Digital real estate offers scalable opportunities through virtual properties and metaverse platforms, while art investment provides tangible value with physical and digital masterpieces appreciating over time. Both asset classes diversify portfolios but differ in liquidity, market volatility, and cultural significance. Explore the unique benefits and risks of digital real estate and art investment to enhance your wealth strategy.

Why it is important

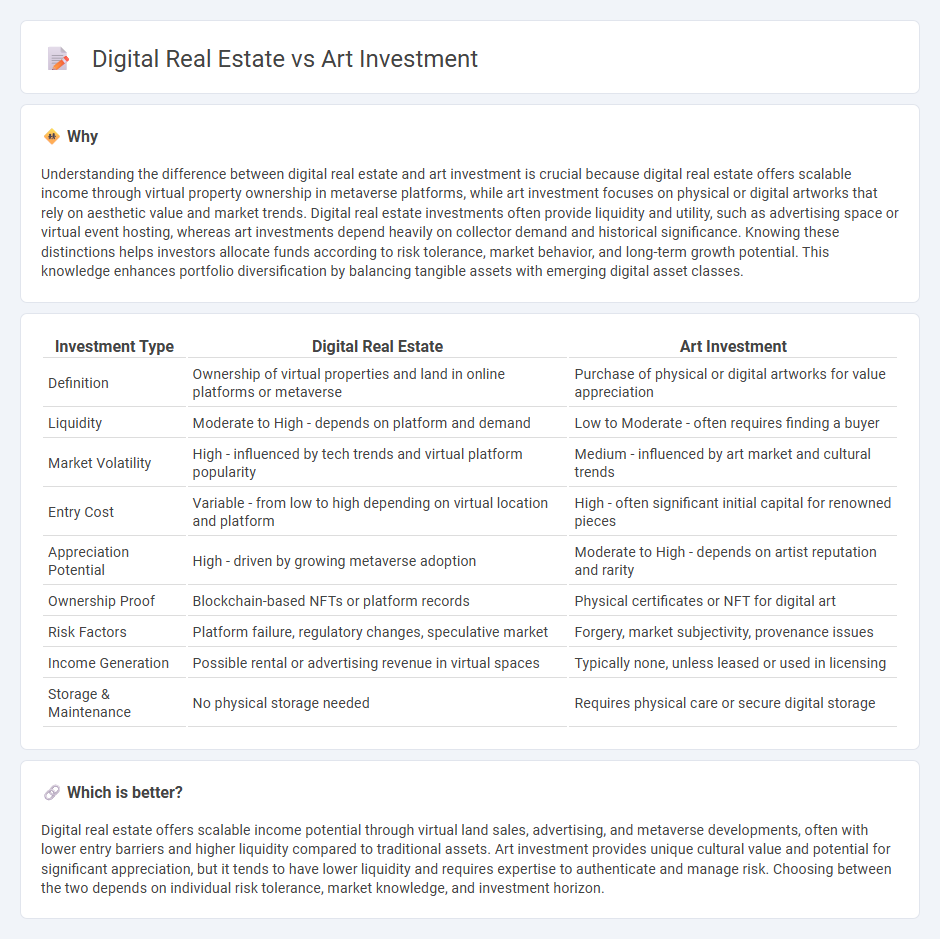

Understanding the difference between digital real estate and art investment is crucial because digital real estate offers scalable income through virtual property ownership in metaverse platforms, while art investment focuses on physical or digital artworks that rely on aesthetic value and market trends. Digital real estate investments often provide liquidity and utility, such as advertising space or virtual event hosting, whereas art investments depend heavily on collector demand and historical significance. Knowing these distinctions helps investors allocate funds according to risk tolerance, market behavior, and long-term growth potential. This knowledge enhances portfolio diversification by balancing tangible assets with emerging digital asset classes.

Comparison Table

| Investment Type | Digital Real Estate | Art Investment |

|---|---|---|

| Definition | Ownership of virtual properties and land in online platforms or metaverse | Purchase of physical or digital artworks for value appreciation |

| Liquidity | Moderate to High - depends on platform and demand | Low to Moderate - often requires finding a buyer |

| Market Volatility | High - influenced by tech trends and virtual platform popularity | Medium - influenced by art market and cultural trends |

| Entry Cost | Variable - from low to high depending on virtual location and platform | High - often significant initial capital for renowned pieces |

| Appreciation Potential | High - driven by growing metaverse adoption | Moderate to High - depends on artist reputation and rarity |

| Ownership Proof | Blockchain-based NFTs or platform records | Physical certificates or NFT for digital art |

| Risk Factors | Platform failure, regulatory changes, speculative market | Forgery, market subjectivity, provenance issues |

| Income Generation | Possible rental or advertising revenue in virtual spaces | Typically none, unless leased or used in licensing |

| Storage & Maintenance | No physical storage needed | Requires physical care or secure digital storage |

Which is better?

Digital real estate offers scalable income potential through virtual land sales, advertising, and metaverse developments, often with lower entry barriers and higher liquidity compared to traditional assets. Art investment provides unique cultural value and potential for significant appreciation, but it tends to have lower liquidity and requires expertise to authenticate and manage risk. Choosing between the two depends on individual risk tolerance, market knowledge, and investment horizon.

Connection

Digital real estate and art investment intersect through the growing value of blockchain technology, which enables ownership verification via non-fungible tokens (NFTs) in virtual environments. Both assets offer diversification opportunities as they represent scarce digital commodities tied to online platforms and metaverses. The integration of digital art within virtual real estate environments enhances engagement and appreciation, driving demand and potential returns.

Key Terms

**Art Investment:**

Art investment offers a unique blend of cultural value and potential financial appreciation, often driven by the rarity and provenance of original works from renowned artists. Unlike digital real estate, art assets are tangible and have historically shown resilience against market volatility, attracting collectors and investors seeking diversification. Explore more about how acquiring fine art can enhance your portfolio and secure long-term wealth.

Provenance

Art investment leverages Provenance to authenticate artwork history, enhancing value and reducing fraud risks. Digital real estate relies on blockchain-based Provenance to verify ownership and transaction history within virtual environments. Explore how Provenance transforms asset authenticity and security in both markets.

Authenticity

Art investment appeals to collectors through the uniqueness and provenance of physical works, with authenticity verified by experts and certificates that enhance value and trust. Digital real estate, such as virtual land in metaverses, relies on blockchain technology to ensure genuine ownership and scarcity, critical factors for investor confidence. Explore how authenticity shapes value and security in these evolving asset classes.

Source and External Links

Basics of Art Funds - Provides information on various strategies used by art investment funds, including traditional buy and hold approaches and geographic arbitrage.

Investing in Art - Discusses the benefits and risks of art as an investment, including portfolio diversification and inflation protection.

How to Invest in Art - Offers a guide to investing in art, highlighting its potential for superior returns compared to other passion investments.

dowidth.com

dowidth.com