Farmland crowdfunding offers investors access to agricultural land assets through pooled funding platforms, providing diversification and potential income from crop yields and land appreciation. Timberland investment involves purchasing forested land to generate returns from timber sales and carbon credits, with long-term growth tied to sustainable forestry management. Explore the detailed differences and benefits of farmland crowdfunding versus timberland investment to make informed portfolio decisions.

Why it is important

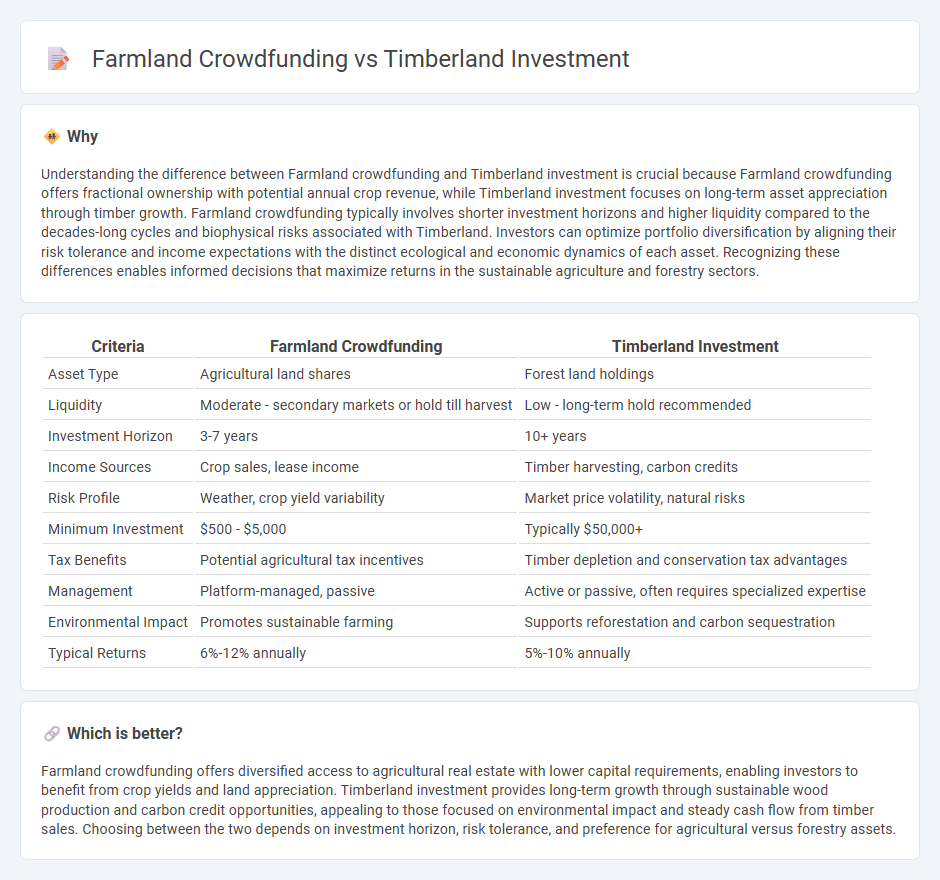

Understanding the difference between Farmland crowdfunding and Timberland investment is crucial because Farmland crowdfunding offers fractional ownership with potential annual crop revenue, while Timberland investment focuses on long-term asset appreciation through timber growth. Farmland crowdfunding typically involves shorter investment horizons and higher liquidity compared to the decades-long cycles and biophysical risks associated with Timberland. Investors can optimize portfolio diversification by aligning their risk tolerance and income expectations with the distinct ecological and economic dynamics of each asset. Recognizing these differences enables informed decisions that maximize returns in the sustainable agriculture and forestry sectors.

Comparison Table

| Criteria | Farmland Crowdfunding | Timberland Investment |

|---|---|---|

| Asset Type | Agricultural land shares | Forest land holdings |

| Liquidity | Moderate - secondary markets or hold till harvest | Low - long-term hold recommended |

| Investment Horizon | 3-7 years | 10+ years |

| Income Sources | Crop sales, lease income | Timber harvesting, carbon credits |

| Risk Profile | Weather, crop yield variability | Market price volatility, natural risks |

| Minimum Investment | $500 - $5,000 | Typically $50,000+ |

| Tax Benefits | Potential agricultural tax incentives | Timber depletion and conservation tax advantages |

| Management | Platform-managed, passive | Active or passive, often requires specialized expertise |

| Environmental Impact | Promotes sustainable farming | Supports reforestation and carbon sequestration |

| Typical Returns | 6%-12% annually | 5%-10% annually |

Which is better?

Farmland crowdfunding offers diversified access to agricultural real estate with lower capital requirements, enabling investors to benefit from crop yields and land appreciation. Timberland investment provides long-term growth through sustainable wood production and carbon credit opportunities, appealing to those focused on environmental impact and steady cash flow from timber sales. Choosing between the two depends on investment horizon, risk tolerance, and preference for agricultural versus forestry assets.

Connection

Farmland crowdfunding and timberland investment both leverage collective funding to acquire and manage natural resource assets that generate income and appreciate in value. These investment types attract investors seeking diversification through tangible assets linked to agriculture and forestry, which provide steady cash flows from crop yields and timber sales. By pooling capital, investors gain access to large-scale farmland and timberland projects that would be otherwise unattainable individually, optimizing risk-adjusted returns.

Key Terms

Asset Diversification

Timberland investment offers long-term growth with sustainable returns tied to timber prices and land appreciation, making it a solid asset for portfolio diversification. Farmland crowdfunding provides access to agricultural assets with potential income from crop production and land value increase, enabling investors to participate in farmland markets with lower entry costs. Explore more to understand how each option can strategically broaden your investment portfolio.

Yield Potential

Timberland investment offers steady returns through both timber sales and land appreciation, with average annual yields ranging from 5% to 7%, while farmland crowdfunding typically delivers yields between 6% and 10% driven by crop sales and land value increase. Timberland investments benefit from long-term sustainability and increasing global demand for wood products, contrasting with farmland's sensitivity to weather and commodity price fluctuations. Explore detailed comparisons to understand which asset aligns better with your financial goals and risk tolerance.

Liquidity

Timberland investment typically offers lower liquidity due to the long growth cycles of trees and the complexities involved in buying or selling large land parcels. Farmland crowdfunding platforms provide higher liquidity by allowing investors to buy shares in agricultural projects with the potential for quicker entry and exit compared to direct land ownership. Explore the nuances between timberland and farmland crowdfunding investments to determine which liquidity profile aligns with your financial goals.

Source and External Links

Timberland | Institutional - Manulife Investment Management - Timberland investment offers sustainable asset management with strong financial returns, portfolio diversification, inflation protection, and positive environmental impacts such as carbon sequestration and biodiversity support.

Timberland - Overview, How to Diversify, Benefits of Investing - Timberland investment involves putting money into managed tree plantations or natural forests, providing predictable biological growth and portfolio diversification, popular among institutional investors like pension funds and endowments.

Timberland | J.P. Morgan Asset Management - Investing in timberland helps manage inflation risk, generate flexible income through timber sales, diversify portfolios with low correlation to stocks and bonds, and promotes sustainability through responsible forest management.

dowidth.com

dowidth.com