Litigation funding and mutual funds represent two distinct investment options with unique risk profiles and returns. Litigation funding involves financing legal cases in exchange for a portion of the settlement or judgment, offering potential high returns but with significant legal and case-specific risks. Explore the differences between litigation funding and mutual funds to make informed investment decisions.

Why it is important

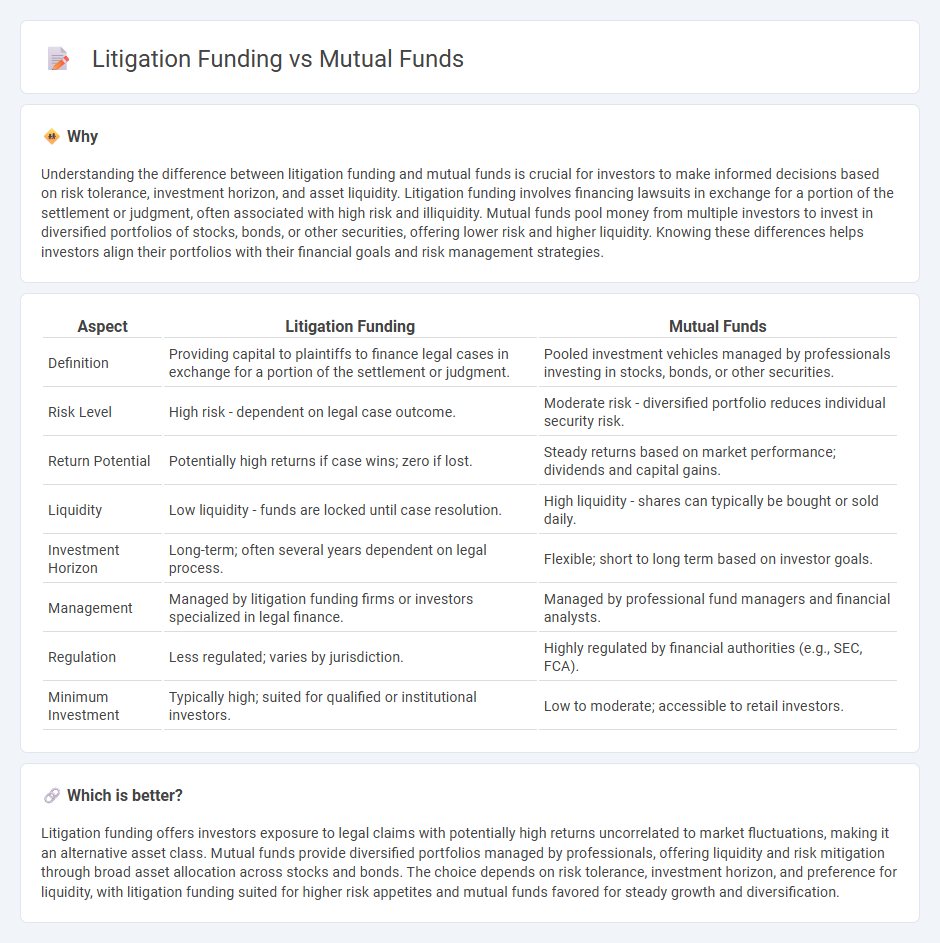

Understanding the difference between litigation funding and mutual funds is crucial for investors to make informed decisions based on risk tolerance, investment horizon, and asset liquidity. Litigation funding involves financing lawsuits in exchange for a portion of the settlement or judgment, often associated with high risk and illiquidity. Mutual funds pool money from multiple investors to invest in diversified portfolios of stocks, bonds, or other securities, offering lower risk and higher liquidity. Knowing these differences helps investors align their portfolios with their financial goals and risk management strategies.

Comparison Table

| Aspect | Litigation Funding | Mutual Funds |

|---|---|---|

| Definition | Providing capital to plaintiffs to finance legal cases in exchange for a portion of the settlement or judgment. | Pooled investment vehicles managed by professionals investing in stocks, bonds, or other securities. |

| Risk Level | High risk - dependent on legal case outcome. | Moderate risk - diversified portfolio reduces individual security risk. |

| Return Potential | Potentially high returns if case wins; zero if lost. | Steady returns based on market performance; dividends and capital gains. |

| Liquidity | Low liquidity - funds are locked until case resolution. | High liquidity - shares can typically be bought or sold daily. |

| Investment Horizon | Long-term; often several years dependent on legal process. | Flexible; short to long term based on investor goals. |

| Management | Managed by litigation funding firms or investors specialized in legal finance. | Managed by professional fund managers and financial analysts. |

| Regulation | Less regulated; varies by jurisdiction. | Highly regulated by financial authorities (e.g., SEC, FCA). |

| Minimum Investment | Typically high; suited for qualified or institutional investors. | Low to moderate; accessible to retail investors. |

Which is better?

Litigation funding offers investors exposure to legal claims with potentially high returns uncorrelated to market fluctuations, making it an alternative asset class. Mutual funds provide diversified portfolios managed by professionals, offering liquidity and risk mitigation through broad asset allocation across stocks and bonds. The choice depends on risk tolerance, investment horizon, and preference for liquidity, with litigation funding suited for higher risk appetites and mutual funds favored for steady growth and diversification.

Connection

Litigation funding provides capital to plaintiffs involved in legal disputes, enabling them to pursue claims without financial strain, which can indirectly impact mutual funds that invest in companies facing significant litigation risks. Mutual funds often assess litigation exposure as a critical risk factor when evaluating portfolio companies, as ongoing legal battles can affect stock performance and investor returns. Understanding the interplay between litigation funding and mutual funds helps investors better manage risk and optimize investment strategies in litigation-sensitive sectors.

Key Terms

**Mutual Funds:**

Mutual funds pool capital from multiple investors to invest in diversified portfolios of stocks, bonds, or other securities, providing professional management and liquidity. They offer investors access to broad market exposure and risk diversification with relatively low minimum investment requirements. Explore the key benefits and strategies of mutual funds to optimize your investment portfolio.

Net Asset Value (NAV)

Mutual funds' Net Asset Value (NAV) reflects the per-share market value of their diversified asset portfolios, providing daily liquidity and transparent valuation based on underlying securities. Litigation funding NAV, while less commonly calculated, represents the net worth of investment positions in legal claims, often lacking daily pricing due to the illiquid, contingent nature of lawsuits. Explore detailed comparisons between mutual funds and litigation funding NAV metrics to understand investment risk and valuation complexities.

Diversification

Mutual funds offer diversification by pooling investments across various assets, sectors, and geographies to reduce risk and enhance returns. Litigation funding, in contrast, involves capital allocation to specific legal cases, presenting higher risk due to limited asset diversification but potential for substantial returns if cases succeed. Explore the differences in risk profiles and diversification strategies between mutual funds and litigation funding to make informed investment decisions.

Source and External Links

Mutual Funds | Investor.gov - Mutual funds are SEC-registered investment companies that pool money from many investors to invest in stocks, bonds, and other securities, offering benefits like professional management and diversification.

Mutual fund - Wikipedia - Mutual funds are investment vehicles that pool money to buy securities, categorized into types like money market, bond, stock, and hybrid funds, with varying management strategies.

Understanding mutual funds - Charles Schwab - Mutual funds allow investors to pool their money to buy stocks, bonds, and other investments, offering diversification, low costs, and professional management.

dowidth.com

dowidth.com