Sports memorabilia funds offer investors exposure to rare collectibles with potential for high appreciation, driven by limited supply and passionate fan bases. Exchange-traded funds (ETFs) provide diversified portfolios of stocks or bonds, delivering liquidity, lower fees, and broad market access. Explore the advantages and risks of sports memorabilia funds versus ETFs to make informed investment decisions.

Why it is important

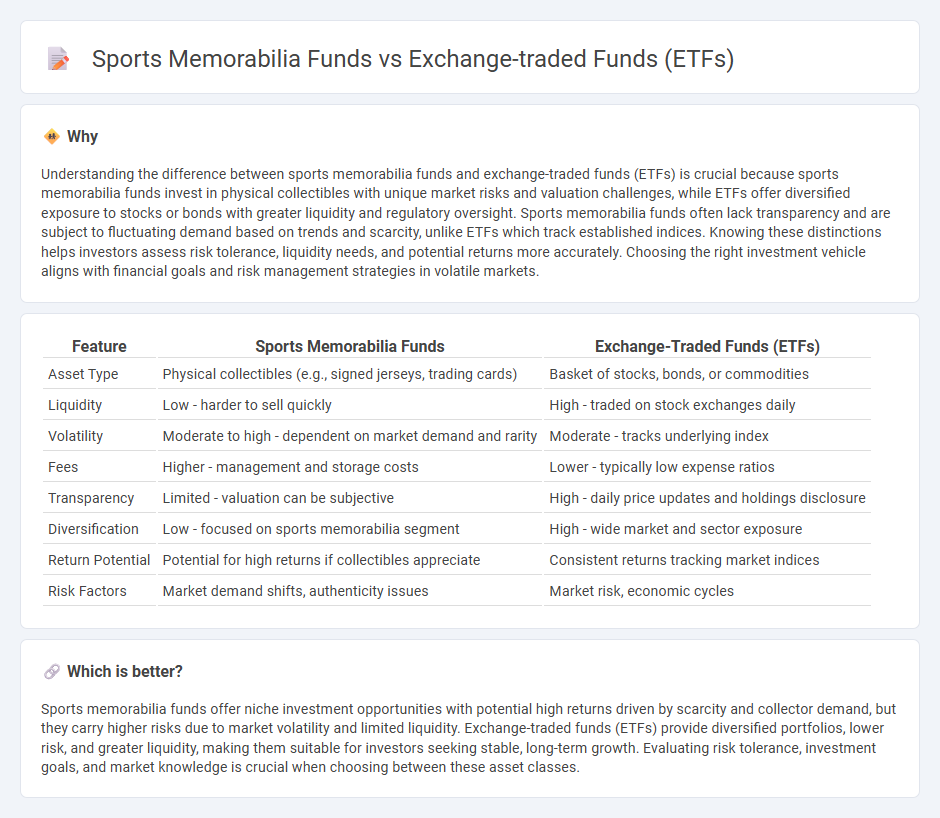

Understanding the difference between sports memorabilia funds and exchange-traded funds (ETFs) is crucial because sports memorabilia funds invest in physical collectibles with unique market risks and valuation challenges, while ETFs offer diversified exposure to stocks or bonds with greater liquidity and regulatory oversight. Sports memorabilia funds often lack transparency and are subject to fluctuating demand based on trends and scarcity, unlike ETFs which track established indices. Knowing these distinctions helps investors assess risk tolerance, liquidity needs, and potential returns more accurately. Choosing the right investment vehicle aligns with financial goals and risk management strategies in volatile markets.

Comparison Table

| Feature | Sports Memorabilia Funds | Exchange-Traded Funds (ETFs) |

|---|---|---|

| Asset Type | Physical collectibles (e.g., signed jerseys, trading cards) | Basket of stocks, bonds, or commodities |

| Liquidity | Low - harder to sell quickly | High - traded on stock exchanges daily |

| Volatility | Moderate to high - dependent on market demand and rarity | Moderate - tracks underlying index |

| Fees | Higher - management and storage costs | Lower - typically low expense ratios |

| Transparency | Limited - valuation can be subjective | High - daily price updates and holdings disclosure |

| Diversification | Low - focused on sports memorabilia segment | High - wide market and sector exposure |

| Return Potential | Potential for high returns if collectibles appreciate | Consistent returns tracking market indices |

| Risk Factors | Market demand shifts, authenticity issues | Market risk, economic cycles |

Which is better?

Sports memorabilia funds offer niche investment opportunities with potential high returns driven by scarcity and collector demand, but they carry higher risks due to market volatility and limited liquidity. Exchange-traded funds (ETFs) provide diversified portfolios, lower risk, and greater liquidity, making them suitable for investors seeking stable, long-term growth. Evaluating risk tolerance, investment goals, and market knowledge is crucial when choosing between these asset classes.

Connection

Sports memorabilia funds and exchange-traded funds (ETFs) both represent alternative investment vehicles offering portfolio diversification beyond traditional stocks and bonds. Sports memorabilia funds pool capital to invest in rare collectible items, leveraging market demand and scarcity, while ETFs aggregate diversified assets, including niche markets like collectibles or sports-related companies. Both investment types provide access to specialized markets through collective investment structures, appealing to investors seeking exposure to tangible assets and growth potential driven by fan engagement and market trends.

Key Terms

Liquidity

Exchange-traded funds (ETFs) offer high liquidity through continuous trading on stock exchanges, enabling investors to buy and sell shares instantly at market prices during trading hours. Sports memorabilia funds tend to have lower liquidity due to the niche market and longer selling periods required to find buyers for unique collectibles. Explore the differences in liquidity and investment potential between ETFs and sports memorabilia funds to inform your portfolio strategy.

Valuation

Exchange-traded funds (ETFs) derive valuation from market prices reflecting the underlying asset portfolio, ensuring liquidity and real-time pricing efficiency. Sports memorabilia funds rely on appraisals and market demand, introducing subjectivity and valuation volatility due to rarity and condition factors. Explore deeper insights to understand the valuation nuances between ETFs and sports memorabilia funds.

Diversification

Exchange-traded funds (ETFs) offer broad diversification by pooling a wide range of assets such as stocks, bonds, and commodities, reducing individual asset risk through varied exposure. Sports memorabilia funds concentrate investments in rare and collectible items like signed jerseys and game-used equipment, which can provide niche market gains but carry higher liquidity and valuation risks. Explore detailed comparisons to understand which investment aligns best with your portfolio goals and risk tolerance.

Source and External Links

Exchange-Traded Funds (ETFs) - ETFs are exchange-traded investment products that offer professional management, diversification, low minimum investment, and liquidity, often with tax advantages over mutual funds.

Exchange-Traded Fund (ETF) - This page explains that ETFs are similar to mutual funds but are traded on national securities exchanges at market prices, offering transparency and tax efficiency.

What is an ETF (Exchange-Traded Fund)? - ETFs combine the flexibility of stocks with the diversifying strengths of mutual funds, providing an affordable way to access various asset classes with lower costs and trading flexibility.

dowidth.com

dowidth.com