Secondaries market offers liquidity by enabling investors to buy and sell pre-existing private equity shares, often at a discount, providing an alternative exit strategy compared to primary investments. Private placements involve direct investment in securities offered by companies to a limited audience, focusing on long-term capital infusion with less immediate liquidity. Explore further to understand how each option fits diverse investment strategies.

Why it is important

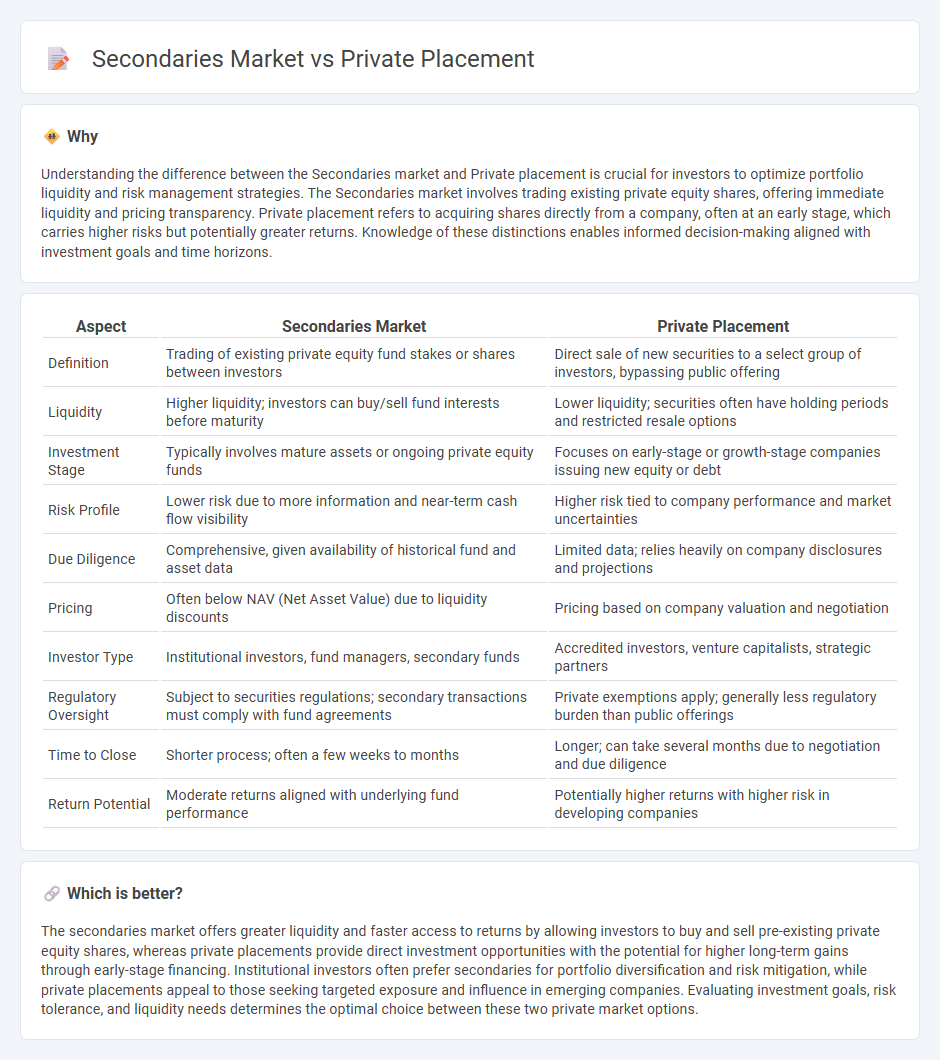

Understanding the difference between the Secondaries market and Private placement is crucial for investors to optimize portfolio liquidity and risk management strategies. The Secondaries market involves trading existing private equity shares, offering immediate liquidity and pricing transparency. Private placement refers to acquiring shares directly from a company, often at an early stage, which carries higher risks but potentially greater returns. Knowledge of these distinctions enables informed decision-making aligned with investment goals and time horizons.

