Farmland crowdfunding offers investors the opportunity to diversify portfolios by directly funding agricultural projects, providing access to tangible assets and potential for steady income through crop yields and land appreciation. Hedge funds, in contrast, utilize pooled capital to engage in a wide range of strategies, often involving higher risk and complex financial instruments aimed at maximizing returns. Explore the differences in risk, accessibility, and long-term growth potential to determine the best investment approach for your financial goals.

Why it is important

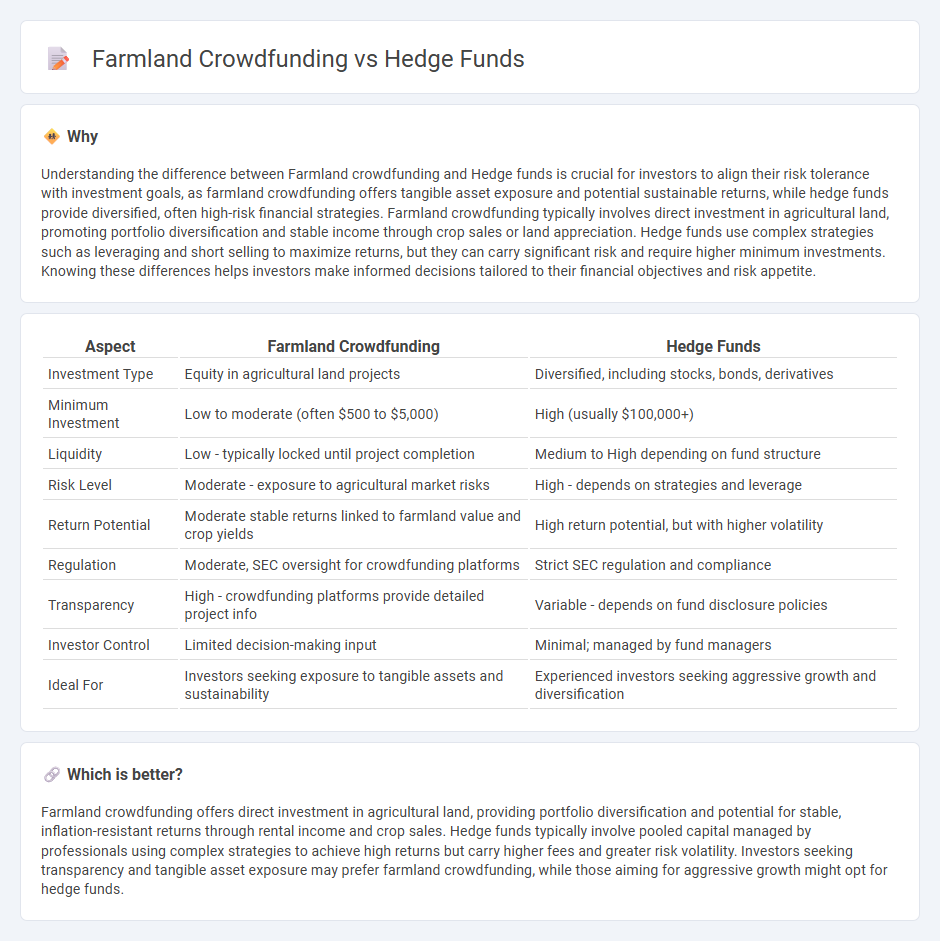

Understanding the difference between Farmland crowdfunding and Hedge funds is crucial for investors to align their risk tolerance with investment goals, as farmland crowdfunding offers tangible asset exposure and potential sustainable returns, while hedge funds provide diversified, often high-risk financial strategies. Farmland crowdfunding typically involves direct investment in agricultural land, promoting portfolio diversification and stable income through crop sales or land appreciation. Hedge funds use complex strategies such as leveraging and short selling to maximize returns, but they can carry significant risk and require higher minimum investments. Knowing these differences helps investors make informed decisions tailored to their financial objectives and risk appetite.

