Fractional ownership allows multiple investors to hold a direct, proportional stake in a single asset, such as real estate or luxury items, providing individual control and potential tax benefits. Syndication pools capital from multiple investors to collectively invest in larger projects, managed by a lead sponsor who handles operations and decision-making. Explore the differences between fractional ownership and syndication to determine the best fit for your investment goals.

Why it is important

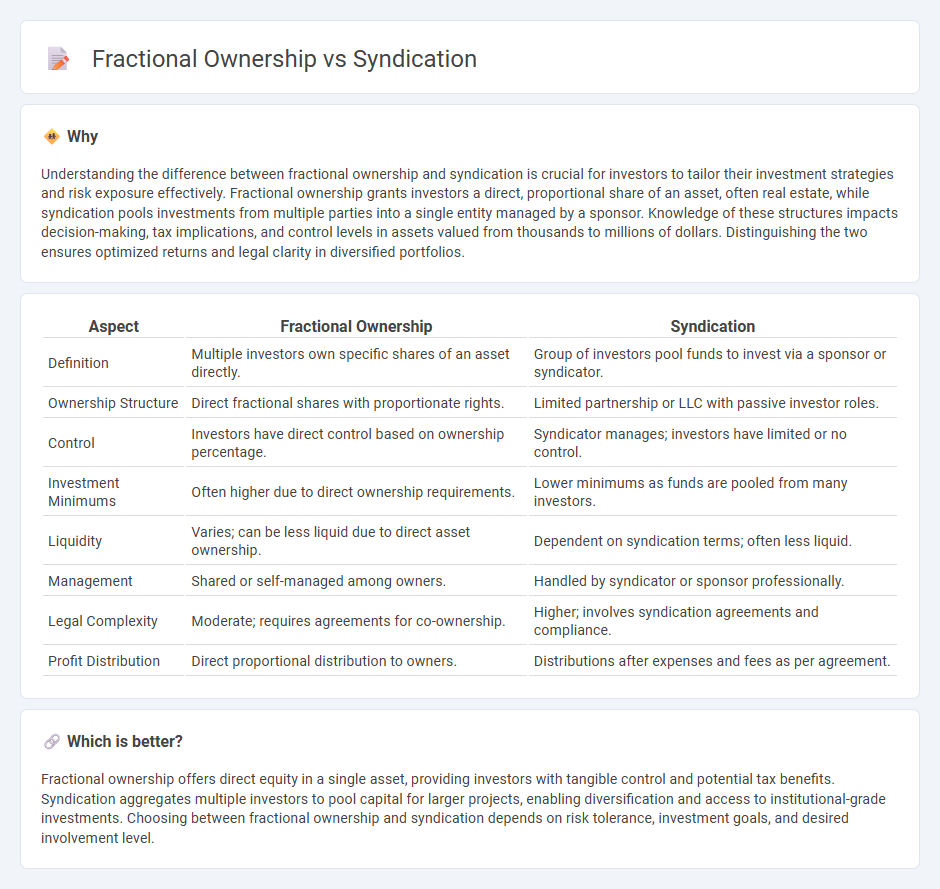

Understanding the difference between fractional ownership and syndication is crucial for investors to tailor their investment strategies and risk exposure effectively. Fractional ownership grants investors a direct, proportional share of an asset, often real estate, while syndication pools investments from multiple parties into a single entity managed by a sponsor. Knowledge of these structures impacts decision-making, tax implications, and control levels in assets valued from thousands to millions of dollars. Distinguishing the two ensures optimized returns and legal clarity in diversified portfolios.

Comparison Table

| Aspect | Fractional Ownership | Syndication |

|---|---|---|

| Definition | Multiple investors own specific shares of an asset directly. | Group of investors pool funds to invest via a sponsor or syndicator. |

| Ownership Structure | Direct fractional shares with proportionate rights. | Limited partnership or LLC with passive investor roles. |

| Control | Investors have direct control based on ownership percentage. | Syndicator manages; investors have limited or no control. |

| Investment Minimums | Often higher due to direct ownership requirements. | Lower minimums as funds are pooled from many investors. |

| Liquidity | Varies; can be less liquid due to direct asset ownership. | Dependent on syndication terms; often less liquid. |

| Management | Shared or self-managed among owners. | Handled by syndicator or sponsor professionally. |

| Legal Complexity | Moderate; requires agreements for co-ownership. | Higher; involves syndication agreements and compliance. |

| Profit Distribution | Direct proportional distribution to owners. | Distributions after expenses and fees as per agreement. |

Which is better?

Fractional ownership offers direct equity in a single asset, providing investors with tangible control and potential tax benefits. Syndication aggregates multiple investors to pool capital for larger projects, enabling diversification and access to institutional-grade investments. Choosing between fractional ownership and syndication depends on risk tolerance, investment goals, and desired involvement level.

Connection

Fractional ownership allows multiple investors to hold proportional shares in high-value assets, while syndication organizes a group of investors to collectively fund such investments. Both structures enable access to expensive properties or ventures by pooling capital, reducing individual financial burden and risk exposure. Syndication often formalizes fractional ownership arrangements through legal agreements and management oversight.

Key Terms

Pooling of Capital

Syndication pools capital from multiple investors to collectively purchase large assets, spreading risk and increasing buying power. Fractional ownership divides a single asset into shares, allowing investors to own a specific percentage without joint decision-making responsibilities. Explore the advantages and structures of both models to understand which suits your investment strategy best.

Shared Ownership

Shared ownership models such as syndication and fractional ownership provide investors with access to high-value real estate assets by pooling capital from multiple parties. Syndication typically involves passive investors partnering with an active sponsor who manages the property, while fractional ownership grants each investor a specific deeded interest and rights to use the asset. Explore our detailed analysis to understand the benefits and distinctions of shared ownership in real estate.

Governance Structure

Syndication typically involves multiple investors pooling resources under a lead sponsor who manages the property, centralizing governance decisions and operational control. Fractional ownership grants individual investors legal ownership fractions with proportional voting rights, allowing more direct influence on governance and decision-making. Explore how these distinct governance structures impact investor control and management efficiency.

Source and External Links

Broadcast Syndication - Describes the practice of licensing TV and radio programs to multiple stations, contrasting with centralized network distribution.

What Is Syndication? - Explains syndication as a model for distributing broadcasting rights to multiple TV and radio stations, allowing producers to maximize profit and stations to maintain programming.

Broadcast Syndication - Discusses the practice of leasing broadcasting rights to TV and radio stations, including variations like strip syndication.

dowidth.com

dowidth.com