Crypto staking offers high liquidity and the potential for passive income through blockchain network participation, while REITs provide stable dividends and exposure to real estate markets without direct property ownership. Staking involves locking digital assets to validate transactions and earn rewards, whereas REITs generate income from commercial or residential property portfolios. Explore detailed comparisons to determine which investment aligns best with your financial goals.

Why it is important

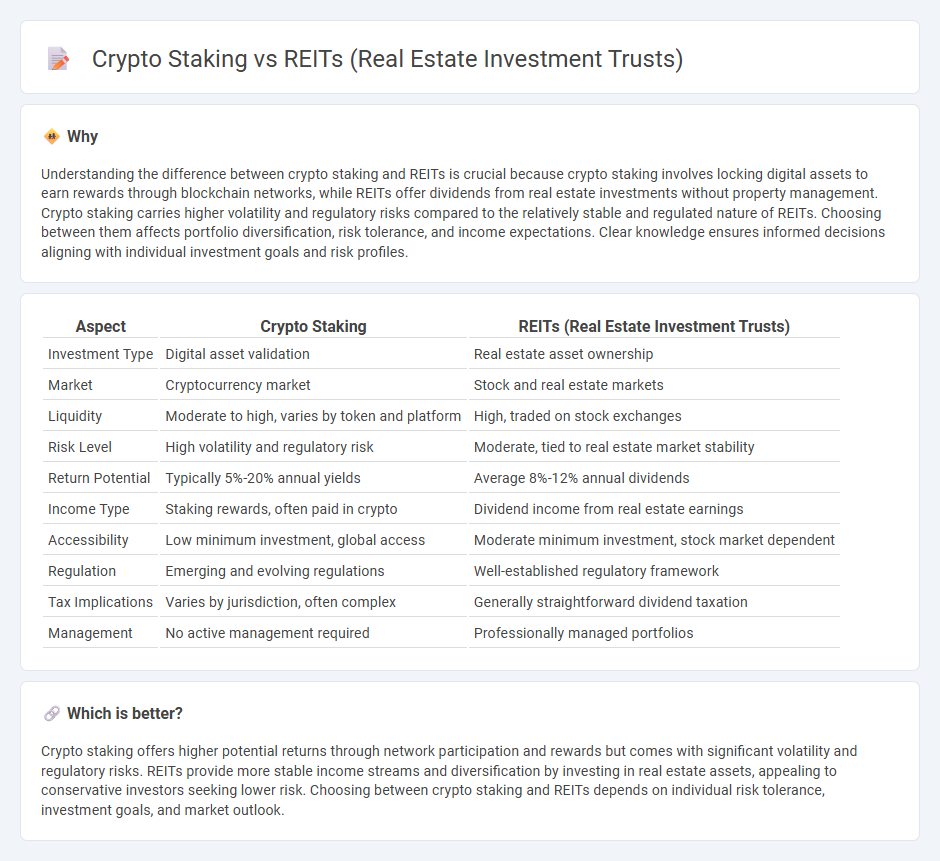

Understanding the difference between crypto staking and REITs is crucial because crypto staking involves locking digital assets to earn rewards through blockchain networks, while REITs offer dividends from real estate investments without property management. Crypto staking carries higher volatility and regulatory risks compared to the relatively stable and regulated nature of REITs. Choosing between them affects portfolio diversification, risk tolerance, and income expectations. Clear knowledge ensures informed decisions aligning with individual investment goals and risk profiles.

Comparison Table

| Aspect | Crypto Staking | REITs (Real Estate Investment Trusts) |

|---|---|---|

| Investment Type | Digital asset validation | Real estate asset ownership |

| Market | Cryptocurrency market | Stock and real estate markets |

| Liquidity | Moderate to high, varies by token and platform | High, traded on stock exchanges |

| Risk Level | High volatility and regulatory risk | Moderate, tied to real estate market stability |

| Return Potential | Typically 5%-20% annual yields | Average 8%-12% annual dividends |

| Income Type | Staking rewards, often paid in crypto | Dividend income from real estate earnings |

| Accessibility | Low minimum investment, global access | Moderate minimum investment, stock market dependent |

| Regulation | Emerging and evolving regulations | Well-established regulatory framework |

| Tax Implications | Varies by jurisdiction, often complex | Generally straightforward dividend taxation |

| Management | No active management required | Professionally managed portfolios |

Which is better?

Crypto staking offers higher potential returns through network participation and rewards but comes with significant volatility and regulatory risks. REITs provide more stable income streams and diversification by investing in real estate assets, appealing to conservative investors seeking lower risk. Choosing between crypto staking and REITs depends on individual risk tolerance, investment goals, and market outlook.

Connection

Crypto staking and REITs (Real Estate Investment Trusts) both offer investors passive income through asset-backed investments, with staking generating rewards by locking cryptocurrencies in a blockchain network while REITs provide dividends from real estate portfolios. Both mechanisms leverage pooled capital to generate steady returns, appealing to investors seeking diversification beyond traditional stocks and bonds. The rise of tokenized real estate on blockchain platforms further bridges the gap by enabling fractional ownership and liquidity similar to crypto staking models.

Key Terms

Yield

REITs typically offer an average annual yield ranging between 4% and 8%, providing consistent income through dividends derived from commercial real estate assets. Crypto staking yields vary widely, often between 5% and 20%, but carry higher market volatility and regulatory risks. Explore further to understand which yield strategy aligns best with your investment goals and risk tolerance.

Liquidity

REITs offer liquidity through publicly traded shares on stock exchanges, enabling investors to buy or sell holdings during market hours, whereas crypto staking often involves locked tokens with fixed lock-up periods reducing immediate liquidity. The volatility of crypto markets can impact liquidity dynamics, contrasting with the generally stable valuation and income distribution in REITs. Explore how liquidity preferences align with your investment strategy in Real Estate Investment Trusts versus crypto staking for a well-informed portfolio decision.

Risk

REITs (Real Estate Investment Trusts) offer investors stable income through diversified real estate portfolios with comparatively lower volatility and regulatory oversight, while crypto staking involves locking up digital assets in blockchain networks to earn rewards but carries higher risk due to market fluctuations, technological vulnerabilities, and less regulatory clarity. REITs provide tangible asset backing and potential dividend yields, making them appealing for conservative investors, whereas crypto staking's value depends on token price and network performance, attracting risk-tolerant participants. Explore detailed risk profiles and strategic considerations to determine which investment aligns best with your financial goals.

Source and External Links

Real estate investment trust - A REIT is a company that owns and typically operates diverse types of income-producing real estate assets, such as offices, hotels, and apartment buildings, and is structured for tax advantages.

What is a REIT? - REITs allow individual investors to buy shares in large, professionally managed real estate portfolios, offering regular income through dividends as the REIT collects rent and distributes at least 90% of taxable income to shareholders.

Real Estate Investment Trusts (REITs) - REITs offer a practical way for retail investors to gain exposure to commercial real estate income streams without the need to directly purchase, manage, or finance large properties themselves.

dowidth.com

dowidth.com