Comparison Table

| Aspect | Secondaries Market | Private Placement |

|---|---|---|

| Definition | Trading of existing private equity fund stakes or shares between investors | Direct sale of new securities to a select group of investors, bypassing public offering |

| Liquidity | Higher liquidity; investors can buy/sell fund interests before maturity | Lower liquidity; securities often have holding periods and restricted resale options |

| Investment Stage | Typically involves mature assets or ongoing private equity funds | Focuses on early-stage or growth-stage companies issuing new equity or debt |

| Risk Profile | Lower risk due to more information and near-term cash flow visibility | Higher risk tied to company performance and market uncertainties |

| Due Diligence | Comprehensive, given availability of historical fund and asset data | Limited data; relies heavily on company disclosures and projections |

| Pricing | Often below NAV (Net Asset Value) due to liquidity discounts | Pricing based on company valuation and negotiation |

| Investor Type | Institutional investors, fund managers, secondary funds | Accredited investors, venture capitalists, strategic partners |

| Regulatory Oversight | Subject to securities regulations; secondary transactions must comply with fund agreements | Private exemptions apply; generally less regulatory burden than public offerings |

| Time to Close | Shorter process; often a few weeks to months | Longer; can take several months due to negotiation and due diligence |

| Return Potential | Moderate returns aligned with underlying fund performance | Potentially higher returns with higher risk in developing companies |

Which is better?

The secondaries market offers greater liquidity and faster access to returns by allowing investors to buy and sell pre-existing private equity shares, whereas private placements provide direct investment opportunities with the potential for higher long-term gains through early-stage financing. Institutional investors often prefer secondaries for portfolio diversification and risk mitigation, while private placements appeal to those seeking targeted exposure and influence in emerging companies. Evaluating investment goals, risk tolerance, and liquidity needs determines the optimal choice between these two private market options.

Connection

Secondaries market facilitates liquidity for private equity investors by enabling the buying and selling of existing stakes in private placements, providing an exit route without waiting for the fund's maturity. Private placements often serve as the initial primary market where shares or interests in private companies are issued, which can later be traded on the secondaries market. This connection enhances portfolio flexibility and capital efficiency by allowing investors to adjust their holdings in illiquid private assets.

Key Terms

Direct Investment

Direct investment in private placements involves acquiring equity stakes directly from a company seeking capital, often yielding early access to high-growth opportunities and potential for significant returns. In contrast, the secondaries market facilitates the purchase and sale of existing investor positions, offering increased liquidity and reduced risk due to historical performance data. Explore how direct investments can optimize your portfolio strategy by learning more about their unique advantages.

Liquidity

Private placements offer liquidity by enabling investors to buy shares directly from a company before public listing, though often with lock-up periods limiting immediate resale. In contrast, the secondaries market facilitates liquidity by allowing investors to trade existing shares among themselves, providing faster access to cash without company involvement. Explore more insights on how these markets impact investment flexibility and portfolio management.

Ownership Transfer

Private placements facilitate ownership transfer through direct transactions between issuers and selected investors, allowing companies to raise capital without public offering constraints. The secondaries market enables existing shareholders to sell their equity stakes to new investors, providing liquidity without new shares being issued. Explore the nuances of ownership transfer in these markets to optimize your investment strategy.

Source and External Links

What is a Private Placement? - DebtBook - A private placement is a non-public offering of securities to a limited number of sophisticated investors, often institutional, involving fewer reporting requirements and faster sale processes than public offerings, with resale restrictions and private disclosures instead of public statements.

What is a Private Placement? - PGIM Private Capital - Private placement is a method of raising capital by selling securities privately to a limited number of accredited investors without registering with the SEC, offering issuers flexibility, confidentiality, and cost savings compared to public offerings.

Private Placement | Definition + Transaction Examples - Private placement refers to the sale of securities directly to a small group of accredited, often institutional, investors under less stringent regulatory requirements than public offerings, providing a quicker, more convenient capital-raising option.

dowidth.com

dowidth.com