Spice trading involves the exchange of commodity goods like cinnamon, cardamom, and pepper, often influenced by seasonal harvests and geopolitical conditions affecting supply chains. Stock trading focuses on buying and selling shares of publicly listed companies, driven by market performance, company earnings, and economic indicators. Explore the unique risks and opportunities of each to make informed investment decisions.

Why it is important

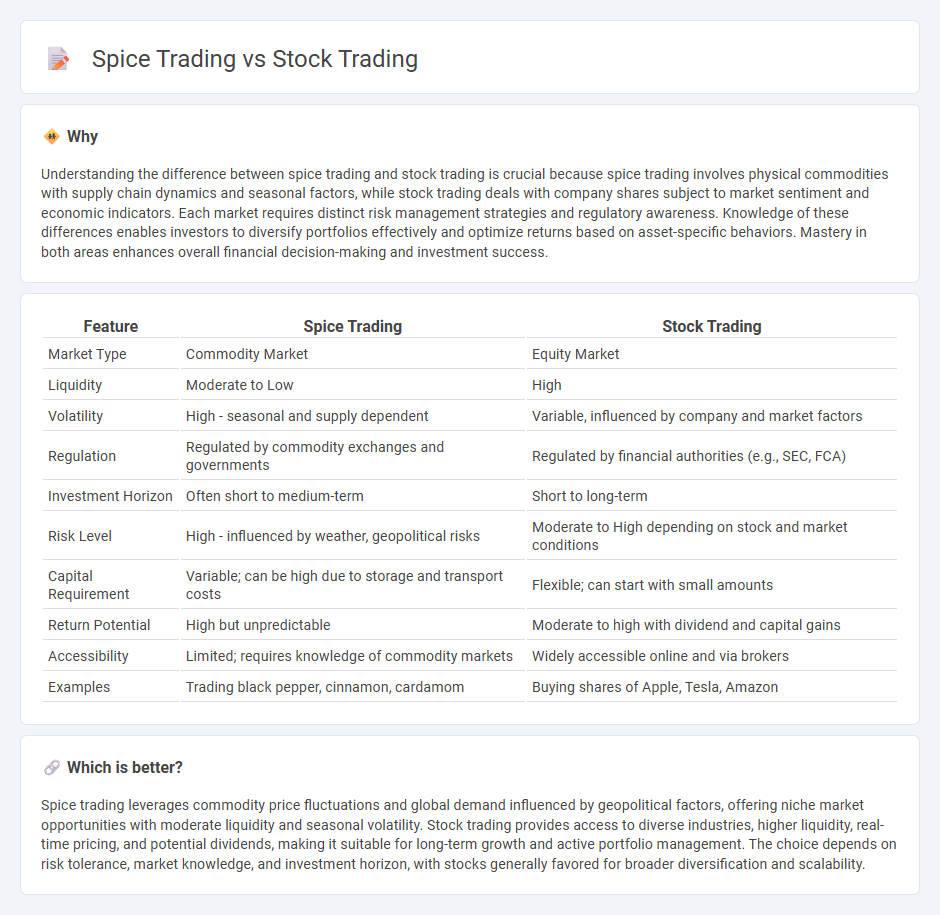

Understanding the difference between spice trading and stock trading is crucial because spice trading involves physical commodities with supply chain dynamics and seasonal factors, while stock trading deals with company shares subject to market sentiment and economic indicators. Each market requires distinct risk management strategies and regulatory awareness. Knowledge of these differences enables investors to diversify portfolios effectively and optimize returns based on asset-specific behaviors. Mastery in both areas enhances overall financial decision-making and investment success.

Comparison Table

| Feature | Spice Trading | Stock Trading |

|---|---|---|

| Market Type | Commodity Market | Equity Market |

| Liquidity | Moderate to Low | High |

| Volatility | High - seasonal and supply dependent | Variable, influenced by company and market factors |

| Regulation | Regulated by commodity exchanges and governments | Regulated by financial authorities (e.g., SEC, FCA) |

| Investment Horizon | Often short to medium-term | Short to long-term |

| Risk Level | High - influenced by weather, geopolitical risks | Moderate to High depending on stock and market conditions |

| Capital Requirement | Variable; can be high due to storage and transport costs | Flexible; can start with small amounts |

| Return Potential | High but unpredictable | Moderate to high with dividend and capital gains |

| Accessibility | Limited; requires knowledge of commodity markets | Widely accessible online and via brokers |

| Examples | Trading black pepper, cinnamon, cardamom | Buying shares of Apple, Tesla, Amazon |

Which is better?

Spice trading leverages commodity price fluctuations and global demand influenced by geopolitical factors, offering niche market opportunities with moderate liquidity and seasonal volatility. Stock trading provides access to diverse industries, higher liquidity, real-time pricing, and potential dividends, making it suitable for long-term growth and active portfolio management. The choice depends on risk tolerance, market knowledge, and investment horizon, with stocks generally favored for broader diversification and scalability.

Connection

Spice trading and stock trading share a fundamental connection through the principles of market speculation and asset valuation, where both involve buying and selling commodities or shares to generate profit. Historical spice trade routes influenced early global economic systems, laying groundwork for modern stock exchanges by introducing the concept of commodities as tradable assets. Furthermore, the volatility and demand shifts in spice markets mirror fluctuations in stock prices, demonstrating interconnected risk and opportunity management strategies in both fields.

Key Terms

Liquidity

Stock trading offers high liquidity with millions of shares exchanged daily on global exchanges like NYSE and NASDAQ, enabling investors to buy or sell assets quickly and at transparent prices. Spice trading, while historically significant, operates in much smaller, niche markets with limited trading volumes and longer transaction times due to the physical nature and supply chain complexities of commodities like cinnamon and cardamom. Explore the detailed differences in liquidity and market dynamics between stock and spice trading to enhance your trading strategy.

Volatility

Stock trading exhibits high volatility characterized by rapid price fluctuations influenced by market sentiment, earnings reports, and geopolitical events. Spice trading, meanwhile, experiences volatility driven primarily by seasonal harvests, weather conditions, and fluctuations in global demand and supply chains. Explore the intricate dynamics of volatility in both markets to enhance your trading strategy.

Market Regulation

Stock trading operates under stringent market regulations established by entities like the SEC to ensure transparency, protect investors, and maintain market integrity. Spice trading, governed by agricultural and commodity laws, encounters different regulatory challenges related to quality standards, import-export restrictions, and sustainability certifications. Explore deeper insights into how distinct regulatory frameworks shape these markets' dynamics and risk management.

Source and External Links

How Online Stock Trading Works: Understanding the Trade Lifecycle - Explains the detailed process of how an online stock trade is executed from placing an order to completion through a brokerage firm and market execution.

Stock Trading | Charles Schwab - Provides information on trading a wide range of stocks, including major U.S. exchanges, OTC stocks, IPOs, fractional shares, and global market access with support and tools for investors at all levels.

Invest Confidently with Webull - Stocks, Options, ETFs - Offers commission-free trading of stocks, ETFs, and options with features such as real-time quotes, advanced charting tools, extended hours trading, and education for new and experienced investors.

dowidth.com

dowidth.com