Investment in luxury handbags often yields tangible assets with potential long-term value appreciation driven by brand exclusivity and limited editions. Stock market investment offers liquidity, diversification, and potential for dividend income, but is subject to market volatility and economic fluctuations. Explore the unique advantages and risks of both to make informed investment decisions.

Why it is important

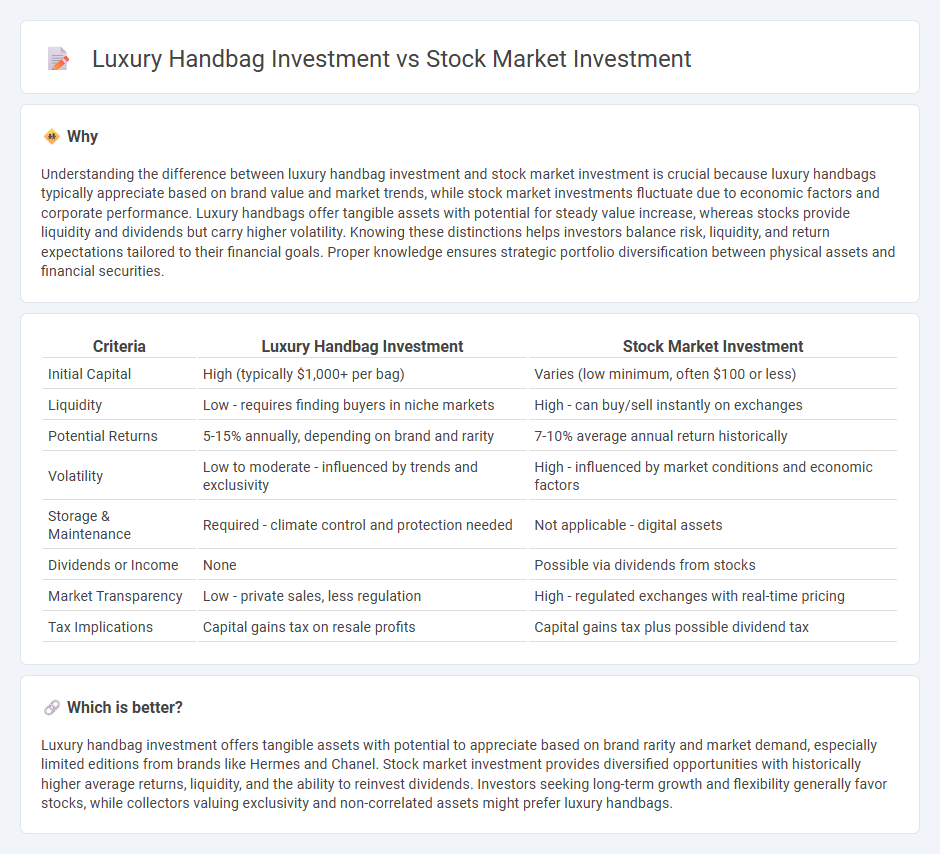

Understanding the difference between luxury handbag investment and stock market investment is crucial because luxury handbags typically appreciate based on brand value and market trends, while stock market investments fluctuate due to economic factors and corporate performance. Luxury handbags offer tangible assets with potential for steady value increase, whereas stocks provide liquidity and dividends but carry higher volatility. Knowing these distinctions helps investors balance risk, liquidity, and return expectations tailored to their financial goals. Proper knowledge ensures strategic portfolio diversification between physical assets and financial securities.

Comparison Table

| Criteria | Luxury Handbag Investment | Stock Market Investment |

|---|---|---|

| Initial Capital | High (typically $1,000+ per bag) | Varies (low minimum, often $100 or less) |

| Liquidity | Low - requires finding buyers in niche markets | High - can buy/sell instantly on exchanges |

| Potential Returns | 5-15% annually, depending on brand and rarity | 7-10% average annual return historically |

| Volatility | Low to moderate - influenced by trends and exclusivity | High - influenced by market conditions and economic factors |

| Storage & Maintenance | Required - climate control and protection needed | Not applicable - digital assets |

| Dividends or Income | None | Possible via dividends from stocks |

| Market Transparency | Low - private sales, less regulation | High - regulated exchanges with real-time pricing |

| Tax Implications | Capital gains tax on resale profits | Capital gains tax plus possible dividend tax |

Which is better?

Luxury handbag investment offers tangible assets with potential to appreciate based on brand rarity and market demand, especially limited editions from brands like Hermes and Chanel. Stock market investment provides diversified opportunities with historically higher average returns, liquidity, and the ability to reinvest dividends. Investors seeking long-term growth and flexibility generally favor stocks, while collectors valuing exclusivity and non-correlated assets might prefer luxury handbags.

Connection

Luxury handbag investment and stock market investment both serve as alternative asset classes that can diversify an investment portfolio and hedge against market volatility. High-demand luxury handbags, like limited-edition models from brands such as Hermes and Chanel, often appreciate in value similar to blue-chip stocks and can offer tangible, inflation-resistant returns. Investors benefit from tracking market trends, brand reputation, and rarity, which mirror the analysis of financial performance and market sentiment in stock investments.

Key Terms

**Stock market investment:**

Stock market investment offers opportunities for portfolio diversification, capital appreciation, and dividend income, driven by company performance and economic trends. Historical data shows that stocks have provided average annual returns of around 7-10%, adjusted for inflation, outperforming many other asset classes over the long term. Explore detailed strategies and risk management techniques to maximize your stock market investment potential.

Dividend

Dividend-paying stocks provide consistent income and potential capital appreciation, making them a reliable option for investors seeking steady returns over time. Luxury handbags, while appreciating in value due to rarity and brand prestige, do not offer periodic income like dividends, relying instead on market demand and condition at resale. Explore further to understand how dividend yields compare with luxury asset appreciation in building a balanced investment portfolio.

Capital gains

Stock market investment often yields higher capital gains through dividends and stock price appreciation, benefiting from compound growth and market liquidity. Luxury handbag investment offers capital gains through rarity and brand desirability, with certain limited-edition pieces appreciating significantly over time. Explore detailed analyses and trends to understand which investment aligns best with your capital gain goals.

Source and External Links

Stocks | FINRA.org - Investing in stocks means buying ownership shares in a company, with returns coming from dividends or capital gains, but stock prices can be volatile, making stocks riskier for short-term goals compared to bonds.

How to Invest in Stocks: 2025 Beginner's Guide - NerdWallet - To begin investing in stocks, open a brokerage account, contribute funds, and buy stocks or stock funds like ETFs or index funds, which offer diversification and generally lower risk than individual stocks.

Stocks | Investor.gov - Stocks provide the greatest potential for long-term growth but come with risk of price fluctuations and loss; diversification and balancing stocks with bonds can help manage risk depending on the investor's age and goals.

dowidth.com

dowidth.com