Carbon credits trading enables businesses to offset their carbon emissions by purchasing credits generated from environmentally friendly projects, providing a market-driven approach to reducing greenhouse gases. Climate transition funds invest in companies actively shifting towards sustainable operations and low-carbon technologies, supporting long-term decarbonization strategies. Explore how these two investment avenues drive the global shift to a low-carbon economy.

Why it is important

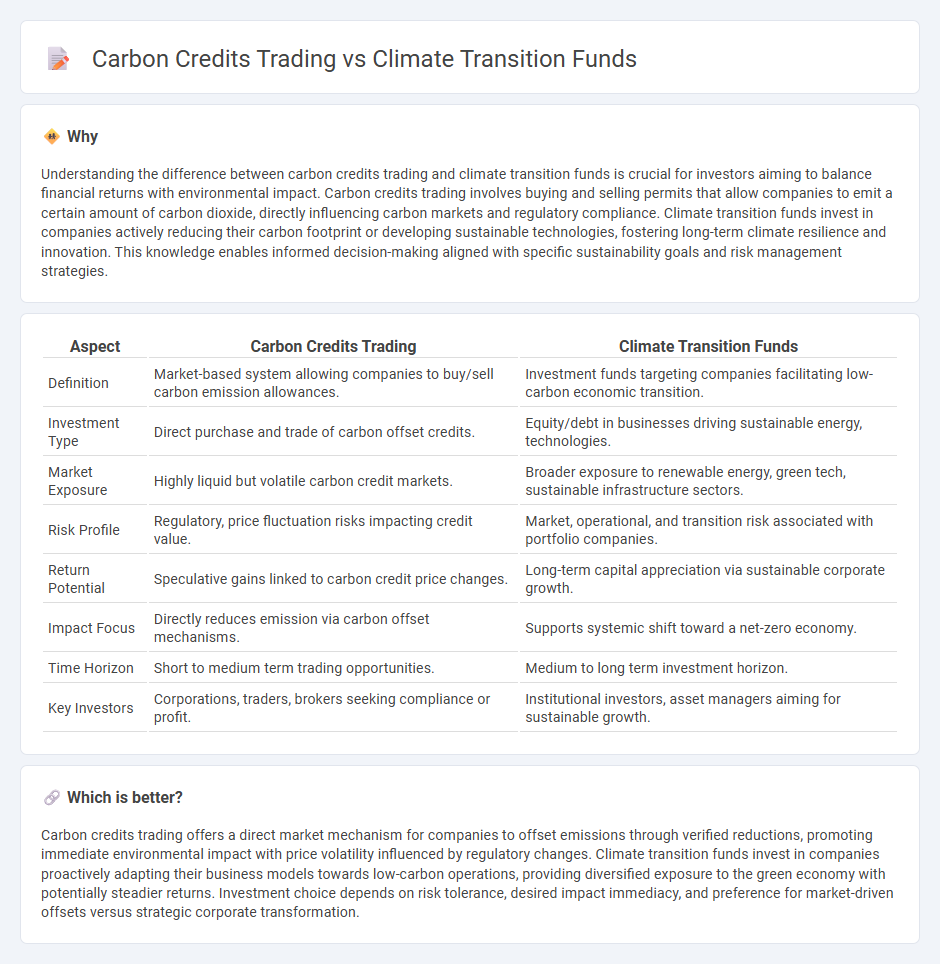

Understanding the difference between carbon credits trading and climate transition funds is crucial for investors aiming to balance financial returns with environmental impact. Carbon credits trading involves buying and selling permits that allow companies to emit a certain amount of carbon dioxide, directly influencing carbon markets and regulatory compliance. Climate transition funds invest in companies actively reducing their carbon footprint or developing sustainable technologies, fostering long-term climate resilience and innovation. This knowledge enables informed decision-making aligned with specific sustainability goals and risk management strategies.

