Crowdlending platforms offer higher potential returns by connecting investors directly with borrowers, bypassing traditional financial institutions, while savings accounts provide lower risk with guaranteed interest backed by banks. These platforms typically involve peer-to-peer lending, with varying levels of risk and liquidity, whereas savings accounts offer stable, insured deposits but limited growth. Explore the key differences and decide which investment aligns best with your financial goals.

Why it is important

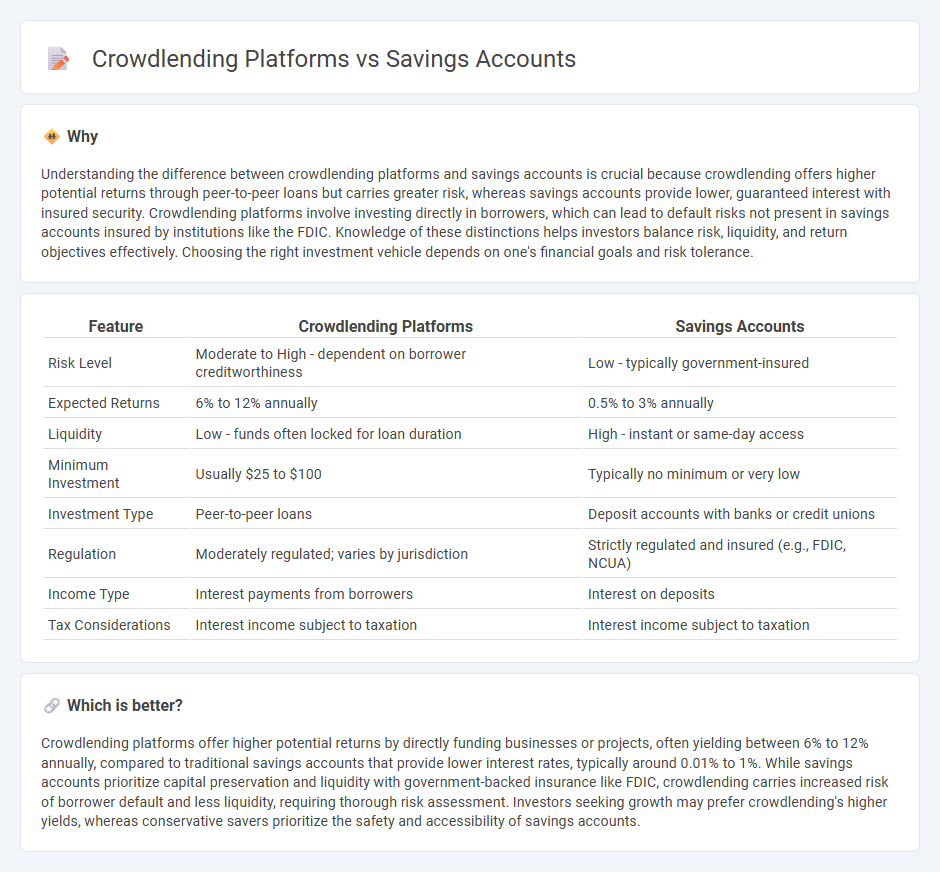

Understanding the difference between crowdlending platforms and savings accounts is crucial because crowdlending offers higher potential returns through peer-to-peer loans but carries greater risk, whereas savings accounts provide lower, guaranteed interest with insured security. Crowdlending platforms involve investing directly in borrowers, which can lead to default risks not present in savings accounts insured by institutions like the FDIC. Knowledge of these distinctions helps investors balance risk, liquidity, and return objectives effectively. Choosing the right investment vehicle depends on one's financial goals and risk tolerance.

Comparison Table

| Feature | Crowdlending Platforms | Savings Accounts |

|---|---|---|

| Risk Level | Moderate to High - dependent on borrower creditworthiness | Low - typically government-insured |

| Expected Returns | 6% to 12% annually | 0.5% to 3% annually |

| Liquidity | Low - funds often locked for loan duration | High - instant or same-day access |

| Minimum Investment | Usually $25 to $100 | Typically no minimum or very low |

| Investment Type | Peer-to-peer loans | Deposit accounts with banks or credit unions |

| Regulation | Moderately regulated; varies by jurisdiction | Strictly regulated and insured (e.g., FDIC, NCUA) |

| Income Type | Interest payments from borrowers | Interest on deposits |

| Tax Considerations | Interest income subject to taxation | Interest income subject to taxation |

Which is better?

Crowdlending platforms offer higher potential returns by directly funding businesses or projects, often yielding between 6% to 12% annually, compared to traditional savings accounts that provide lower interest rates, typically around 0.01% to 1%. While savings accounts prioritize capital preservation and liquidity with government-backed insurance like FDIC, crowdlending carries increased risk of borrower default and less liquidity, requiring thorough risk assessment. Investors seeking growth may prefer crowdlending's higher yields, whereas conservative savers prioritize the safety and accessibility of savings accounts.

Connection

Crowdlending platforms and savings accounts both serve as alternative avenues for individuals seeking to earn interest on their funds outside traditional banking systems. Crowdlending enables savers to directly lend money to businesses or individuals through online platforms, often offering higher returns compared to conventional savings accounts. This connection highlights a shift towards diversified investment strategies, where savers balance risk and reward by combining low-risk savings accounts with potentially higher-yield crowdlending opportunities.

Key Terms

Liquidity

Savings accounts offer high liquidity with immediate access to funds and minimal withdrawal restrictions, making them ideal for emergency cash needs. Crowdlending platforms typically lock investments for fixed terms ranging from several months to years, resulting in lower liquidity but potentially higher returns. Explore detailed comparisons to optimize your portfolio liquidity strategy.

Risk

Savings accounts provide low-risk returns backed by government guarantees, ensuring principal safety and stable interest income. Crowdlending platforms offer higher potential yields by funding loans to businesses or individuals but carry increased risk of default and lack of deposit insurance. Explore further to understand the risk profiles and benefits of each investment option.

Returns

Savings accounts typically offer annual interest rates ranging from 0.01% to 2%, providing a secure but modest return on investment. Crowdlending platforms, such as Funding Circle and LendingClub, often deliver higher average returns between 5% and 12%, albeit with increased risk due to borrower default possibilities. Explore detailed comparisons to understand which investment aligns best with your financial goals.

Source and External Links

Savings Accounts - View our best rates | Open online - U.S. Bank - Offers up to 3.50% APY on savings with a qualifying checking account and combined balance, $5 monthly fee, and a $25 minimum to open.

6 Best Savings Accounts of July 2025: Up to 4.66% - NerdWallet - Lists top savings accounts with APYs up to 4.66%, including options with no minimum deposit and strong FDIC insurance.

Open a Savings Account Online - Wells Fargo - Provides interest-bearing savings accounts and CDs, with online or in-person account opening options for individuals and joint customers.

dowidth.com

dowidth.com