Wine investing offers tangible asset appreciation driven by rarity, vintage quality, and global demand, contrasting with stock investing, which depends on corporate earnings, market trends, and economic indicators. Fine wine portfolios can provide diversification with lower correlation to traditional financial markets, while stocks provide liquidity and potential for dividends and capital gains. Explore the unique advantages and risks of both investment types to determine the best fit for your financial goals.

Why it is important

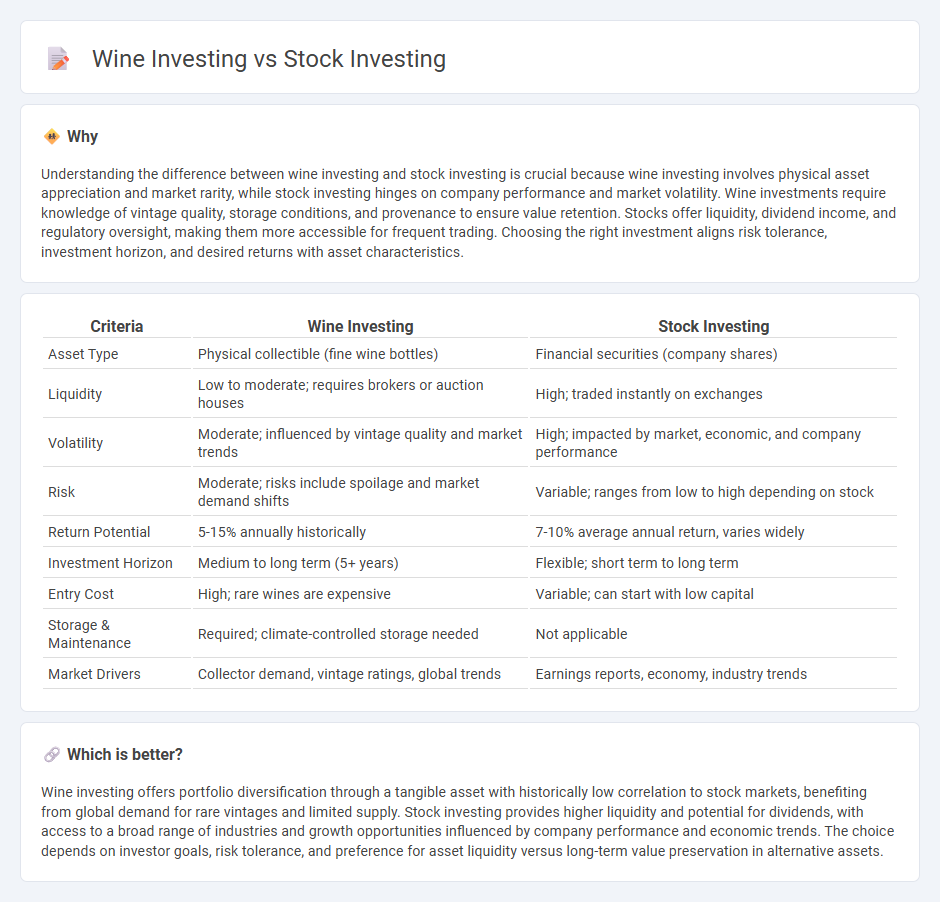

Understanding the difference between wine investing and stock investing is crucial because wine investing involves physical asset appreciation and market rarity, while stock investing hinges on company performance and market volatility. Wine investments require knowledge of vintage quality, storage conditions, and provenance to ensure value retention. Stocks offer liquidity, dividend income, and regulatory oversight, making them more accessible for frequent trading. Choosing the right investment aligns risk tolerance, investment horizon, and desired returns with asset characteristics.

Comparison Table

| Criteria | Wine Investing | Stock Investing |

|---|---|---|

| Asset Type | Physical collectible (fine wine bottles) | Financial securities (company shares) |

| Liquidity | Low to moderate; requires brokers or auction houses | High; traded instantly on exchanges |

| Volatility | Moderate; influenced by vintage quality and market trends | High; impacted by market, economic, and company performance |

| Risk | Moderate; risks include spoilage and market demand shifts | Variable; ranges from low to high depending on stock |

| Return Potential | 5-15% annually historically | 7-10% average annual return, varies widely |

| Investment Horizon | Medium to long term (5+ years) | Flexible; short term to long term |

| Entry Cost | High; rare wines are expensive | Variable; can start with low capital |

| Storage & Maintenance | Required; climate-controlled storage needed | Not applicable |

| Market Drivers | Collector demand, vintage ratings, global trends | Earnings reports, economy, industry trends |

Which is better?

Wine investing offers portfolio diversification through a tangible asset with historically low correlation to stock markets, benefiting from global demand for rare vintages and limited supply. Stock investing provides higher liquidity and potential for dividends, with access to a broad range of industries and growth opportunities influenced by company performance and economic trends. The choice depends on investor goals, risk tolerance, and preference for asset liquidity versus long-term value preservation in alternative assets.

Connection

Wine investing and stock investing are connected through their shared reliance on market trends and asset valuation principles. Both investment types require analyzing supply and demand dynamics, assessing potential returns, and managing risks associated with market volatility. Diversifying portfolios by including tangible assets like fine wine alongside equities can enhance financial stability and long-term growth prospects.

Key Terms

**Stock Investing:**

Stock investing offers liquidity, allowing investors to buy and sell shares quickly on global exchanges such as the NYSE and NASDAQ. With historical average annual returns around 7-10%, diversified stock portfolios provide long-term growth potential driven by company earnings and market trends. Explore the strategies and benefits of stock investing to build an informed financial future.

Dividend

Stock investing offers consistent dividend income, providing regular cash flow and potential for reinvestment, while wine investing generates returns primarily through capital appreciation without dividends. Dividends from stocks can enhance overall portfolio stability and compound wealth over time, contrasting with the less predictable liquidity and income from wine assets. Explore detailed comparisons to understand which investment aligns best with your financial goals.

Market Capitalization

Stock investing hinges on market capitalization, measuring a company's total value by multiplying its share price by outstanding shares, crucial for assessing investment size and risk. Wine investing, while lacking market capitalization metrics, relies on rarity, vintage quality, and auction prices to gauge value and demand in a niche market. Explore deeper insights into how these valuation methods impact portfolio diversification and growth potential.

Source and External Links

How to Invest in Stocks: 2025 Beginner's Guide - NerdWallet - To start investing in stocks, open an online brokerage account, fund it, and you can buy stocks or stock-based funds; it's important to consider your investment time horizon and risk tolerance before deciding your stock allocation.

The Basics of Investing In Stocks - Stocks represent ownership in a company, offering potential capital gains and dividends but also bearing risks like price drops or company failure, and you can buy them directly through companies, brokers, or stock funds.

Stock Investment Tips for Beginners - Charles Schwab - Beginners should consider investing in companies they understand and use personally, as familiarity can help develop a sound investment thesis while recognizing that future profits and dividends are never guaranteed.

dowidth.com

dowidth.com