Royalty streaming agreements provide investors with a percentage of revenue generated by an asset, offering predictable cash flow without equity dilution. Convertible notes serve as short-term debt that converts into equity, allowing investors to benefit from future valuation increases. Explore the advantages and risks of both investment strategies to determine the best fit for your financial goals.

Why it is important

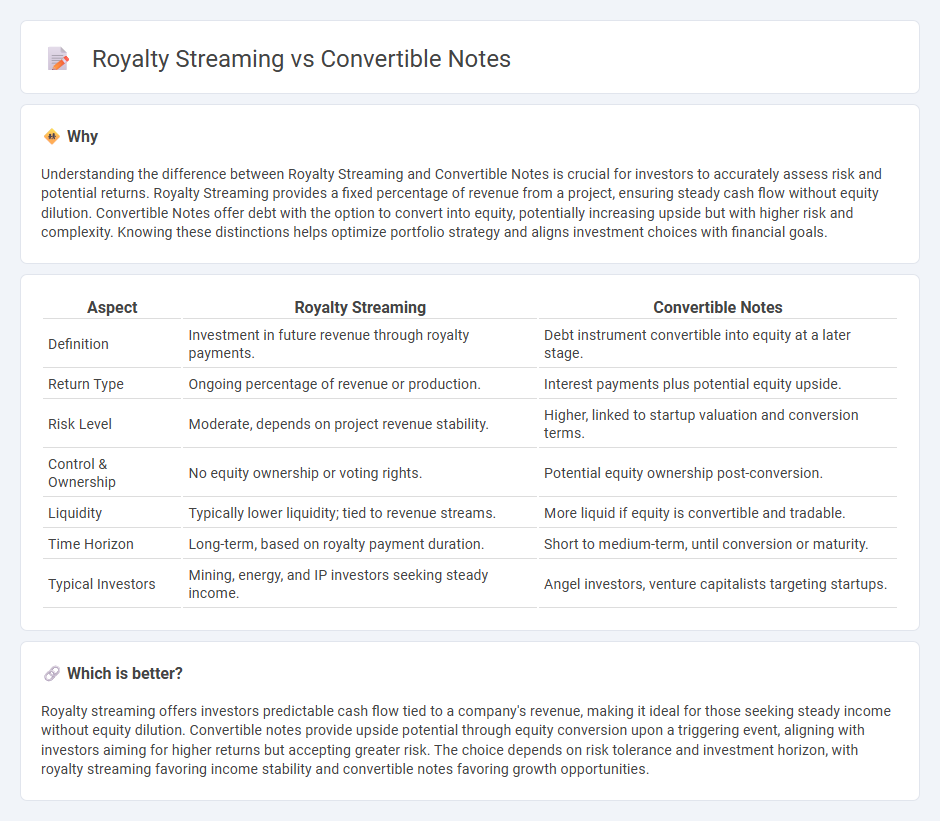

Understanding the difference between Royalty Streaming and Convertible Notes is crucial for investors to accurately assess risk and potential returns. Royalty Streaming provides a fixed percentage of revenue from a project, ensuring steady cash flow without equity dilution. Convertible Notes offer debt with the option to convert into equity, potentially increasing upside but with higher risk and complexity. Knowing these distinctions helps optimize portfolio strategy and aligns investment choices with financial goals.

Comparison Table

| Aspect | Royalty Streaming | Convertible Notes |

|---|---|---|

| Definition | Investment in future revenue through royalty payments. | Debt instrument convertible into equity at a later stage. |

| Return Type | Ongoing percentage of revenue or production. | Interest payments plus potential equity upside. |

| Risk Level | Moderate, depends on project revenue stability. | Higher, linked to startup valuation and conversion terms. |

| Control & Ownership | No equity ownership or voting rights. | Potential equity ownership post-conversion. |

| Liquidity | Typically lower liquidity; tied to revenue streams. | More liquid if equity is convertible and tradable. |

| Time Horizon | Long-term, based on royalty payment duration. | Short to medium-term, until conversion or maturity. |

| Typical Investors | Mining, energy, and IP investors seeking steady income. | Angel investors, venture capitalists targeting startups. |

Which is better?

Royalty streaming offers investors predictable cash flow tied to a company's revenue, making it ideal for those seeking steady income without equity dilution. Convertible notes provide upside potential through equity conversion upon a triggering event, aligning with investors aiming for higher returns but accepting greater risk. The choice depends on risk tolerance and investment horizon, with royalty streaming favoring income stability and convertible notes favoring growth opportunities.

Connection

Royalty streaming and convertible notes are connected through their hybrid structure that combines debt and equity features, allowing investors to earn returns from company revenues while maintaining potential equity upside. Royalty streaming provides investors with ongoing payments based on a percentage of revenue, offering steady cash flow, whereas convertible notes start as debt but can convert into equity under predefined conditions, aligning investor interests with company growth. Both instruments offer flexible financing options favored in sectors like mining and startups, balancing risk and reward through their linked financial mechanisms.

Key Terms

Debt-to-equity conversion (Convertible Notes)

Convertible notes offer debt-to-equity conversion, enabling investors to convert outstanding debt into company equity at a predetermined valuation or discount during a funding round, providing flexibility and potential upside in high-growth startups. Royalty streaming, in contrast, involves investors receiving a percentage of revenue or royalties without equity participation, offering predictable cash flow but no ownership stake or conversion option. Discover how debt-to-equity conversion in convertible notes can optimize your investment strategy.

Royalty payment structure (Royalty Streaming)

Royalty streaming offers investors a fixed percentage of revenue generated from a project's future production, ensuring consistent income without diluting ownership or equity. Unlike convertible notes that convert debt into equity at a later valuation, royalty payments provide direct cash flow tied to the asset's output. Explore how royalty streaming structures can optimize investment returns and risk management in resource finance.

Exit strategy

Convertible notes offer debt financing that can convert into equity upon an exit event such as an acquisition or IPO, providing investors with potential upside through equity participation. Royalty streaming involves investors receiving a percentage of revenue generated by a project or asset, offering consistent cash flow but typically no equity ownership or control during exit events. Explore detailed comparisons to understand which exit strategy aligns best with your investment goals.

Source and External Links

Convertible Securities: SAFEs vs. Convertible Notes - Convertible notes are short-term debt instruments that can convert into equity, typically during a future priced funding round, and often include features like a valuation cap or conversion discount to reward early investors.

The Pros and Cons of Convertible Notes - Convertible notes allow startups to raise capital quickly and inexpensively without setting a company valuation, and they are commonly used as bridge financing before a larger equity round.

What is a convertible note? - Convertible notes are hybrid financing instruments where investors lend money to a startup with the option to convert the debt into equity at a future date, offering both upside potential and some debt protection if the company fails.

dowidth.com

dowidth.com