Investing in viticulture land offers tangible asset ownership with potential for long-term appreciation and control over grape production quality, while wine investment focuses on acquiring collectible bottles or wine funds that can generate high returns through market appreciation and auction sales. Viticulture land acquisition requires understanding agricultural practices and regional terroir impacts, whereas wine investment demands expertise in vintage valuation and storage conditions. Explore the nuances of each investment type to determine the best strategy for your portfolio growth.

Why it is important

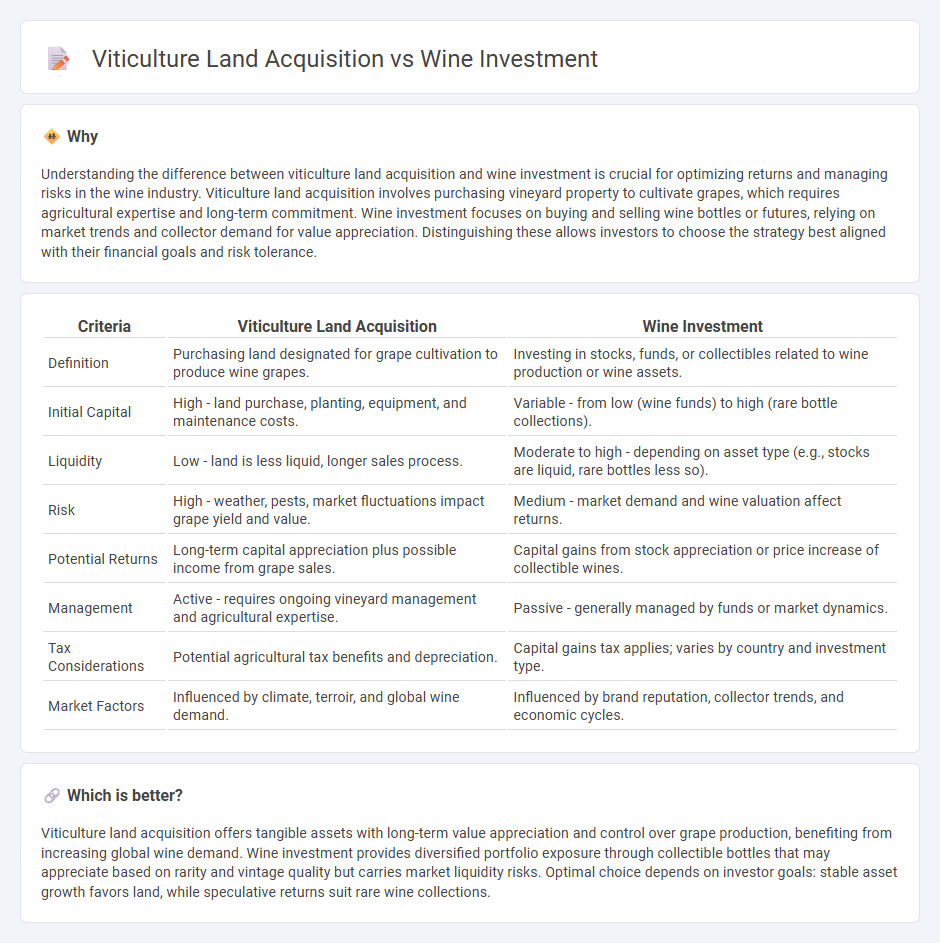

Understanding the difference between viticulture land acquisition and wine investment is crucial for optimizing returns and managing risks in the wine industry. Viticulture land acquisition involves purchasing vineyard property to cultivate grapes, which requires agricultural expertise and long-term commitment. Wine investment focuses on buying and selling wine bottles or futures, relying on market trends and collector demand for value appreciation. Distinguishing these allows investors to choose the strategy best aligned with their financial goals and risk tolerance.

