Wine funds and music royalties funds offer unique investment opportunities by allowing investors to diversify beyond traditional assets. Wine funds focus on acquiring and aging fine wines with high appreciation potential, while music royalties funds generate income through the ongoing earnings of popular songs and catalogs. Explore the benefits and risks of these alternative investments to enhance your portfolio.

Why it is important

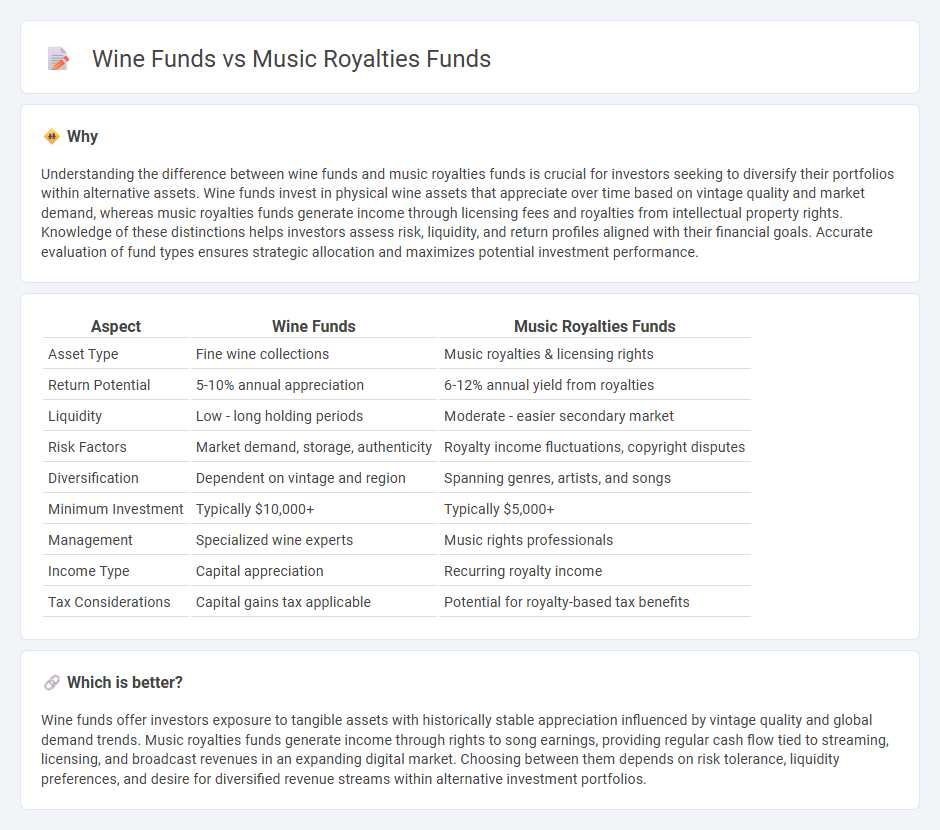

Understanding the difference between wine funds and music royalties funds is crucial for investors seeking to diversify their portfolios within alternative assets. Wine funds invest in physical wine assets that appreciate over time based on vintage quality and market demand, whereas music royalties funds generate income through licensing fees and royalties from intellectual property rights. Knowledge of these distinctions helps investors assess risk, liquidity, and return profiles aligned with their financial goals. Accurate evaluation of fund types ensures strategic allocation and maximizes potential investment performance.

Comparison Table

| Aspect | Wine Funds | Music Royalties Funds |

|---|---|---|

| Asset Type | Fine wine collections | Music royalties & licensing rights |

| Return Potential | 5-10% annual appreciation | 6-12% annual yield from royalties |

| Liquidity | Low - long holding periods | Moderate - easier secondary market |

| Risk Factors | Market demand, storage, authenticity | Royalty income fluctuations, copyright disputes |

| Diversification | Dependent on vintage and region | Spanning genres, artists, and songs |

| Minimum Investment | Typically $10,000+ | Typically $5,000+ |

| Management | Specialized wine experts | Music rights professionals |

| Income Type | Capital appreciation | Recurring royalty income |

| Tax Considerations | Capital gains tax applicable | Potential for royalty-based tax benefits |

Which is better?

Wine funds offer investors exposure to tangible assets with historically stable appreciation influenced by vintage quality and global demand trends. Music royalties funds generate income through rights to song earnings, providing regular cash flow tied to streaming, licensing, and broadcast revenues in an expanding digital market. Choosing between them depends on risk tolerance, liquidity preferences, and desire for diversified revenue streams within alternative investment portfolios.

Connection

Wine funds and music royalties funds are alternative investment vehicles that generate returns through the appreciation and sale of niche assets, such as rare vintages and intellectual property rights. Both funds capitalize on the growing demand for tangible and intangible assets with steady income streams, leveraging market trends and expert valuation to mitigate traditional market risks. Diversification across these funds can enhance portfolio stability by providing exposure to non-correlated asset classes.

Key Terms

Income Stream Predictability

Music royalties funds offer a highly predictable income stream due to consistent royalties from streaming services, radio plays, and licensing deals, providing steady cash flow. Wine funds, while profitable through the appreciation of rare vintages, present less predictable income as returns depend heavily on market demand and wine auction performance. Explore the detailed comparison of income stream predictability in music royalties and wine investment funds to optimize your portfolio strategy.

Asset Liquidity

Music royalties funds offer higher asset liquidity due to regular royalty payments and the ability to trade rights on secondary markets, contrasting with wine funds which face lower liquidity because physical assets like wine bottles require time-consuming sales and storage considerations. Investors prioritize music royalties funds for steady cash flow and faster exit options, whereas wine funds appeal to those embracing long-term appreciation but facing locked-in capital. Explore detailed comparisons of asset liquidity between music royalties and wine funds to make informed investment choices.

Valuation Methodology

Music royalties funds often rely on discounted cash flow (DCF) analysis to project future royalty income streams and determine present value, incorporating factors such as catalog size, historical earnings, and contract terms. Wine funds leverage asset appraisal based on vintage rarity, provenance, market demand, and storage conditions, using auction results and price indices to assess current value and appreciation potential. Explore the distinct valuation methodologies of each fund to better understand their investment dynamics and risk profiles.

Source and External Links

Music Royalty Funds: A New Way to Invest - Music royalty funds purchase rights to music already generating royalties, allowing investors to earn steady income streams from royalties paid by streaming services, radio stations, and other users.

Key Players in Music Royalty Investments - Leading music royalty funds like Hipgnosis Songs Fund and Primary Wave Music acquire major catalogs of iconic artists, offering investors access to diverse music portfolios with potential for reliable returns.

Music Royalties Inc. | Invest in the Top Artists - Music Royalties Inc. enables investors to directly invest in cash flows from song royalties of famous artists, providing dividend income secured by music copyrights.

dowidth.com

dowidth.com