Digital real estate offers investors the opportunity to acquire virtual properties and online assets such as websites, domain names, and virtual land in metaverses, providing unique avenues for passive income and portfolio diversification. Stocks represent ownership in publicly traded companies, offering liquidity, dividends, and growth potential tied to corporate performance and market trends. Explore the advantages and risks of digital real estate compared to traditional stocks to make informed investment decisions.

Why it is important

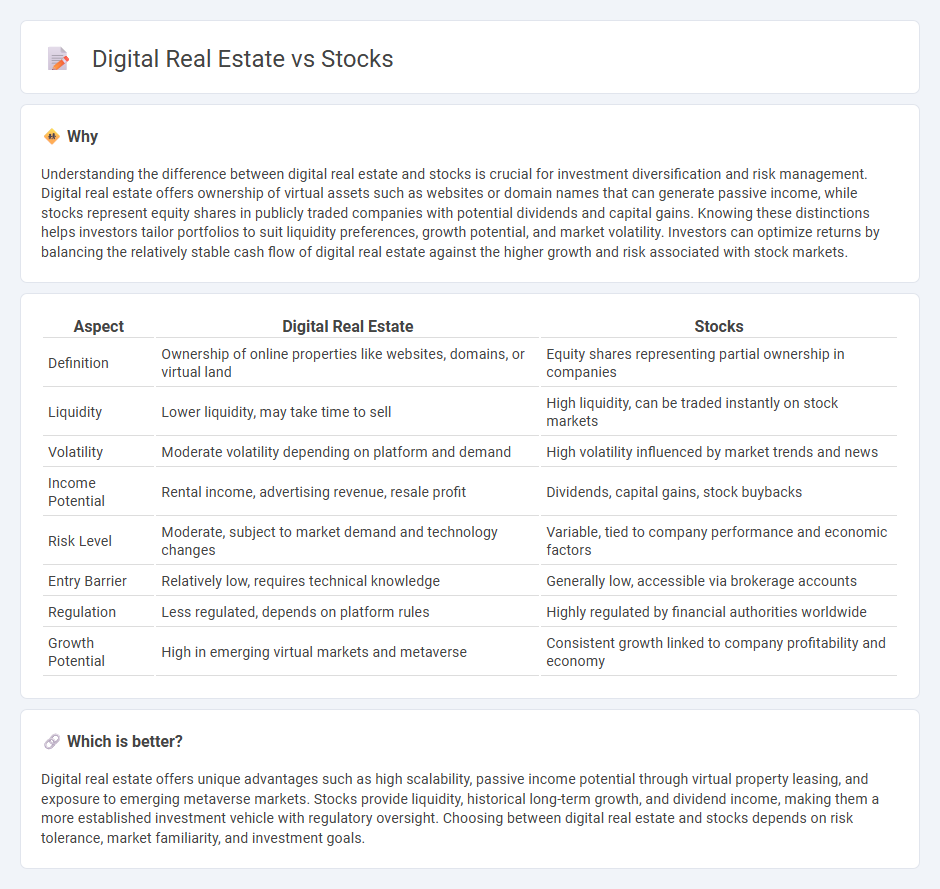

Understanding the difference between digital real estate and stocks is crucial for investment diversification and risk management. Digital real estate offers ownership of virtual assets such as websites or domain names that can generate passive income, while stocks represent equity shares in publicly traded companies with potential dividends and capital gains. Knowing these distinctions helps investors tailor portfolios to suit liquidity preferences, growth potential, and market volatility. Investors can optimize returns by balancing the relatively stable cash flow of digital real estate against the higher growth and risk associated with stock markets.

Comparison Table

| Aspect | Digital Real Estate | Stocks |

|---|---|---|

| Definition | Ownership of online properties like websites, domains, or virtual land | Equity shares representing partial ownership in companies |

| Liquidity | Lower liquidity, may take time to sell | High liquidity, can be traded instantly on stock markets |

| Volatility | Moderate volatility depending on platform and demand | High volatility influenced by market trends and news |

| Income Potential | Rental income, advertising revenue, resale profit | Dividends, capital gains, stock buybacks |

| Risk Level | Moderate, subject to market demand and technology changes | Variable, tied to company performance and economic factors |

| Entry Barrier | Relatively low, requires technical knowledge | Generally low, accessible via brokerage accounts |

| Regulation | Less regulated, depends on platform rules | Highly regulated by financial authorities worldwide |

| Growth Potential | High in emerging virtual markets and metaverse | Consistent growth linked to company profitability and economy |

Which is better?

Digital real estate offers unique advantages such as high scalability, passive income potential through virtual property leasing, and exposure to emerging metaverse markets. Stocks provide liquidity, historical long-term growth, and dividend income, making them a more established investment vehicle with regulatory oversight. Choosing between digital real estate and stocks depends on risk tolerance, market familiarity, and investment goals.

Connection

Digital real estate and stocks intersect through their roles as investment assets leveraging technological advancements and market dynamics. Investors capitalize on digital real estate by buying virtual land or online properties within blockchain platforms, while stocks represent equity ownership in companies driving these digital innovations. Both asset classes offer liquidity, growth potential, and exposure to tech-driven economies, highlighting their interconnected investment appeal.

Key Terms

Ownership

Stocks represent fractional ownership in publicly traded companies, offering liquidity and potential dividends, while digital real estate entails owning virtual properties such as websites, domains, or metaverse land with control over content and monetization. Digital real estate ownership often provides greater autonomy and creative freedom compared to the regulated nature of stock investments. Explore the distinct benefits and risks of each asset type to determine the best fit for your investment strategy.

Liquidity

Stocks offer high liquidity, enabling investors to buy and sell shares quickly through established exchanges with minimal transaction costs. Digital real estate, such as virtual land in metaverses or domain names, exhibits lower liquidity due to limited marketplaces and longer transaction times. Explore deeper insights into the liquidity dynamics between stocks and digital real estate investments.

Passive Income

Stocks typically generate passive income through dividends, offering regular cash flow without active management, while digital real estate, such as websites or domain names, produces revenue via ads, affiliate marketing, or e-commerce. Digital real estate often requires upfront work to build traffic or value but can provide scalable, automated income streams that complement traditional stock investments. Explore how combining stocks and digital real estate can optimize your passive income strategy for diversification and growth.

Source and External Links

Stocks - Investor.gov - Stocks, or equities, represent ownership shares in a company, with two main types: common stock (which provides voting rights and potential dividends) and preferred stock (which has priority in dividends and bankruptcy but usually no voting rights); stocks can be categorized by growth, income, value, blue-chip status, or company size.

What are stocks? - Charles Schwab - Stocks represent partial ownership in a company and come mainly in common stock, preferred stock, and ADRs, each with distinct benefits and risks regarding dividends, voting rights, volatility, and international exposure.

Stocks | FINRA - Investing in stocks means buying equity shares with potential returns from price changes and dividends; common stock prices fluctuate more and have voting rights, while preferred stocks have fixed dividends and priority in bankruptcy but less price movement.

dowidth.com

dowidth.com