Collectibles investment offers potential high returns through rare items like art, vintage cars, or coins, but it carries risks such as market volatility and lack of liquidity. Farmland investment provides stable, long-term income with benefits from land appreciation and agricultural production, typically exhibiting lower volatility than collectibles. Explore the advantages and challenges of these unique investment options to determine the best fit for your portfolio.

Why it is important

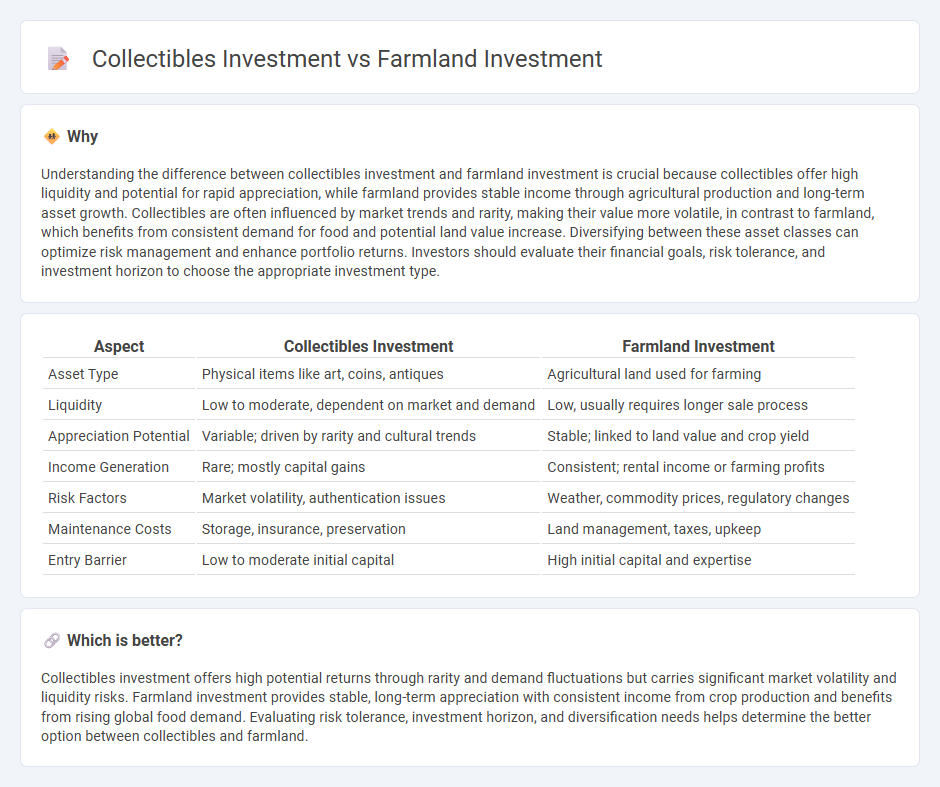

Understanding the difference between collectibles investment and farmland investment is crucial because collectibles offer high liquidity and potential for rapid appreciation, while farmland provides stable income through agricultural production and long-term asset growth. Collectibles are often influenced by market trends and rarity, making their value more volatile, in contrast to farmland, which benefits from consistent demand for food and potential land value increase. Diversifying between these asset classes can optimize risk management and enhance portfolio returns. Investors should evaluate their financial goals, risk tolerance, and investment horizon to choose the appropriate investment type.

Comparison Table

| Aspect | Collectibles Investment | Farmland Investment |

|---|---|---|

| Asset Type | Physical items like art, coins, antiques | Agricultural land used for farming |

| Liquidity | Low to moderate, dependent on market and demand | Low, usually requires longer sale process |

| Appreciation Potential | Variable; driven by rarity and cultural trends | Stable; linked to land value and crop yield |

| Income Generation | Rare; mostly capital gains | Consistent; rental income or farming profits |

| Risk Factors | Market volatility, authentication issues | Weather, commodity prices, regulatory changes |

| Maintenance Costs | Storage, insurance, preservation | Land management, taxes, upkeep |

| Entry Barrier | Low to moderate initial capital | High initial capital and expertise |

Which is better?

Collectibles investment offers high potential returns through rarity and demand fluctuations but carries significant market volatility and liquidity risks. Farmland investment provides stable, long-term appreciation with consistent income from crop production and benefits from rising global food demand. Evaluating risk tolerance, investment horizon, and diversification needs helps determine the better option between collectibles and farmland.

Connection

Collectibles investment and farmland investment are connected through their shared characteristic as alternative asset classes that offer portfolio diversification beyond traditional stocks and bonds. Both asset types tend to have lower correlation with financial markets, providing investors with a hedge against inflation and economic volatility. The unique valuation drivers for collectibles, such as rarity and demand, and farmland, including crop yields and land appreciation, contribute to their appeal in long-term wealth preservation.

Key Terms

**Farmland Investment:**

Farmland investment offers consistent returns through crop production and land appreciation, benefiting from increasing global food demand and limited arable land. It provides a tangible asset with low correlation to stock markets, reducing portfolio volatility and offering tax advantages such as depreciation and income deferral. Explore the advantages of farmland investment to diversify your portfolio and secure long-term wealth growth.

Yield

Farmland investment typically offers stable and attractive yields due to consistent agricultural production and land appreciation, often averaging 4-7% annually. Collectibles, such as art or rare items, provide highly variable yields reliant on market demand and rarity, with returns fluctuating widely and lacking income generation. Explore more to understand which investment aligns best with your financial goals and risk tolerance.

Land Appreciation

Farmland investment offers stable returns driven by land appreciation tied to agricultural demand and limited supply, making it a resilient asset class compared to collectibles, which often rely on market trends and subjective value. Farmland typically appreciates due to rising food demand, soil fertility, and government policies supporting agriculture, whereas collectibles can be volatile and affected by changing cultural interests. Explore more about how farmland investment can provide long-term wealth growth through land appreciation.

Source and External Links

Investing in farmland | Nuveen - Farmland offers stable returns, diversification, inflation protection, and low correlation to traditional assets, driven by global population growth and rising food demand.

Land as an Investment: Can I Afford It? | FCSAmerica - Farmland investment requires significant upfront capital, but revenue from leasing, crop sales, and non-farm income can help service debt and manage risk.

AcreTrader: Farmland Investing. Simplified. - Farmland has delivered attractive long-term returns and portfolio diversification, though it is illiquid and involves unique risks compared to stocks or bonds.

dowidth.com

dowidth.com