Whiskey barrel investment offers potential for high returns due to the maturation process increasing the liquid's value over time, often with lower market volatility compared to traditional assets. Wine investment similarly benefits from aging, with rare vintages appreciating in value and a growing global demand in secondary markets. Explore the differences in market dynamics and risk factors to determine which alternative asset suits your portfolio goals.

Why it is important

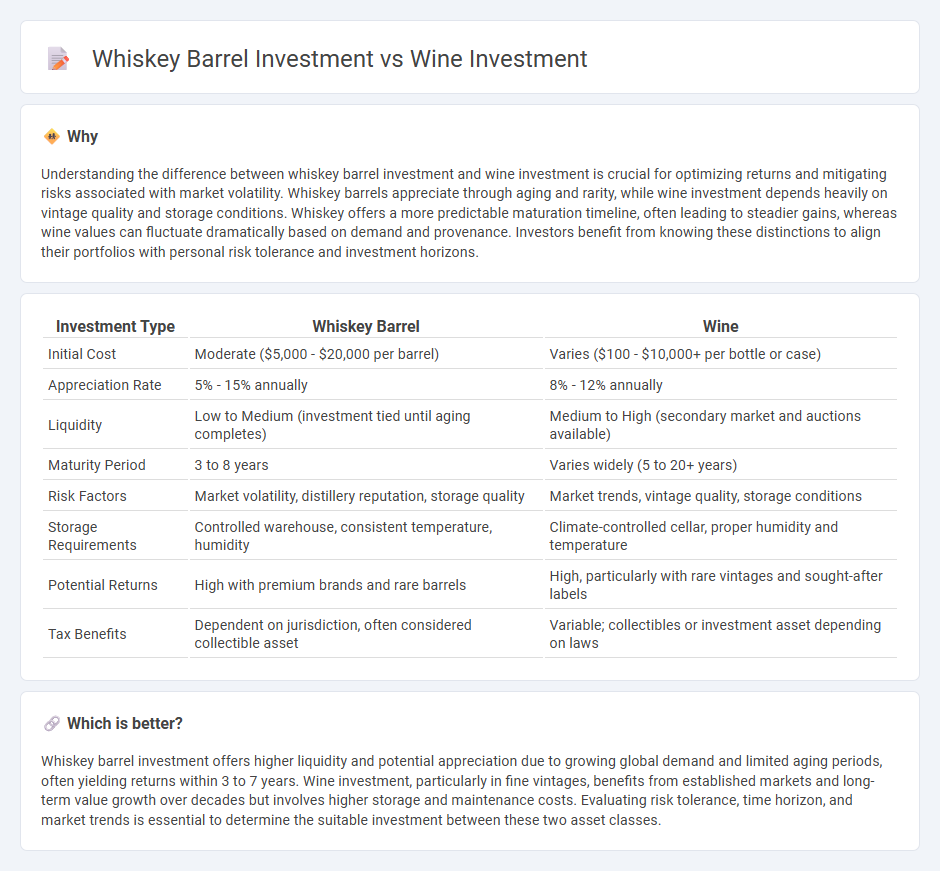

Understanding the difference between whiskey barrel investment and wine investment is crucial for optimizing returns and mitigating risks associated with market volatility. Whiskey barrels appreciate through aging and rarity, while wine investment depends heavily on vintage quality and storage conditions. Whiskey offers a more predictable maturation timeline, often leading to steadier gains, whereas wine values can fluctuate dramatically based on demand and provenance. Investors benefit from knowing these distinctions to align their portfolios with personal risk tolerance and investment horizons.

Comparison Table

| Investment Type | Whiskey Barrel | Wine |

|---|---|---|

| Initial Cost | Moderate ($5,000 - $20,000 per barrel) | Varies ($100 - $10,000+ per bottle or case) |

| Appreciation Rate | 5% - 15% annually | 8% - 12% annually |

| Liquidity | Low to Medium (investment tied until aging completes) | Medium to High (secondary market and auctions available) |

| Maturity Period | 3 to 8 years | Varies widely (5 to 20+ years) |

| Risk Factors | Market volatility, distillery reputation, storage quality | Market trends, vintage quality, storage conditions |

| Storage Requirements | Controlled warehouse, consistent temperature, humidity | Climate-controlled cellar, proper humidity and temperature |

| Potential Returns | High with premium brands and rare barrels | High, particularly with rare vintages and sought-after labels |

| Tax Benefits | Dependent on jurisdiction, often considered collectible asset | Variable; collectibles or investment asset depending on laws |

Which is better?

Whiskey barrel investment offers higher liquidity and potential appreciation due to growing global demand and limited aging periods, often yielding returns within 3 to 7 years. Wine investment, particularly in fine vintages, benefits from established markets and long-term value growth over decades but involves higher storage and maintenance costs. Evaluating risk tolerance, time horizon, and market trends is essential to determine the suitable investment between these two asset classes.

Connection

Whiskey barrel investment and wine investment both capitalize on the aging process, where barrels or bottles appreciate in value over time due to enhanced quality and rarity. These investments rely on market trends influenced by consumer demand, limited editions, and historical appreciation rates, making them alternative asset classes linked by their reliance on aging and scarcity. Collectors and investors benefit from the tangible nature of these assets and their potential for high returns in the luxury beverage market.

Key Terms

Wine Investment:

Wine investment offers potential for significant returns through the appreciation of rare vintages and collectible bottles, driven by global demand and limited supply. Fine wines from renowned regions like Bordeaux, Burgundy, and Napa Valley often outperform traditional assets due to their historical price stability and increasing scarcity. Explore detailed insights on how to start and optimize your wine investment portfolio for maximum gains.

Provenance

Wine investment benefits significantly from detailed provenance records, including vineyard origin, vintage year, and storage conditions, which validate authenticity and impact resale value. Whiskey barrel investment relies heavily on provenance data such as distillery reputation, barrel age, and cask number to assess potential aging quality and market demand. Explore further to understand how provenance influences the risk and return profiles of these alternative assets.

Vintage

Vintage wine investment capitalizes on rare, age-worthy bottles from renowned regions like Bordeaux and Burgundy, often appreciating as they mature over decades. Whiskey barrel investment hinges on the aging process in oak casks, where limited-edition or rare vintage barrels from distilleries like Macallan or Glenfiddich gain value due to unique flavor profiles and scarcity. Explore the nuances of vintage wine and whiskey barrel investments to determine which suits your portfolio strategy best.

Source and External Links

Getting Started with Wine Investments | Wine Folly - Investment wines are typically fine Bordeaux and Grand Cru Burgundy costing $600+ per bottle; buying by the case and ensuring provenance is key for resale, while expanding to collectible Napa Cabernets and Champagne can diversify a portfolio.

Wine Investment | Investing in Fine Wines - Cru Wine - Fine wine offers stable, tangible investment with long-term growth, low correlation to traditional markets, global demand, and tax advantages, managed securely with transparent portfolios and insured storage by firms like Cru Wine.

Evaluating the Investment Performance of Fine Wine: Returns and ... - Fine wine investments have averaged 10% annual returns since 1988, recommending a minimum 5-year horizon with Bordeaux, Burgundy, Champagne, Italy, and other regions contributing to portfolio diversification.

dowidth.com

dowidth.com