Fine art micro-shares allow investors to own fractional interests in high-value artworks, providing access to a traditionally exclusive market with tangible asset backing and potential long-term appreciation. Cryptocurrency tokens represent digital assets that offer liquidity and ease of transfer through blockchain technology but often carry higher volatility and regulatory uncertainty. Explore the unique benefits and risks of fine art micro-shares and cryptocurrency tokens to determine the best fit for your investment portfolio.

Why it is important

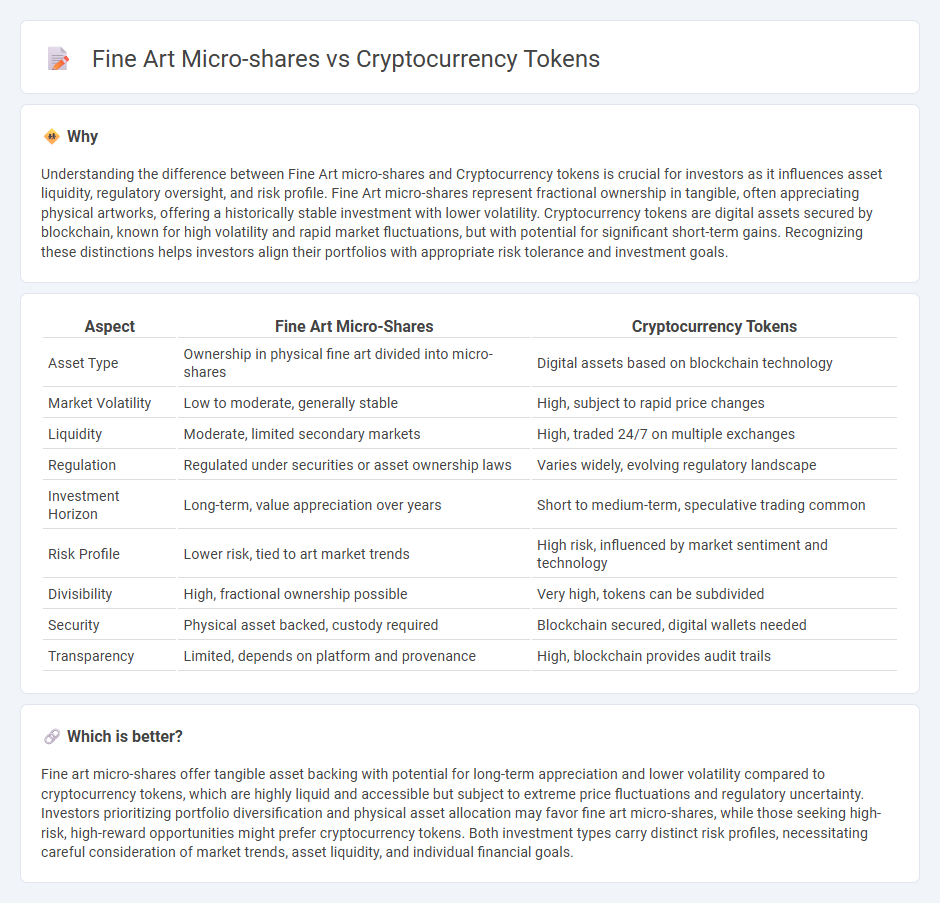

Understanding the difference between Fine Art micro-shares and Cryptocurrency tokens is crucial for investors as it influences asset liquidity, regulatory oversight, and risk profile. Fine Art micro-shares represent fractional ownership in tangible, often appreciating physical artworks, offering a historically stable investment with lower volatility. Cryptocurrency tokens are digital assets secured by blockchain, known for high volatility and rapid market fluctuations, but with potential for significant short-term gains. Recognizing these distinctions helps investors align their portfolios with appropriate risk tolerance and investment goals.

Comparison Table

| Aspect | Fine Art Micro-Shares | Cryptocurrency Tokens |

|---|---|---|

| Asset Type | Ownership in physical fine art divided into micro-shares | Digital assets based on blockchain technology |

| Market Volatility | Low to moderate, generally stable | High, subject to rapid price changes |

| Liquidity | Moderate, limited secondary markets | High, traded 24/7 on multiple exchanges |

| Regulation | Regulated under securities or asset ownership laws | Varies widely, evolving regulatory landscape |

| Investment Horizon | Long-term, value appreciation over years | Short to medium-term, speculative trading common |

| Risk Profile | Lower risk, tied to art market trends | High risk, influenced by market sentiment and technology |

| Divisibility | High, fractional ownership possible | Very high, tokens can be subdivided |

| Security | Physical asset backed, custody required | Blockchain secured, digital wallets needed |

| Transparency | Limited, depends on platform and provenance | High, blockchain provides audit trails |

Which is better?

Fine art micro-shares offer tangible asset backing with potential for long-term appreciation and lower volatility compared to cryptocurrency tokens, which are highly liquid and accessible but subject to extreme price fluctuations and regulatory uncertainty. Investors prioritizing portfolio diversification and physical asset allocation may favor fine art micro-shares, while those seeking high-risk, high-reward opportunities might prefer cryptocurrency tokens. Both investment types carry distinct risk profiles, necessitating careful consideration of market trends, asset liquidity, and individual financial goals.

Connection

Fine art micro-shares and cryptocurrency tokens are connected through blockchain technology, enabling fractional ownership and secure trading of high-value assets. These digital tokens represent partial stakes in fine art pieces, increasing liquidity and accessibility for investors worldwide. This convergence of art and crypto markets creates innovative investment opportunities and diversifies portfolios.

Key Terms

Ownership structure

Cryptocurrency tokens represent fractional ownership encoded on blockchain technology, enabling transparent, secure, and easily transferable digital assets. Fine art micro-shares offer fractional equity in physical artworks, often managed through custodial arrangements and regulatory frameworks that govern tangible asset ownership. Explore the nuances of each ownership structure to understand their benefits and limitations in diversifying investment portfolios.

Liquidity

Cryptocurrency tokens offer high liquidity through 24/7 global trading on decentralized exchanges, enabling instant transactions and price discovery. Fine art micro-shares provide fractional ownership but often suffer from limited market depth and longer holding periods, impacting liquidity and exit options. Explore the nuances of liquidity dynamics in asset tokenization to make informed investment decisions.

Regulatory environment

Cryptocurrency tokens and fine art micro-shares operate under distinct regulatory frameworks that impact their market accessibility and investor protections. Cryptocurrency tokens are often subject to securities laws, anti-money laundering regulations, and evolving guidelines from entities like the SEC and FINRA, whereas fine art micro-shares fall under securities and asset-specific regulations that vary by jurisdiction and emphasize provenance and authenticity. Explore detailed regulatory comparisons to better understand compliance requirements and investment risks in both markets.

Source and External Links

Digital Assets: Cryptocurrencies vs. Crypto Tokens - Gemini - Cryptocurrency tokens are digital assets built on top of an existing blockchain (like Ethereum), unlike cryptocurrencies that have their own native blockchain; tokens can serve various functions including platform participation and gameplay, often programmable, permissionless, trustless, and transparent.

What is a token? - Coinbase - Tokens are crypto assets that typically run on another cryptocurrency's blockchain and have diverse functions such as enabling decentralized finance or representing virtual assets, and they can be traded like cryptocurrencies.

Crypto tokens - BaFin - Crypto tokens are digital representations of value created within blockchains via smart contracts, classified under different supervisory categories and possibly regarded as financial instruments under regulatory law in some jurisdictions like Germany.

dowidth.com

dowidth.com