Collectibles investment involves acquiring tangible assets like art, rare coins, or vintage cars, offering potential for unique value appreciation and portfolio diversification. Hedge funds pool capital from accredited investors to employ diverse strategies including equities, derivatives, and leverage, aiming for high returns with managed risk. Explore how collectibles and hedge funds compare in risk, liquidity, and long-term growth opportunities.

Why it is important

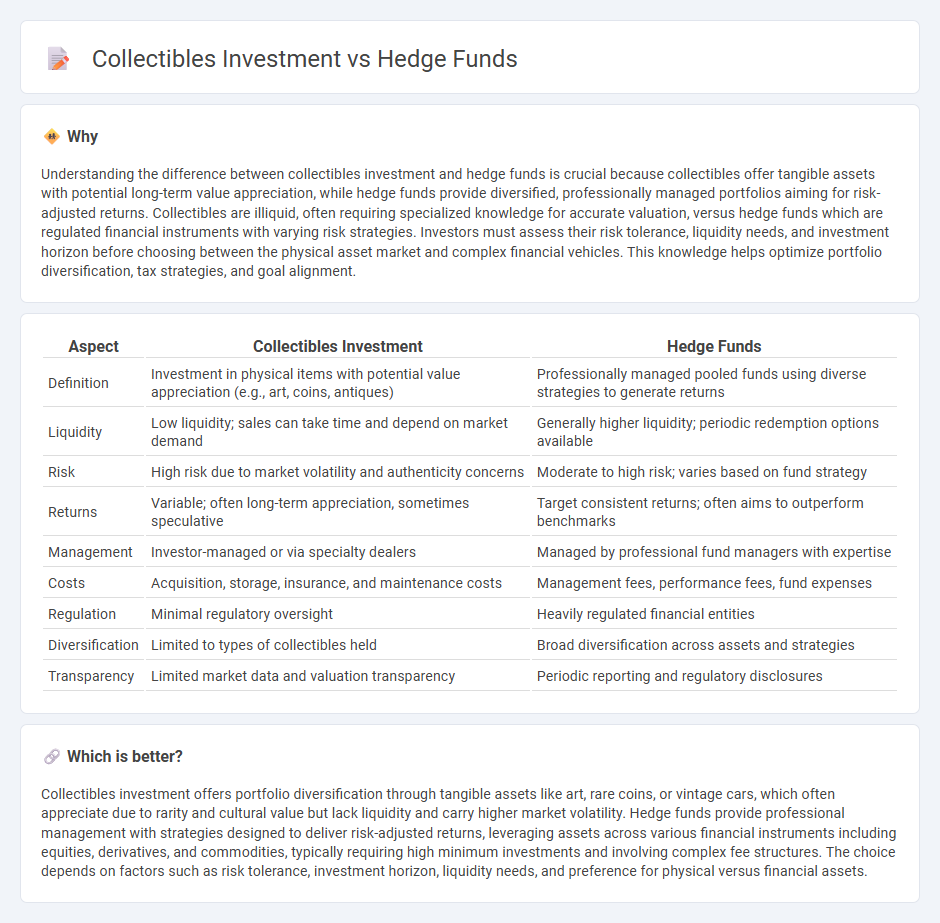

Understanding the difference between collectibles investment and hedge funds is crucial because collectibles offer tangible assets with potential long-term value appreciation, while hedge funds provide diversified, professionally managed portfolios aiming for risk-adjusted returns. Collectibles are illiquid, often requiring specialized knowledge for accurate valuation, versus hedge funds which are regulated financial instruments with varying risk strategies. Investors must assess their risk tolerance, liquidity needs, and investment horizon before choosing between the physical asset market and complex financial vehicles. This knowledge helps optimize portfolio diversification, tax strategies, and goal alignment.

