Hedge fund replication employs quantitative methods to mimic the risk-return profile of hedge funds using liquid securities, reducing fees and improving transparency compared to direct hedge fund investments. Alpha capture focuses on identifying and trading strategies that generate excess returns by leveraging proprietary signals or insights from expert analysts. Explore these innovative approaches to optimize your investment strategy and enhance portfolio performance.

Why it is important

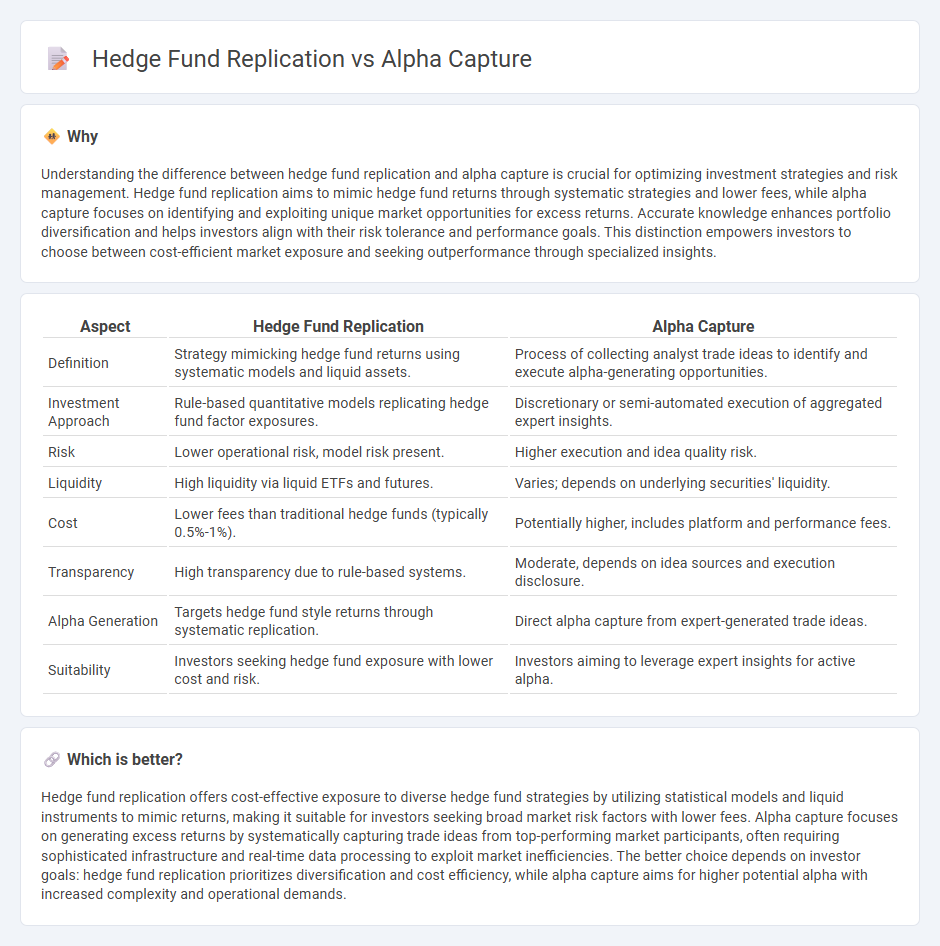

Understanding the difference between hedge fund replication and alpha capture is crucial for optimizing investment strategies and risk management. Hedge fund replication aims to mimic hedge fund returns through systematic strategies and lower fees, while alpha capture focuses on identifying and exploiting unique market opportunities for excess returns. Accurate knowledge enhances portfolio diversification and helps investors align with their risk tolerance and performance goals. This distinction empowers investors to choose between cost-efficient market exposure and seeking outperformance through specialized insights.