Comparison Table

| Aspect | Farmland Crowdfunding | Hedge Funds |

|---|---|---|

| Investment Type | Equity in agricultural land projects | Diversified, including stocks, bonds, derivatives |

| Minimum Investment | Low to moderate (often $500 to $5,000) | High (usually $100,000+) |

| Liquidity | Low - typically locked until project completion | Medium to High depending on fund structure |

| Risk Level | Moderate - exposure to agricultural market risks | High - depends on strategies and leverage |

| Return Potential | Moderate stable returns linked to farmland value and crop yields | High return potential, but with higher volatility |

| Regulation | Moderate, SEC oversight for crowdfunding platforms | Strict SEC regulation and compliance |

| Transparency | High - crowdfunding platforms provide detailed project info | Variable - depends on fund disclosure policies |

| Investor Control | Limited decision-making input | Minimal; managed by fund managers |

| Ideal For | Investors seeking exposure to tangible assets and sustainability | Experienced investors seeking aggressive growth and diversification |

Which is better?

Farmland crowdfunding offers direct investment in agricultural land, providing portfolio diversification and potential for stable, inflation-resistant returns through rental income and crop sales. Hedge funds typically involve pooled capital managed by professionals using complex strategies to achieve high returns but carry higher fees and greater risk volatility. Investors seeking transparency and tangible asset exposure may prefer farmland crowdfunding, while those aiming for aggressive growth might opt for hedge funds.

Connection

Farmland crowdfunding and hedge funds intersect through their shared investment in agricultural assets, offering diversified exposure to farmland as an alternative asset class. Farmland crowdfunding platforms aggregate capital from multiple investors to purchase and manage farmland, while hedge funds may allocate capital to these platforms or directly invest in large-scale agricultural ventures to hedge against market volatility and inflation. Both investment strategies capitalize on the growing demand for food production and land scarcity, leveraging farmland's potential for steady cash flow and capital appreciation.

Key Terms

Leverage

Hedge funds typically use high leverage to amplify returns, often borrowing multiple times their capital to maximize investment potential, which increases both risk and reward profiles. Farmland crowdfunding platforms generally employ minimal or no leverage, relying on collective investor equity to purchase agricultural assets, thereby offering a lower-risk exposure to farmland appreciation and income. Explore how leverage impacts your investment strategy between hedge funds and farmland crowdfunding opportunities.

Diversification

Hedge funds offer investors access to diversified portfolios through various asset classes such as equities, derivatives, and commodities, aiming for high returns with managed risk. Farmland crowdfunding provides diversification by allowing individuals to invest in agricultural land across regions, benefiting from steady income and inflation protection. Explore the distinct advantages of each investment strategy to enhance your portfolio's resilience.

Liquidity

Hedge funds typically offer higher liquidity with frequent redemption opportunities, while farmland crowdfunding often involves longer lock-in periods due to the illiquid nature of real assets. Investors in farmland crowdfunding gain exposure to agricultural markets and stable income streams but must accept reduced liquidity compared to hedge funds. Explore the detailed liquidity comparison to determine which investment aligns best with your financial goals.

Source and External Links

Hedge Funds: Overview, Recruitment, Careers & Salaries - A hedge fund is an investment firm that raises capital from institutional and accredited investors to invest in diverse strategies aiming for absolute returns, often using complex techniques like short-selling and derivatives to outperform markets or reduce risk.

Hedge Funds - Hedge funds are private, unregistered investment funds that pool money from accredited investors to invest in securities or other assets with flexible, sometimes higher-risk strategies, and are not subject to many regulations that govern mutual funds and ETFs.

Hedge fund - Hedge funds manage pooled liquid assets using sophisticated trading and risk management methods, typically charging both management and performance fees, and while originally designed to hedge risk, modern funds employ various strategies that may contribute to systemic financial risk under stress.

dowidth.com

dowidth.com