Vintage luxury handbags funds focus on acquiring and managing collections of rare designer bags, leveraging brand heritage and rarity to generate returns. Sports memorabilia funds invest in iconic items like signed jerseys and game-used equipment, capitalizing on fan passion and event-driven value appreciation. Explore the unique advantages and risks of these alternative investment asset classes to diversify your portfolio effectively.

Why it is important

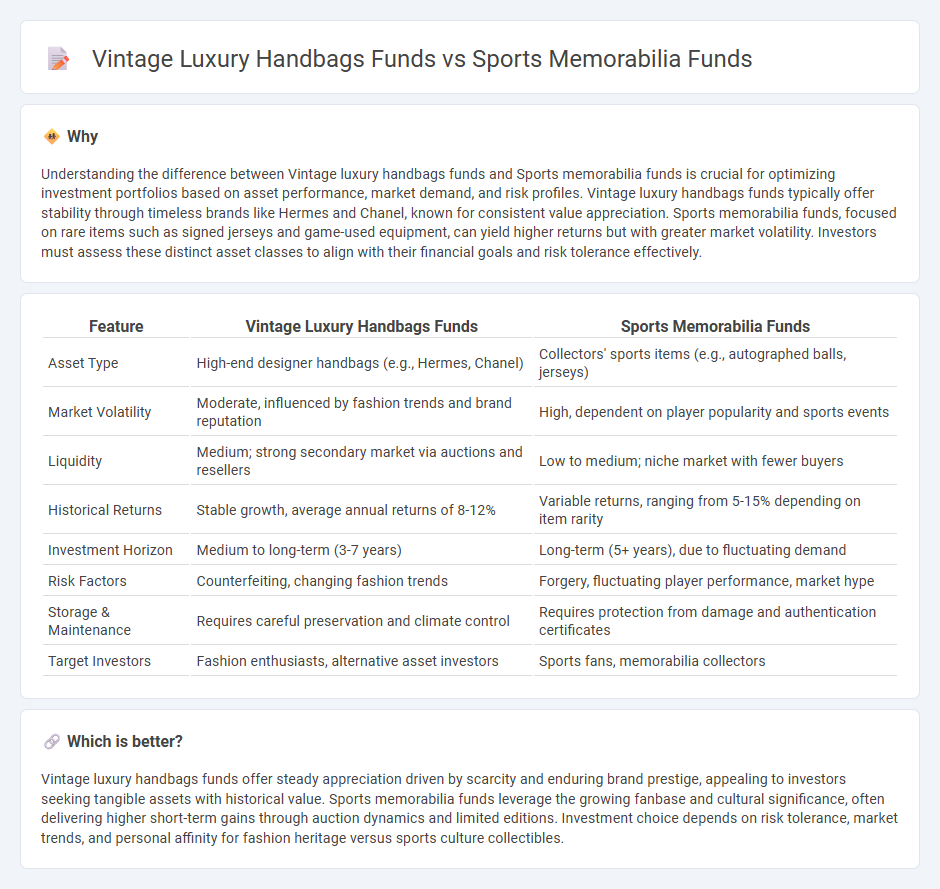

Understanding the difference between Vintage luxury handbags funds and Sports memorabilia funds is crucial for optimizing investment portfolios based on asset performance, market demand, and risk profiles. Vintage luxury handbags funds typically offer stability through timeless brands like Hermes and Chanel, known for consistent value appreciation. Sports memorabilia funds, focused on rare items such as signed jerseys and game-used equipment, can yield higher returns but with greater market volatility. Investors must assess these distinct asset classes to align with their financial goals and risk tolerance effectively.

Comparison Table

| Feature | Vintage Luxury Handbags Funds | Sports Memorabilia Funds |

|---|---|---|

| Asset Type | High-end designer handbags (e.g., Hermes, Chanel) | Collectors' sports items (e.g., autographed balls, jerseys) |

| Market Volatility | Moderate, influenced by fashion trends and brand reputation | High, dependent on player popularity and sports events |

| Liquidity | Medium; strong secondary market via auctions and resellers | Low to medium; niche market with fewer buyers |

| Historical Returns | Stable growth, average annual returns of 8-12% | Variable returns, ranging from 5-15% depending on item rarity |

| Investment Horizon | Medium to long-term (3-7 years) | Long-term (5+ years), due to fluctuating demand |

| Risk Factors | Counterfeiting, changing fashion trends | Forgery, fluctuating player performance, market hype |

| Storage & Maintenance | Requires careful preservation and climate control | Requires protection from damage and authentication certificates |

| Target Investors | Fashion enthusiasts, alternative asset investors | Sports fans, memorabilia collectors |

Which is better?

Vintage luxury handbags funds offer steady appreciation driven by scarcity and enduring brand prestige, appealing to investors seeking tangible assets with historical value. Sports memorabilia funds leverage the growing fanbase and cultural significance, often delivering higher short-term gains through auction dynamics and limited editions. Investment choice depends on risk tolerance, market trends, and personal affinity for fashion heritage versus sports culture collectibles.

Connection

Vintage luxury handbags funds and sports memorabilia funds both represent niche alternative investment categories that leverage the growing market for rare, collectible assets. These funds capitalize on the appreciation potential driven by scarcity, brand heritage, and cultural significance, attracting investors seeking portfolio diversification beyond traditional equities and bonds. The connection lies in their focus on tangible, high-demand collectibles that have shown resilience to market volatility and offer unique inflation-hedging characteristics.

Key Terms

Authenticity

Sports memorabilia funds rely heavily on rigorous authentication processes, including expert verification and provenance tracking, to ensure the originality and value of rare items such as signed jerseys or game-used equipment. Vintage luxury handbags funds emphasize authenticity through detailed condition reports, certification by recognized luxury brands, and digital tracking technologies to prevent counterfeiting of iconic items from brands like Hermes and Chanel. Explore more about how authentication standards shape investment security in these specialized asset classes.

Market Liquidity

Sports memorabilia funds generally offer higher market liquidity due to growing mainstream interest and frequent auction activities, attracting investors seeking quicker asset turnover. Vintage luxury handbags funds, while increasingly popular, often experience lower liquidity as transactions are more niche and rely on collector demand and brand reputation over time. Explore detailed comparisons to understand which alternative investment suits your liquidity needs and risk profile.

Provenance

Provenance plays a crucial role in both sports memorabilia funds and vintage luxury handbag funds, authenticating the item's history and enhancing its market value. Sports memorabilia often derives provenance from game-used evidence or player signatures authenticated by reputable organizations, while vintage handbags rely on brand stamps, purchase receipts, and documented ownership by celebrities or collectors. Explore how provenance impacts investment potential and risk management in these alternative asset classes.

Source and External Links

Invest in Sports Memorabilia - Sports memorabilia investment funds allow investors to pool money and buy fractional shares of high-end, pre-vetted memorabilia, providing a passive and expert-managed way to enter the market with as little as EUR50.

How to Invest in Sports Memorabilia - SmartAsset - Investing in sports memorabilia involves focusing on verified, historically significant items such as autographed gear, trading cards, game-used equipment, championship rings, and historic artifacts to maximize value.

How sports memorabilia is becoming more investable - CFA Institute - The sports memorabilia market blends passion with potential profit, with growing investor interest supported by the broader trading of diverse collectibles including cards, trophies, and rings.

dowidth.com

dowidth.com