Collectibles investment offers tangible assets like art, antiques, and rare items that can appreciate in value based on rarity and demand, contrasting with the stock market where investments are made in company shares influenced by financial performance and market trends. Unlike stocks, collectibles often provide portfolio diversification and can serve as a hedge against inflation due to their physical nature. Explore more to understand the benefits and risks of collectibles versus stock market investments.

Why it is important

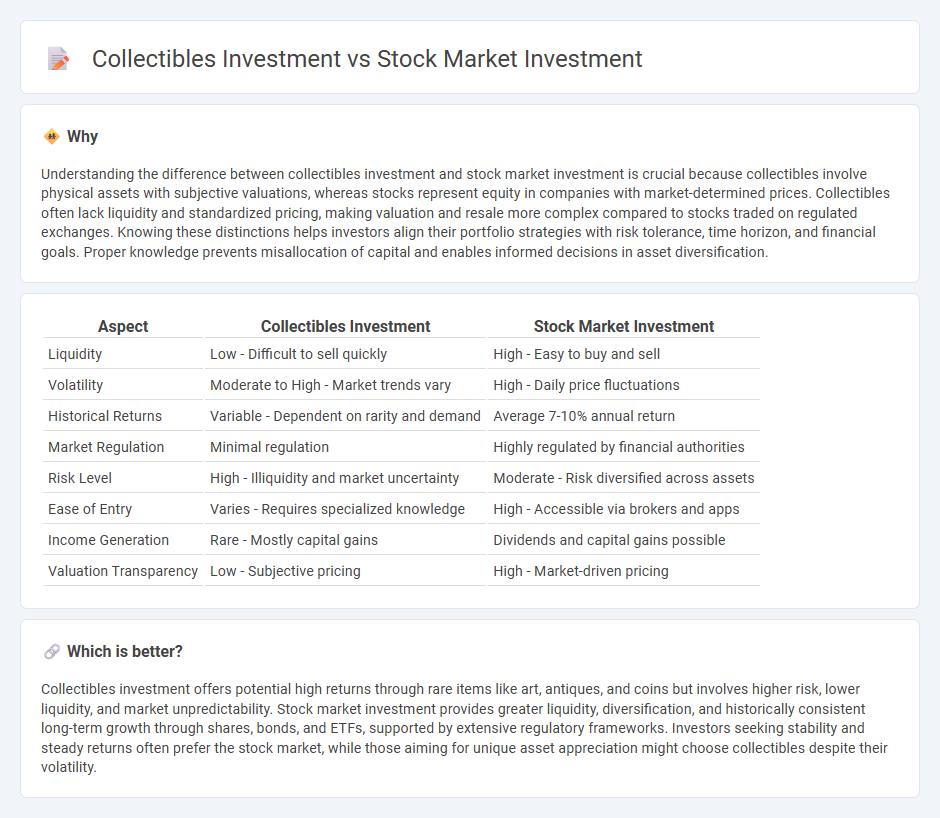

Understanding the difference between collectibles investment and stock market investment is crucial because collectibles involve physical assets with subjective valuations, whereas stocks represent equity in companies with market-determined prices. Collectibles often lack liquidity and standardized pricing, making valuation and resale more complex compared to stocks traded on regulated exchanges. Knowing these distinctions helps investors align their portfolio strategies with risk tolerance, time horizon, and financial goals. Proper knowledge prevents misallocation of capital and enables informed decisions in asset diversification.

Comparison Table

| Aspect | Collectibles Investment | Stock Market Investment |

|---|---|---|

| Liquidity | Low - Difficult to sell quickly | High - Easy to buy and sell |

| Volatility | Moderate to High - Market trends vary | High - Daily price fluctuations |

| Historical Returns | Variable - Dependent on rarity and demand | Average 7-10% annual return |

| Market Regulation | Minimal regulation | Highly regulated by financial authorities |

| Risk Level | High - Illiquidity and market uncertainty | Moderate - Risk diversified across assets |

| Ease of Entry | Varies - Requires specialized knowledge | High - Accessible via brokers and apps |

| Income Generation | Rare - Mostly capital gains | Dividends and capital gains possible |

| Valuation Transparency | Low - Subjective pricing | High - Market-driven pricing |

Which is better?

Collectibles investment offers potential high returns through rare items like art, antiques, and coins but involves higher risk, lower liquidity, and market unpredictability. Stock market investment provides greater liquidity, diversification, and historically consistent long-term growth through shares, bonds, and ETFs, supported by extensive regulatory frameworks. Investors seeking stability and steady returns often prefer the stock market, while those aiming for unique asset appreciation might choose collectibles despite their volatility.

Connection

Collectibles investment and stock market investment both rely on market demand and scarcity to determine value appreciation over time. Investors analyze trends, authenticity, and economic conditions to assess potential returns while managing risks associated with volatility in asset liquidity. Diversifying portfolios with tangible assets like collectibles can complement traditional stock market holdings by offering alternative growth opportunities.

Key Terms

**Stock Market Investment:**

Stock market investment offers liquidity, diversification, and the potential for long-term capital growth through equities, bonds, and ETFs traded on global exchanges. It provides access to real-time pricing, regulatory oversight, and the ability to leverage market data for informed decision-making. Explore more about optimizing portfolio strategies and risk management in stock market investments.

Dividend

Dividend income from stock market investments provides consistent, tangible cash flow through regular payments from publicly traded companies, often linked to their profitability and financial health. Collectibles, such as rare coins or art, do not generate dividends but rely on potential appreciation in value over time, making their returns less predictable and more dependent on market trends and buyer interest. Explore further to understand the benefits and risks of dividend-focused stock investments compared to collectibles.

Capital Gain

Stock market investment offers high liquidity and potential for capital gain through price appreciation and dividends, with historical average annual returns around 7-10%. Collectibles investment, such as art, coins, and rare items, often yields unpredictable capital gains influenced by rarity, condition, and market trends, but with less liquidity and higher transaction costs. Explore detailed comparisons and strategies to maximize capital gain in both investment types.

Source and External Links

How to Invest in Stocks: 2025 Beginner's Guide - NerdWallet - To invest in stocks, open an online brokerage account, add funds, buy stocks or stock-based funds like index funds or ETFs, and focus on a long-term plan rather than short-term trading, as low-cost mutual funds often outperform individual stocks over time.

Stocks | FINRA.org - Stocks represent ownership shares in a company, and investors can earn returns through dividends or capital gains, but stock prices can fluctuate significantly so diversification with stock funds is often recommended for new investors.

Warren Buffett has harsh words for stock market investors - Despite the anxiety caused by market volatility, investing in stocks is important to outpace inflation and build long-term wealth, and investors are advised to stay the course even through market downturns.

dowidth.com

dowidth.com