Sports memorabilia trading involves investing in physical collectibles like signed jerseys, rare cards, and game-used equipment, which often appreciate based on player popularity and historical significance. Cryptocurrency trading centers on buying and selling digital assets like Bitcoin or Ethereum on volatile markets influenced by technological developments and regulatory changes. Explore the detailed advantages and risks of sports memorabilia versus cryptocurrency trading to make an informed investment choice.

Why it is important

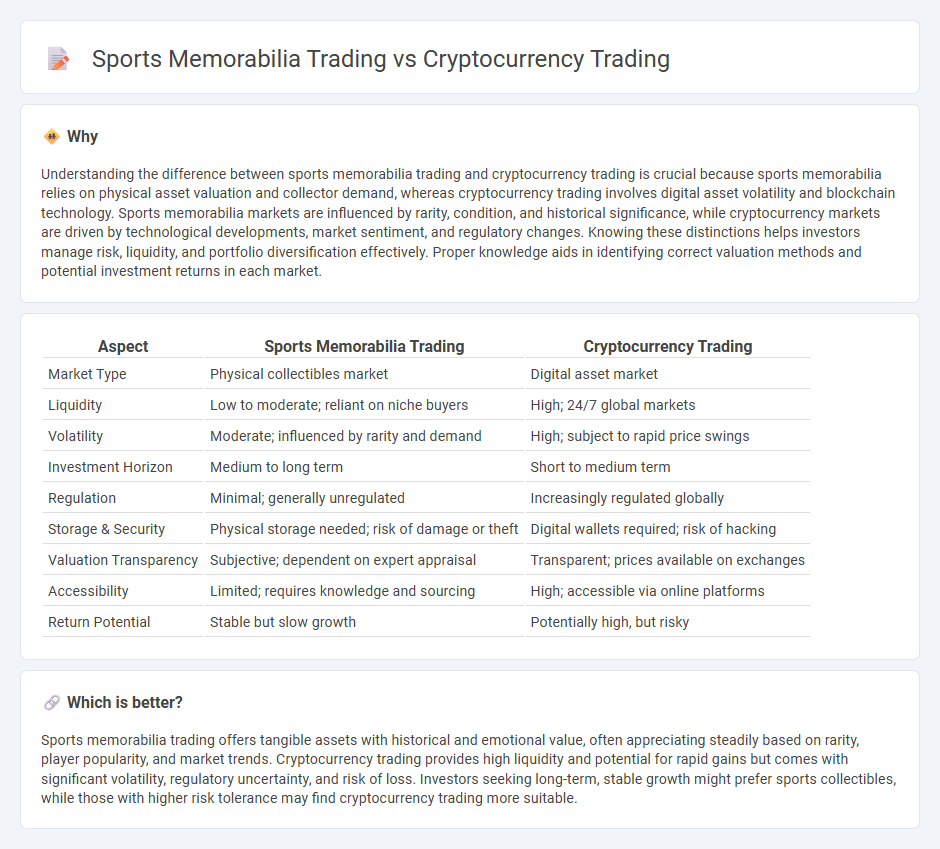

Understanding the difference between sports memorabilia trading and cryptocurrency trading is crucial because sports memorabilia relies on physical asset valuation and collector demand, whereas cryptocurrency trading involves digital asset volatility and blockchain technology. Sports memorabilia markets are influenced by rarity, condition, and historical significance, while cryptocurrency markets are driven by technological developments, market sentiment, and regulatory changes. Knowing these distinctions helps investors manage risk, liquidity, and portfolio diversification effectively. Proper knowledge aids in identifying correct valuation methods and potential investment returns in each market.

Comparison Table

| Aspect | Sports Memorabilia Trading | Cryptocurrency Trading |

|---|---|---|

| Market Type | Physical collectibles market | Digital asset market |

| Liquidity | Low to moderate; reliant on niche buyers | High; 24/7 global markets |

| Volatility | Moderate; influenced by rarity and demand | High; subject to rapid price swings |

| Investment Horizon | Medium to long term | Short to medium term |

| Regulation | Minimal; generally unregulated | Increasingly regulated globally |

| Storage & Security | Physical storage needed; risk of damage or theft | Digital wallets required; risk of hacking |

| Valuation Transparency | Subjective; dependent on expert appraisal | Transparent; prices available on exchanges |

| Accessibility | Limited; requires knowledge and sourcing | High; accessible via online platforms |

| Return Potential | Stable but slow growth | Potentially high, but risky |

Which is better?

Sports memorabilia trading offers tangible assets with historical and emotional value, often appreciating steadily based on rarity, player popularity, and market trends. Cryptocurrency trading provides high liquidity and potential for rapid gains but comes with significant volatility, regulatory uncertainty, and risk of loss. Investors seeking long-term, stable growth might prefer sports collectibles, while those with higher risk tolerance may find cryptocurrency trading more suitable.

Connection

Sports memorabilia trading and cryptocurrency trading intersect through blockchain technology, which enhances the authentication and provenance tracking of collectibles. Non-fungible tokens (NFTs) represent unique sports items digitally, enabling secure ownership transfer and investment diversification. Both markets leverage decentralized digital assets, attracting investors seeking alternative portfolio opportunities and liquidity.

Key Terms

Volatility

Cryptocurrency trading exhibits extreme volatility driven by market speculation, regulatory news, and technological developments, often resulting in rapid and unpredictable price swings within minutes or hours. Sports memorabilia trading, while also subject to market demand fluctuations and rarity factors, typically experiences more stable and gradual value changes over time. Explore further to understand the nuanced risk profiles and investment strategies of both markets.

Liquidity

Cryptocurrency trading offers high liquidity due to its 24/7 global market and rapid transaction execution, allowing investors to quickly buy or sell assets like Bitcoin or Ethereum. In contrast, sports memorabilia trading typically experiences lower liquidity because items such as signed jerseys or rare cards are unique and sold in niche markets, often requiring more time to find buyers at the desired price. Explore in-depth comparisons on liquidity factors and market dynamics between these two investment types to enhance your trading strategy.

Authenticity

Cryptocurrency trading relies on blockchain technology to ensure transaction transparency and asset authenticity, preventing fraud through decentralized ledger verification. Sports memorabilia trading demands rigorous provenance verification and expert authentication to confirm item legitimacy and protect against counterfeits. Explore how modern verification methods impact trust and value in both markets for deeper insights.

Source and External Links

Crypto.com | Securely Buy, Sell & Trade Bitcoin, Ethereum and 400+ cryptocurrencies - Crypto trading involves selecting a platform, creating an account, depositing funds, choosing trading pairs, and placing buy or sell orders with different order types while noting that it carries significant risk and one should only trade what they can afford to lose.

What is Cryptocurrency Trading and How Does it Work? - IG - Cryptocurrency trading can be done by speculating on price movements via CFDs or by buying and selling the underlying coins on exchanges, with leveraged products amplifying both profits and losses, requiring margin deposits and proper risk management.

A Beginner's Guide to Day Trading Crypto - Gemini - Day trading crypto requires setting specific time frames, performing technical analysis, and practicing risk management such as using stop-loss orders, and while it offers high-profit potential and flexibility it also demands discipline and poses risks due to market volatility.

dowidth.com

dowidth.com