Comparison Table

| Aspect | Carbon Credits Trading | Climate Transition Funds |

|---|---|---|

| Definition | Market-based system allowing companies to buy/sell carbon emission allowances. | Investment funds targeting companies facilitating low-carbon economic transition. |

| Investment Type | Direct purchase and trade of carbon offset credits. | Equity/debt in businesses driving sustainable energy, technologies. |

| Market Exposure | Highly liquid but volatile carbon credit markets. | Broader exposure to renewable energy, green tech, sustainable infrastructure sectors. |

| Risk Profile | Regulatory, price fluctuation risks impacting credit value. | Market, operational, and transition risk associated with portfolio companies. |

| Return Potential | Speculative gains linked to carbon credit price changes. | Long-term capital appreciation via sustainable corporate growth. |

| Impact Focus | Directly reduces emission via carbon offset mechanisms. | Supports systemic shift toward a net-zero economy. |

| Time Horizon | Short to medium term trading opportunities. | Medium to long term investment horizon. |

| Key Investors | Corporations, traders, brokers seeking compliance or profit. | Institutional investors, asset managers aiming for sustainable growth. |

Which is better?

Carbon credits trading offers a direct market mechanism for companies to offset emissions through verified reductions, promoting immediate environmental impact with price volatility influenced by regulatory changes. Climate transition funds invest in companies proactively adapting their business models towards low-carbon operations, providing diversified exposure to the green economy with potentially steadier returns. Investment choice depends on risk tolerance, desired impact immediacy, and preference for market-driven offsets versus strategic corporate transformation.

Connection

Carbon credits trading and climate transition funds are interconnected financial mechanisms driving sustainable investment by channeling capital into projects that reduce greenhouse gas emissions. Carbon credits create a market-based incentive for companies to lower their carbon footprint, while climate transition funds allocate investments to support businesses' shift towards low-carbon technologies and practices. Together, they accelerate the decarbonization process by aligning economic incentives with climate goals, enhancing environmental impact and financial returns.

Key Terms

**Climate transition funds:**

Climate transition funds are investment vehicles designed to support companies and projects that are actively reducing their carbon footprints and shifting to sustainable business models. These funds channel capital into renewable energy, energy efficiency, and technology innovations that facilitate the transition to a low-carbon economy. Explore how climate transition funds drive impactful environmental change and offer long-term financial returns.

ESG criteria

Climate transition funds channel investments into companies prioritizing decarbonization and sustainable innovation, directly supporting ESG goals by promoting environmental and social governance improvements. Carbon credits trading involves buying and selling emission allowances, incentivizing companies to reduce carbon footprints while meeting regulatory requirements, thus playing a critical role in environmental impact mitigation. Explore how integrating these strategies can enhance ESG compliance and drive sustainable investment portfolios.

Decarbonization pathway

Climate transition funds allocate capital to companies actively reducing carbon emissions, driving innovation in renewable energy and energy efficiency as key decarbonization pathways. Carbon credits trading facilitates emission reductions by allowing organizations to buy and sell certificates representing avoided or offset emissions, promoting cost-effective compliance with climate targets. Explore how integrating these financial mechanisms accelerates corporate decarbonization strategies and aligns with global sustainability goals.

Source and External Links

Olive Is the New Black: The Rise of Transition Funds - Transition-labeled funds are the fastest-growing category of climate funds, with many aligned to limiting temperature rise under 2.5degC and investing significantly in companies with net-zero targets and green revenues like alternative energy and energy efficiency.

REI, Allbirds and 20 other companies start climate ... - Climate transition funds guide companies to invest in climate action proportionally to their emissions via a money-for-ton mitigation framework, focusing on funding a wide range of climate solutions beyond direct carbon offsetting.

What is climate transition finance and why bother? - Climate transition finance focuses on funding companies actively decarbonizing and includes investments like climate transition leaders, solutions providers, and GSS bonds, with robust standards to prevent greenwashing and measure progress credibly.

dowidth.com

dowidth.com