Comparison Table

| Aspect | Collectibles Investment | Hedge Funds |

|---|---|---|

| Definition | Investment in physical items with potential value appreciation (e.g., art, coins, antiques) | Professionally managed pooled funds using diverse strategies to generate returns |

| Liquidity | Low liquidity; sales can take time and depend on market demand | Generally higher liquidity; periodic redemption options available |

| Risk | High risk due to market volatility and authenticity concerns | Moderate to high risk; varies based on fund strategy |

| Returns | Variable; often long-term appreciation, sometimes speculative | Target consistent returns; often aims to outperform benchmarks |

| Management | Investor-managed or via specialty dealers | Managed by professional fund managers with expertise |

| Costs | Acquisition, storage, insurance, and maintenance costs | Management fees, performance fees, fund expenses |

| Regulation | Minimal regulatory oversight | Heavily regulated financial entities |

| Diversification | Limited to types of collectibles held | Broad diversification across assets and strategies |

| Transparency | Limited market data and valuation transparency | Periodic reporting and regulatory disclosures |

Which is better?

Collectibles investment offers portfolio diversification through tangible assets like art, rare coins, or vintage cars, which often appreciate due to rarity and cultural value but lack liquidity and carry higher market volatility. Hedge funds provide professional management with strategies designed to deliver risk-adjusted returns, leveraging assets across various financial instruments including equities, derivatives, and commodities, typically requiring high minimum investments and involving complex fee structures. The choice depends on factors such as risk tolerance, investment horizon, liquidity needs, and preference for physical versus financial assets.

Connection

Collectibles investment offers portfolio diversification by providing tangible assets with low correlation to traditional markets, which hedge funds often integrate to mitigate risks and enhance returns. Hedge funds deploy sophisticated strategies leveraging collectibles' unique valuation dynamics to exploit market inefficiencies and capitalize on alternative asset appreciation. The intersection of collectibles and hedge funds exemplifies innovative asset management approaches focused on blending liquidity, rarity, and long-term growth potential.

Key Terms

Liquidity

Hedge funds offer high liquidity through frequent trading and redemption options, enabling investors to access capital quickly compared to collectibles, which often require longer periods to sell due to niche markets and appraisal processes. Collectibles, including art, rare coins, and vintage cars, face price volatility and market illiquidity, making them less suitable for investors prioritizing quick asset liquidation. Explore the nuances of liquidity differences between hedge funds and collectibles for informed investment decisions.

Risk Profile

Hedge funds often present a diversified risk profile driven by sophisticated strategies, market hedging, and professional management, aiming for higher returns with managed volatility. Collectibles, such as art or rare items, carry unique risks including market illiquidity, valuation subjectivity, and potential for physical damage, often resulting in less predictable returns. Explore deeper insights on balancing these distinctive risk factors to optimize your investment portfolio.

Valuation Method

Hedge funds typically use quantitative models such as discounted cash flow (DCF) analysis and risk-adjusted return metrics to value their portfolios, emphasizing market liquidity and financial performance. Collectibles investment relies on subjective appraisal techniques including rarity, provenance, and condition assessments, often guided by expert opinions and auction results. Explore further to understand the nuances of valuation methods in these distinct investment categories.

Source and External Links

Hedge Funds: Overview, Recruitment, Careers & Salaries - Hedge funds are investment firms that raise capital from institutional and accredited investors and use diverse strategies such as short-selling and derivatives to seek absolute returns or reduce risk, differing from mutual funds by targeting positive returns regardless of market direction.

Hedge Funds | Investor.gov - Hedge funds are private, unregistered funds limited to sophisticated investors, employing flexible and often riskier strategies than traditional investment funds, and are not subject to many regulatory protections typical of mutual funds or ETFs.

Hedge fund - Wikipedia - Hedge funds are pooled investment funds employing complex trading strategies and risk management, typically charging both management and performance fees, with assets totaling trillions and potential systemic risks due to leverage and correlated trading behavior.

dowidth.com

dowidth.com