Comparison Table

| Aspect | Hedge Fund Replication | Alpha Capture |

|---|---|---|

| Definition | Strategy mimicking hedge fund returns using systematic models and liquid assets. | Process of collecting analyst trade ideas to identify and execute alpha-generating opportunities. |

| Investment Approach | Rule-based quantitative models replicating hedge fund factor exposures. | Discretionary or semi-automated execution of aggregated expert insights. |

| Risk | Lower operational risk, model risk present. | Higher execution and idea quality risk. |

| Liquidity | High liquidity via liquid ETFs and futures. | Varies; depends on underlying securities' liquidity. |

| Cost | Lower fees than traditional hedge funds (typically 0.5%-1%). | Potentially higher, includes platform and performance fees. |

| Transparency | High transparency due to rule-based systems. | Moderate, depends on idea sources and execution disclosure. |

| Alpha Generation | Targets hedge fund style returns through systematic replication. | Direct alpha capture from expert-generated trade ideas. |

| Suitability | Investors seeking hedge fund exposure with lower cost and risk. | Investors aiming to leverage expert insights for active alpha. |

Which is better?

Hedge fund replication offers cost-effective exposure to diverse hedge fund strategies by utilizing statistical models and liquid instruments to mimic returns, making it suitable for investors seeking broad market risk factors with lower fees. Alpha capture focuses on generating excess returns by systematically capturing trade ideas from top-performing market participants, often requiring sophisticated infrastructure and real-time data processing to exploit market inefficiencies. The better choice depends on investor goals: hedge fund replication prioritizes diversification and cost efficiency, while alpha capture aims for higher potential alpha with increased complexity and operational demands.

Connection

Hedge fund replication leverages systematic strategies to mimic the risk-return profile of hedge funds by utilizing liquid assets and factor models, while Alpha capture focuses on identifying and exploiting market inefficiencies to generate excess returns beyond benchmark indices. Both approaches aim to achieve superior investment performance by isolating and harnessing alpha sources, often employing quantitative analysis and alternative data to optimize portfolio construction. Integration of hedge fund replication techniques with alpha capture strategies enhances risk-adjusted returns by combining diversified exposure with targeted alpha generation.

Key Terms

Excess Return

Alpha capture strategies aim to generate excess return by systematically aggregating and exploiting market forecasts from expert investors, enhancing traditional portfolio performance. Hedge fund replication focuses on mimicking hedge fund returns through factor exposure and risk premia capture, targeting similar risk-adjusted excess returns without the high fees and illiquidity. Explore more about how these approaches differ in delivering consistent excess return and risk management.

Systematic Strategies

Alpha capture strategies systematically gather and analyze trading ideas from multiple sources to generate excess returns, often leveraging machine learning and alternative data for enhanced predictive power. Hedge fund replication focuses on mimicking hedge fund returns by deconstructing and replicating their risk factors and exposures with lower costs and improved transparency. Explore how these systematic strategies transform portfolio management and risk optimization.

Alternative Beta

Alpha capture strategies aim to generate excess returns by identifying mispriced securities through proprietary models and expert insights, whereas hedge fund replication focuses on mimicking hedge fund returns by isolating and replicating alternative beta factors such as momentum, value, and low volatility. Alternative beta captures systematic risk premia embedded in hedge fund returns, offering a cost-effective, transparent way to access hedge fund-like performance without the high fees and complexity of traditional hedge funds. Explore further to understand how alternative beta reshapes investment strategies in the evolving asset management landscape.

Source and External Links

Here's Why Alpha Capture Is Hot in the Hedge Fund World - Alpha capture is a strategy that systematically turns trading signals from humans and market data into portfolios, widely used by hedge funds like Man Group and Squarepoint, leveraging vast sources of trading and fundamental research data.

Alpha Capture: A Platform For Collaboration For Emerging Managers - Alpha capture platforms connect emerging managers who submit trade ideas to large hedge funds, enabling hedge funds to access diverse, niche insights cost-effectively while giving emerging managers exposure and execution benefits.

Alpha Capture and Acquired - Dean Markwick - Alpha capture originated as a method to evaluate and profile stock recommendations from multiple sources to identify those with genuine alpha (outperformance), allowing funds to allocate more capital to profitable idea generators and reduce risk.

dowidth.com

dowidth.com