Comparison Table

| Criteria | Viticulture Land Acquisition | Wine Investment |

|---|---|---|

| Definition | Purchasing land designated for grape cultivation to produce wine grapes. | Investing in stocks, funds, or collectibles related to wine production or wine assets. |

| Initial Capital | High - land purchase, planting, equipment, and maintenance costs. | Variable - from low (wine funds) to high (rare bottle collections). |

| Liquidity | Low - land is less liquid, longer sales process. | Moderate to high - depending on asset type (e.g., stocks are liquid, rare bottles less so). |

| Risk | High - weather, pests, market fluctuations impact grape yield and value. | Medium - market demand and wine valuation affect returns. |

| Potential Returns | Long-term capital appreciation plus possible income from grape sales. | Capital gains from stock appreciation or price increase of collectible wines. |

| Management | Active - requires ongoing vineyard management and agricultural expertise. | Passive - generally managed by funds or market dynamics. |

| Tax Considerations | Potential agricultural tax benefits and depreciation. | Capital gains tax applies; varies by country and investment type. |

| Market Factors | Influenced by climate, terroir, and global wine demand. | Influenced by brand reputation, collector trends, and economic cycles. |

Which is better?

Viticulture land acquisition offers tangible assets with long-term value appreciation and control over grape production, benefiting from increasing global wine demand. Wine investment provides diversified portfolio exposure through collectible bottles that may appreciate based on rarity and vintage quality but carries market liquidity risks. Optimal choice depends on investor goals: stable asset growth favors land, while speculative returns suit rare wine collections.

Connection

Viticulture land acquisition offers strategic value by providing direct control over grape production, which significantly influences wine quality and market value, making it a critical asset in wine investment portfolios. Investing in vineyards allows stakeholders to capitalize on the appreciation of both the land and the wine produced, creating diversified revenue streams through grape sales and premium wine production. The synergy between owning viticulture land and wine investment enhances long-term asset growth and mitigates risks associated with supply chain disruptions in the luxury beverage market.

Key Terms

Asset Liquidity

Wine investment typically offers higher liquidity due to the ease of buying and selling bottles or shares in wine funds on secondary markets, compared to viticulture land acquisition which involves lengthy transactions and legal complexities. Viticulture land provides tangible assets with potential for agricultural production but can be illiquid, requiring significant time to find buyers and complete sales. Discover the key differences in liquidity and investment potential between these two asset types.

Capital Appreciation

Wine investment targets liquid assets in fine wine with historical annual capital appreciation rates ranging from 7% to 12%, driven by global demand and rarity of vintages. Viticulture land acquisition offers tangible real estate assets that appreciate based on factors such as location quality, vineyard productivity, and future development potential, often yielding stable long-term returns through both land value increase and agricultural output. Explore further to understand the nuances of capital growth between these two distinct investment avenues.

Regulatory Environment

Regulatory environments for wine investment often involve strict compliance with securities laws and international trade regulations, impacting market liquidity and investor protections. Viticulture land acquisition requires understanding zoning laws, agricultural subsidies, and environmental regulations that govern land use and cultivation practices in specific wine regions. Explore detailed legal frameworks and regional policies to make informed decisions between wine investment and land acquisition opportunities.

Source and External Links

Getting Started with Wine Investments | Wine Folly - The most in-demand investment wines are fine Bordeaux and Grand Cru Burgundy, with investment focusing on buying cases, ensuring provenance, and potentially including cult wines and flagship wines from other regions like Napa and Champagne.

Wine Investment | Investing in Fine Wines - Cru Wine - Fine wine is a stable, tangible asset offering diversification, low correlation to traditional markets, and global demand, with portfolio management, insured storage, and digital transparency provided by a leading fine wine investment firm.

The ten things you need to know about wine investment - Tim Atkin - Wine investment should be viewed as medium- to long-term, forming a small part of a portfolio, stored in bonded warehouses to avoid VAT and duty, with careful attention to provenance and awareness of liquidity challenges and sale commissions.

dowidth.com

dowidth.com