Fractional farmland ownership allows investors to purchase a share of agricultural land, providing direct exposure to farmland assets and potential rental income without the need for full ownership. Private equity in agriculture involves pooled investments in agribusinesses or farming operations, offering access to professional management and diversified agricultural portfolios. Discover the comparative benefits and risks of these investment vehicles to make informed decisions.

Why it is important

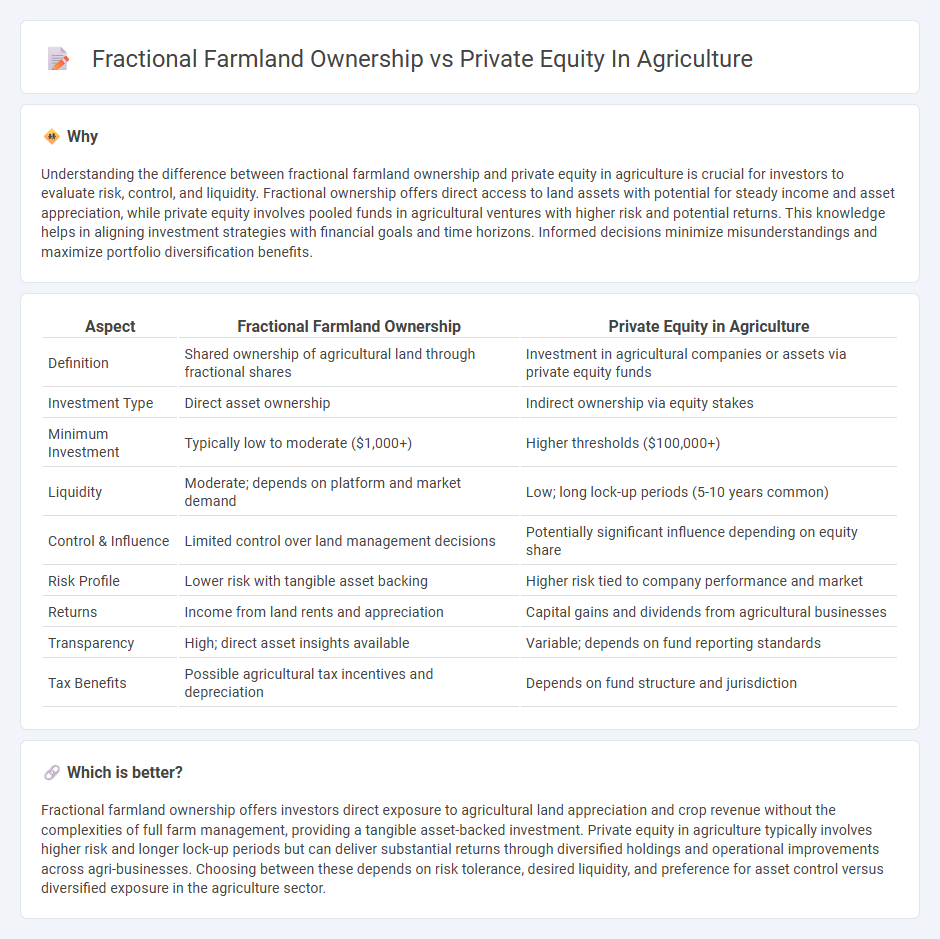

Understanding the difference between fractional farmland ownership and private equity in agriculture is crucial for investors to evaluate risk, control, and liquidity. Fractional ownership offers direct access to land assets with potential for steady income and asset appreciation, while private equity involves pooled funds in agricultural ventures with higher risk and potential returns. This knowledge helps in aligning investment strategies with financial goals and time horizons. Informed decisions minimize misunderstandings and maximize portfolio diversification benefits.

Comparison Table

| Aspect | Fractional Farmland Ownership | Private Equity in Agriculture |

|---|---|---|

| Definition | Shared ownership of agricultural land through fractional shares | Investment in agricultural companies or assets via private equity funds |

| Investment Type | Direct asset ownership | Indirect ownership via equity stakes |

| Minimum Investment | Typically low to moderate ($1,000+) | Higher thresholds ($100,000+) |

| Liquidity | Moderate; depends on platform and market demand | Low; long lock-up periods (5-10 years common) |

| Control & Influence | Limited control over land management decisions | Potentially significant influence depending on equity share |

| Risk Profile | Lower risk with tangible asset backing | Higher risk tied to company performance and market |

| Returns | Income from land rents and appreciation | Capital gains and dividends from agricultural businesses |

| Transparency | High; direct asset insights available | Variable; depends on fund reporting standards |

| Tax Benefits | Possible agricultural tax incentives and depreciation | Depends on fund structure and jurisdiction |

Which is better?

Fractional farmland ownership offers investors direct exposure to agricultural land appreciation and crop revenue without the complexities of full farm management, providing a tangible asset-backed investment. Private equity in agriculture typically involves higher risk and longer lock-up periods but can deliver substantial returns through diversified holdings and operational improvements across agri-businesses. Choosing between these depends on risk tolerance, desired liquidity, and preference for asset control versus diversified exposure in the agriculture sector.

Connection

Fractional farmland ownership enables investors to purchase smaller, more affordable shares of agricultural land, increasing accessibility to this asset class. Private equity in agriculture often utilizes fractional ownership structures to pool capital from multiple investors and acquire large-scale farmland holdings for higher returns. Both models enhance diversification, liquidity, and scalability in agricultural investments by lowering barriers to entry and spreading risk across multiple participants.

Key Terms

Capital commitment

Private equity in agriculture typically involves substantial capital commitments, often requiring millions of dollars and long-term lock-ins to access diversified farming operations managed by specialized firms. Fractional farmland ownership allows investors to allocate smaller amounts of capital, gaining partial stakes in farmland with lower entry costs and greater liquidity through shared ownership structures. Explore more to understand the nuances in capital commitment and investment flexibility between these two agricultural investment strategies.

Asset liquidity

Private equity in agriculture typically involves long-term investments with limited liquidity, as capital is often locked in until the fund exits through asset sales or IPOs. Fractional farmland ownership offers enhanced liquidity by allowing investors to buy and sell smaller shares of farmland more easily on secondary markets. Explore how these contrasting liquidity profiles impact investment strategies in the agricultural sector.

Ownership structure

Private equity in agriculture typically involves institutional investors acquiring significant stakes in large-scale farming operations, granting them direct control and decision-making power over assets and management. Fractional farmland ownership divides land into smaller shares sold to multiple individual investors, allowing diversified ownership without the need for active management or large capital commitments. Explore our detailed analysis to understand the nuances and benefits of each ownership structure in agricultural investments.

Source and External Links

How Private Equity Is Shaping the Future of Agriculture? - Private equity is driving innovation in agriculture by funding agri-tech, biotech, and sustainable farming technologies to boost productivity and sustainability, while also optimizing supply chains through IoT and blockchain innovations.

Private Equity Agriculture Investment: 2025 Top Trends - In 2025, private equity investments in agriculture are projected to surpass $20 billion globally, accelerating sector innovation, sustainability initiatives, and modernization critical for global food security.

Betting the farm: Private equity buyouts in US agriculture - Private equity firms have acquired large-scale farm operations in the US impacting key crop markets while focusing on new farming technologies to address food production challenges amid labor and economic concerns.

dowidth.com

dowidth.com