Sneaker flipping involves buying limited-edition sneakers at retail price and reselling them at a higher price on secondary markets, capitalizing on sneaker culture and demand spikes. Stock trading focuses on buying and selling shares of companies within financial markets, relying on analysis of market trends, company performance, and economic indicators. Explore deeper insights into sneaker flipping and stock trading strategies to optimize your investment portfolio.

Why it is important

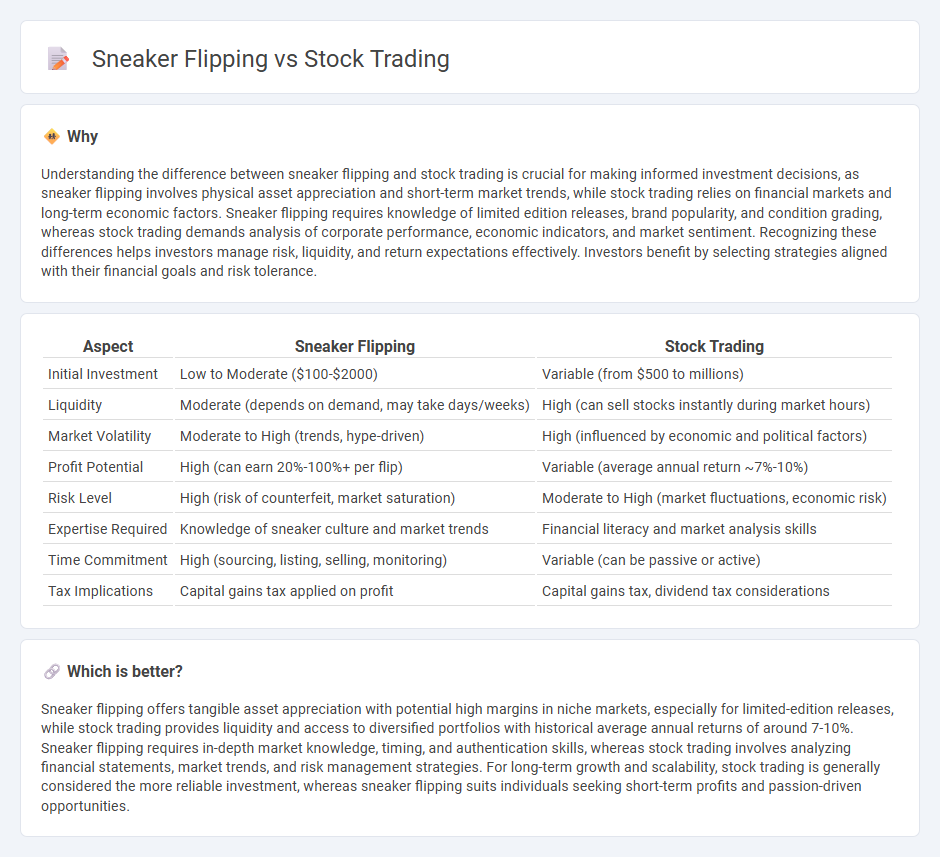

Understanding the difference between sneaker flipping and stock trading is crucial for making informed investment decisions, as sneaker flipping involves physical asset appreciation and short-term market trends, while stock trading relies on financial markets and long-term economic factors. Sneaker flipping requires knowledge of limited edition releases, brand popularity, and condition grading, whereas stock trading demands analysis of corporate performance, economic indicators, and market sentiment. Recognizing these differences helps investors manage risk, liquidity, and return expectations effectively. Investors benefit by selecting strategies aligned with their financial goals and risk tolerance.

Comparison Table

| Aspect | Sneaker Flipping | Stock Trading |

|---|---|---|

| Initial Investment | Low to Moderate ($100-$2000) | Variable (from $500 to millions) |

| Liquidity | Moderate (depends on demand, may take days/weeks) | High (can sell stocks instantly during market hours) |

| Market Volatility | Moderate to High (trends, hype-driven) | High (influenced by economic and political factors) |

| Profit Potential | High (can earn 20%-100%+ per flip) | Variable (average annual return ~7%-10%) |

| Risk Level | High (risk of counterfeit, market saturation) | Moderate to High (market fluctuations, economic risk) |

| Expertise Required | Knowledge of sneaker culture and market trends | Financial literacy and market analysis skills |

| Time Commitment | High (sourcing, listing, selling, monitoring) | Variable (can be passive or active) |

| Tax Implications | Capital gains tax applied on profit | Capital gains tax, dividend tax considerations |

Which is better?

Sneaker flipping offers tangible asset appreciation with potential high margins in niche markets, especially for limited-edition releases, while stock trading provides liquidity and access to diversified portfolios with historical average annual returns of around 7-10%. Sneaker flipping requires in-depth market knowledge, timing, and authentication skills, whereas stock trading involves analyzing financial statements, market trends, and risk management strategies. For long-term growth and scalability, stock trading is generally considered the more reliable investment, whereas sneaker flipping suits individuals seeking short-term profits and passion-driven opportunities.

Connection

Sneaker flipping and stock trading both capitalize on market trends and consumer demand to generate profit through buying low and selling high. Both practices require analyzing price fluctuations, timing trades strategically, and understanding market sentiment to maximize returns. The core principle of liquidity and speculative investment underpins success in sneaker resale markets and stock exchanges alike.

Key Terms

**Stock trading:**

Stock trading involves buying and selling shares of publicly traded companies on stock exchanges like the NYSE or NASDAQ, with the goal of generating profit through price appreciation or dividends. It requires analysis of market trends, company performance, and economic indicators to make informed decisions. Explore the fundamentals and strategies of stock trading to enhance your investment skills.

Dividend

Dividend income from stock trading offers consistent, passive cash flow as companies distribute a portion of their profits to shareholders, providing financial stability and growth potential. In contrast, sneaker flipping relies on market trends and demand volatility, with no guaranteed payouts or residual income. Explore the advantages of dividend investing to enhance your long-term wealth strategy.

Portfolio

Stock trading requires building a diversified portfolio of equities to balance risk and maximize long-term returns. Sneaker flipping revolves around curating a collection of limited-edition sneakers with high resale value, emphasizing rarity and market trends. Explore the dynamics of portfolio management in both arenas to enhance your investment strategy.

Source and External Links

How Online Stock Trading Works: Understanding the Trade Lifecycle - When you place an online stock order through your brokerage account or app, your brokerage processes and routes the order to the appropriate market for execution, completing several compliance and operational steps before you officially own the shares.

Stock Trading | Charles Schwab - Schwab offers commission-free online trading of U.S. and international stocks, fractional shares, OTC stocks, REITs, MLPs, and access to IPOs, along with educational resources and tools for investors at all experience levels.

5 Stocks Trading Under $10 That Pay Massive Monthly Ultra-High-Yield Dividends - While large, high-priced stocks dominate Wall Street, some investors seek out smaller, low-priced companies with ultra-high monthly dividend yields to maximize share count and income potential.

dowidth.com

dowidth.com