver, platinum, and palladium bullion with fast, free shipping for orders over $199.

dowidth.com

dowidth.com