Luxury handbag investment offers tangible assets with strong brand recognition, historical value appreciation, and a thriving resale market driven by exclusivity and craftsmanship. Rare whisky investment provides opportunities for portfolio diversification, capitalizing on limited edition releases and aging potential that increases bottles' rarity and value over time. Explore the unique advantages and risks of each asset class to make informed investment decisions tailored to your financial goals.

Why it is important

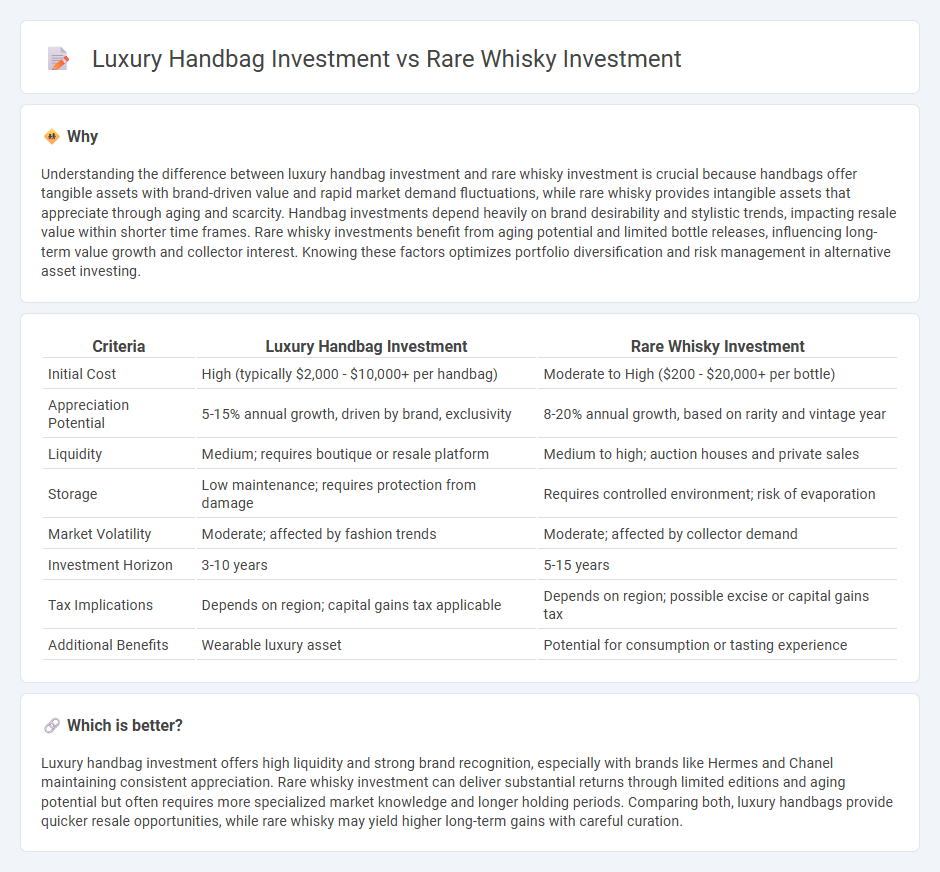

Understanding the difference between luxury handbag investment and rare whisky investment is crucial because handbags offer tangible assets with brand-driven value and rapid market demand fluctuations, while rare whisky provides intangible assets that appreciate through aging and scarcity. Handbag investments depend heavily on brand desirability and stylistic trends, impacting resale value within shorter time frames. Rare whisky investments benefit from aging potential and limited bottle releases, influencing long-term value growth and collector interest. Knowing these factors optimizes portfolio diversification and risk management in alternative asset investing.

Comparison Table

| Criteria | Luxury Handbag Investment | Rare Whisky Investment |

|---|---|---|

| Initial Cost | High (typically $2,000 - $10,000+ per handbag) | Moderate to High ($200 - $20,000+ per bottle) |

| Appreciation Potential | 5-15% annual growth, driven by brand, exclusivity | 8-20% annual growth, based on rarity and vintage year |

| Liquidity | Medium; requires boutique or resale platform | Medium to high; auction houses and private sales |

| Storage | Low maintenance; requires protection from damage | Requires controlled environment; risk of evaporation |

| Market Volatility | Moderate; affected by fashion trends | Moderate; affected by collector demand |

| Investment Horizon | 3-10 years | 5-15 years |

| Tax Implications | Depends on region; capital gains tax applicable | Depends on region; possible excise or capital gains tax |

| Additional Benefits | Wearable luxury asset | Potential for consumption or tasting experience |

Which is better?

Luxury handbag investment offers high liquidity and strong brand recognition, especially with brands like Hermes and Chanel maintaining consistent appreciation. Rare whisky investment can deliver substantial returns through limited editions and aging potential but often requires more specialized market knowledge and longer holding periods. Comparing both, luxury handbags provide quicker resale opportunities, while rare whisky may yield higher long-term gains with careful curation.

Connection

Luxury handbag investment and rare whisky investment share the characteristic of appreciating value driven by rarity, craftsmanship, and growing collector demand. Both asset classes benefit from limited supply and increasing interest in alternative investments, offering diversification beyond traditional stocks and bonds. Market trends indicate that provenance and brand prestige significantly enhance the resale value of these luxury goods.

Key Terms

**Rare Whisky Investment:**

Rare whisky investment offers significant appreciation potential driven by limited edition releases, aged bottles, and provenance from renowned distilleries like Macallan and Glenfiddich. Historical data shows rare whiskies have outperformed traditional investments with average annual returns exceeding 20%, fueled by growing global demand and collector interest. Explore how rare whisky can diversify your portfolio and deliver exceptional long-term value.

Age statement

Rare whisky investment benefits from extended age statements, as older whiskies often increase in value due to rarity and flavor complexity, with bottles aged 18 years or more commanding high prices at auctions. Luxury handbag investment emphasizes timeless appeal and brand prestige over age, but vintage pieces, especially limited editions over a decade old, hold strong market demand and appreciation potential. Explore deeper insights into how age influences the appreciation of rare whisky versus luxury handbags.

Distillery provenance

Investing in rare whisky with a strong distillery provenance offers unique value due to limited production, historical significance, and brand prestige, often leading to higher appreciation compared to luxury handbags. Distilleries with a rich heritage and rigorous craftsmanship provide authenticity and provenance that attract connoisseurs and investors alike. Discover how the legacy of a distillery enhances whisky investment potential beyond luxury accessories.

Source and External Links

How to invest in Whisky - Cask Ownership Made Easy - Rare whisky investment has experienced tremendous growth, with values increasing by 582% over 10 years, outperforming many traditional assets, driven by global demand for collectible Scotch whiskies, making it a promising alternative investment class.

Guide to Whiskey Investment: 10 Best Bottles, Expert Tips - Vinovest - Investing in whiskey can be done through buying bottles, casks, or stocks, with average annual returns around 10%, and rare bottles like the 1926 Macallan fetching multi-million dollar prices at auction; online platforms now make investing accessible to retail investors.

The art of whisky investment: expert tips for savvy collectors and ... - While rare whisky investment has boomed with prices growing spectacularly, experts advise caution and informed collecting, as returns are concentrated in very rare bottles and the wider market including casks may not perform as strongly.

dowidth.com

dowidth.com