Fractional real estate ownership allows investors to purchase a specific portion of a physical property, offering tangible asset control and potential rental income, while REITs (Real Estate Investment Trusts) provide liquidity and diversification through publicly traded shares in real estate portfolios. Both investment methods have distinct risk profiles and capital requirements, with fractional ownership often requiring more active management compared to the passive income generated by REIT dividends. Explore deeper insights into choosing between fractional real estate and REITs to optimize your investment strategy.

Why it is important

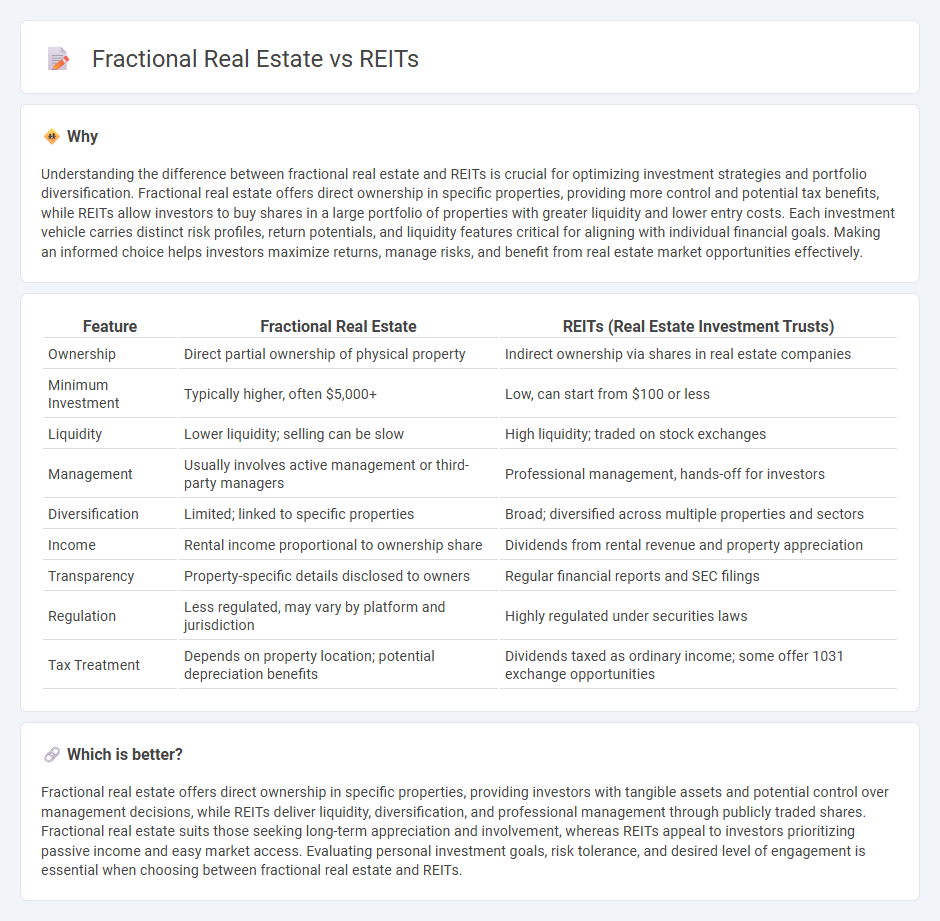

Understanding the difference between fractional real estate and REITs is crucial for optimizing investment strategies and portfolio diversification. Fractional real estate offers direct ownership in specific properties, providing more control and potential tax benefits, while REITs allow investors to buy shares in a large portfolio of properties with greater liquidity and lower entry costs. Each investment vehicle carries distinct risk profiles, return potentials, and liquidity features critical for aligning with individual financial goals. Making an informed choice helps investors maximize returns, manage risks, and benefit from real estate market opportunities effectively.

Comparison Table

| Feature | Fractional Real Estate | REITs (Real Estate Investment Trusts) |

|---|---|---|

| Ownership | Direct partial ownership of physical property | Indirect ownership via shares in real estate companies |

| Minimum Investment | Typically higher, often $5,000+ | Low, can start from $100 or less |

| Liquidity | Lower liquidity; selling can be slow | High liquidity; traded on stock exchanges |

| Management | Usually involves active management or third-party managers | Professional management, hands-off for investors |

| Diversification | Limited; linked to specific properties | Broad; diversified across multiple properties and sectors |

| Income | Rental income proportional to ownership share | Dividends from rental revenue and property appreciation |

| Transparency | Property-specific details disclosed to owners | Regular financial reports and SEC filings |

| Regulation | Less regulated, may vary by platform and jurisdiction | Highly regulated under securities laws |

| Tax Treatment | Depends on property location; potential depreciation benefits | Dividends taxed as ordinary income; some offer 1031 exchange opportunities |

Which is better?

Fractional real estate offers direct ownership in specific properties, providing investors with tangible assets and potential control over management decisions, while REITs deliver liquidity, diversification, and professional management through publicly traded shares. Fractional real estate suits those seeking long-term appreciation and involvement, whereas REITs appeal to investors prioritizing passive income and easy market access. Evaluating personal investment goals, risk tolerance, and desired level of engagement is essential when choosing between fractional real estate and REITs.

Connection

Fractional real estate allows investors to buy partial ownership in physical properties, making real estate investment more accessible and liquid. REITs (Real Estate Investment Trusts) pool capital from multiple investors to invest in diversified real estate portfolios, often traded like stocks. Both fractional real estate and REITs provide opportunities for portfolio diversification, income generation, and lower entry barriers compared to traditional whole-property investments.

Key Terms

Ownership Structure

REITs (Real Estate Investment Trusts) offer investors indirect ownership through shares in a professionally managed portfolio of properties, while fractional real estate provides direct ownership of a specific property portion. REITs trade on public exchanges, providing liquidity and diversification, whereas fractional real estate involves co-ownership agreements with limited liquidity but more control over the asset. Explore the differences in ownership structures to determine which investment aligns best with your financial goals.

Liquidity

REITs offer high liquidity by allowing investors to buy and sell shares on major stock exchanges, providing quick access to capital. Fractional real estate investments, while more accessible than full property ownership, typically involve longer transaction times and less market liquidity. Discover the detailed distinctions between REIT liquidity and fractional real estate to optimize your investment strategy.

Dividend/Income Distribution

REITs typically offer consistent dividend income derived from rental earnings and property operations, providing investors with steady cash flow and potential tax advantages under regulations like the IRS Code Section 856. Fractional real estate investments distribute income based on each investor's proportional ownership, often influenced by property performance and management fees, which can result in variable dividend payouts. Explore deeper insights into dividend structures and income distribution strategies to maximize your real estate investment returns.

Source and External Links

What's a REIT (Real Estate Investment Trust)? - Nareit - A REIT is a company that owns, operates, or finances income-producing real estate; REITs offer investors regular income streams, diversification, and long-term capital appreciation, and most are publicly traded on major stock exchanges.

Real Estate Investment Trusts (REITs) - Charles Schwab - REITs are companies that own and often operate income-producing real estate, offering a liquid way to invest in real estate with the requirement to distribute at least 90% of taxable income as dividends to investors, generally resulting in higher dividend yields.

Best-Performing REITs of July 2025, How to Invest - NerdWallet - REITs come in three types: equity REITs (own and manage properties), mortgage REITs (own real estate debt), and hybrid REITs (combine both), each featuring different risk profiles and dividend potentials for investors.

dowidth.com

dowidth.com