Fractionalized art investment allows multiple investors to own shares of high-value artworks, providing portfolio diversification and exposure to the art market without full ownership. Cryptocurrency investment involves buying and trading digital currencies like Bitcoin or Ethereum, known for high volatility and potential for significant returns. Explore the key differences and advantages of fractionalized art versus cryptocurrency investment to make informed financial decisions.

Why it is important

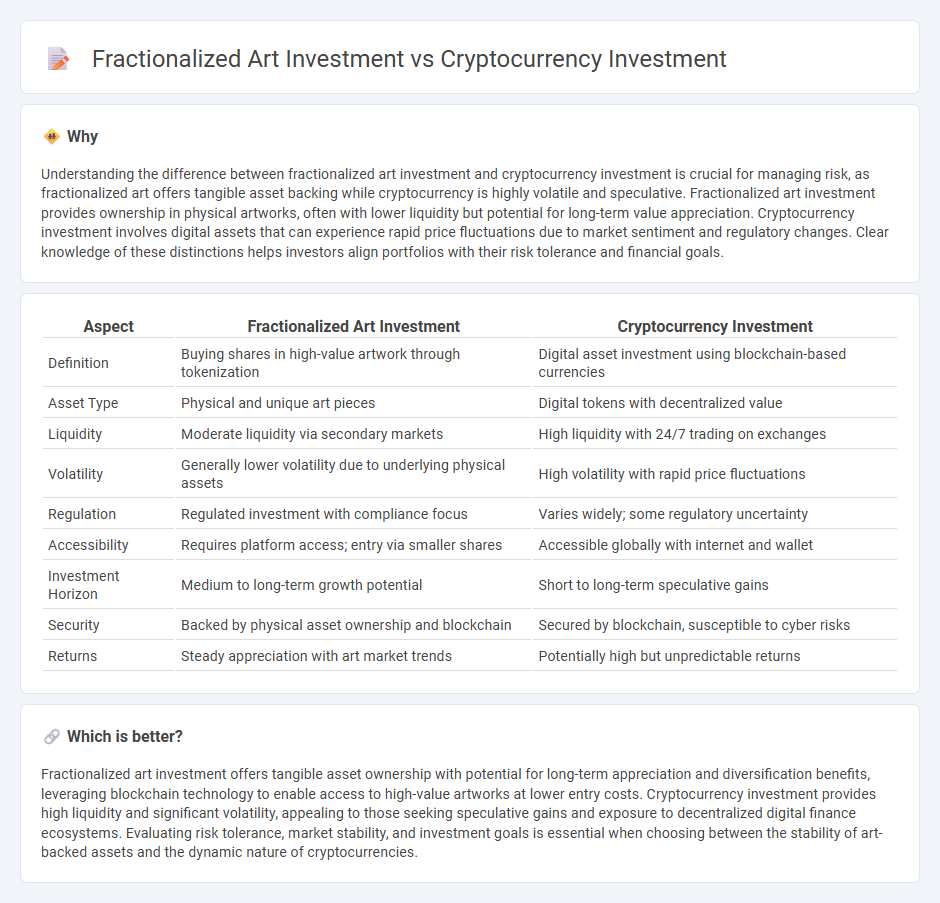

Understanding the difference between fractionalized art investment and cryptocurrency investment is crucial for managing risk, as fractionalized art offers tangible asset backing while cryptocurrency is highly volatile and speculative. Fractionalized art investment provides ownership in physical artworks, often with lower liquidity but potential for long-term value appreciation. Cryptocurrency investment involves digital assets that can experience rapid price fluctuations due to market sentiment and regulatory changes. Clear knowledge of these distinctions helps investors align portfolios with their risk tolerance and financial goals.

Comparison Table

| Aspect | Fractionalized Art Investment | Cryptocurrency Investment |

|---|---|---|

| Definition | Buying shares in high-value artwork through tokenization | Digital asset investment using blockchain-based currencies |

| Asset Type | Physical and unique art pieces | Digital tokens with decentralized value |

| Liquidity | Moderate liquidity via secondary markets | High liquidity with 24/7 trading on exchanges |

| Volatility | Generally lower volatility due to underlying physical assets | High volatility with rapid price fluctuations |

| Regulation | Regulated investment with compliance focus | Varies widely; some regulatory uncertainty |

| Accessibility | Requires platform access; entry via smaller shares | Accessible globally with internet and wallet |

| Investment Horizon | Medium to long-term growth potential | Short to long-term speculative gains |

| Security | Backed by physical asset ownership and blockchain | Secured by blockchain, susceptible to cyber risks |

| Returns | Steady appreciation with art market trends | Potentially high but unpredictable returns |

Which is better?

Fractionalized art investment offers tangible asset ownership with potential for long-term appreciation and diversification benefits, leveraging blockchain technology to enable access to high-value artworks at lower entry costs. Cryptocurrency investment provides high liquidity and significant volatility, appealing to those seeking speculative gains and exposure to decentralized digital finance ecosystems. Evaluating risk tolerance, market stability, and investment goals is essential when choosing between the stability of art-backed assets and the dynamic nature of cryptocurrencies.

Connection

Fractionalized art investment and cryptocurrency investment both leverage blockchain technology to enable secure, transparent ownership of digital assets. Fractionalized art allows investors to buy shares of high-value artworks, utilizing tokenization methods similar to those used in cryptocurrency markets. This connection enhances liquidity and democratizes access to traditionally illiquid art markets through decentralized finance (DeFi) platforms.

Key Terms

Volatility

Cryptocurrency investment is characterized by extreme price volatility due to market speculation and regulatory uncertainties, often experiencing rapid value fluctuations within short periods. Fractionalized art investment offers relatively lower volatility as it is backed by tangible assets with intrinsic cultural and historical value, providing more stable returns over time. Explore deeper insights into volatility patterns and risk management in both investment types to maximize portfolio performance.

Liquidity

Cryptocurrency investments offer high liquidity with assets that can be traded 24/7 on global exchanges, enabling quick buy and sell actions. Fractionalized art investments provide liquidity compared to traditional art markets but typically involve longer transaction times and lower trading volumes on specialized platforms. Explore the nuances of liquidity in both sectors to make informed investment decisions.

Ownership structure

Cryptocurrency investment offers a decentralized ownership structure where assets are held on a blockchain, providing transparency and security without intermediaries, while fractionalized art investment divides the ownership of a physical or digital artwork into shares, enabling investors to own a portion of high-value pieces. Both models use digital platforms, but cryptocurrency offers liquidity and global access, whereas fractionalized art emphasizes tangible cultural asset appreciation and provenance. Explore these ownership frameworks in detail to understand which aligns best with your investment goals.

Source and External Links

How Does Cryptocurrency Work? A Beginner's Guide - Cryptocurrency investment involves understanding its volatile nature, starting small, researching different coins and blockchain technologies, and considering alternatives like crypto funds and ETFs; risk management strategies vary for short-term traders and long-term holders.

Cryptocurrency Basics: Pros, Cons and How It Works - Crypto is a highly volatile yet potentially rewarding investment, with benefits such as decentralized finance, potential for significant appreciation like Bitcoin's price surge, opportunities for passive income via staking, and utility in underserved communities.

What is Cryptocurrency and How Does it Work? - Safe cryptocurrency investing requires careful research of exchanges, secure digital wallet storage, investment diversification, and readiness to handle high volatility, as crypto is considered a highly speculative and risky asset.

dowidth.com

dowidth.com