Vintage sneaker portfolios offer a high-growth alternative to traditional investment options, driven by strong demand in the collectible market and limited supply of rare models. Precious metals investments such as gold and silver provide stability and a hedge against inflation, recognized for their long-term value retention and global acceptance. Explore more to understand the unique benefits and risks associated with each investment strategy.

Why it is important

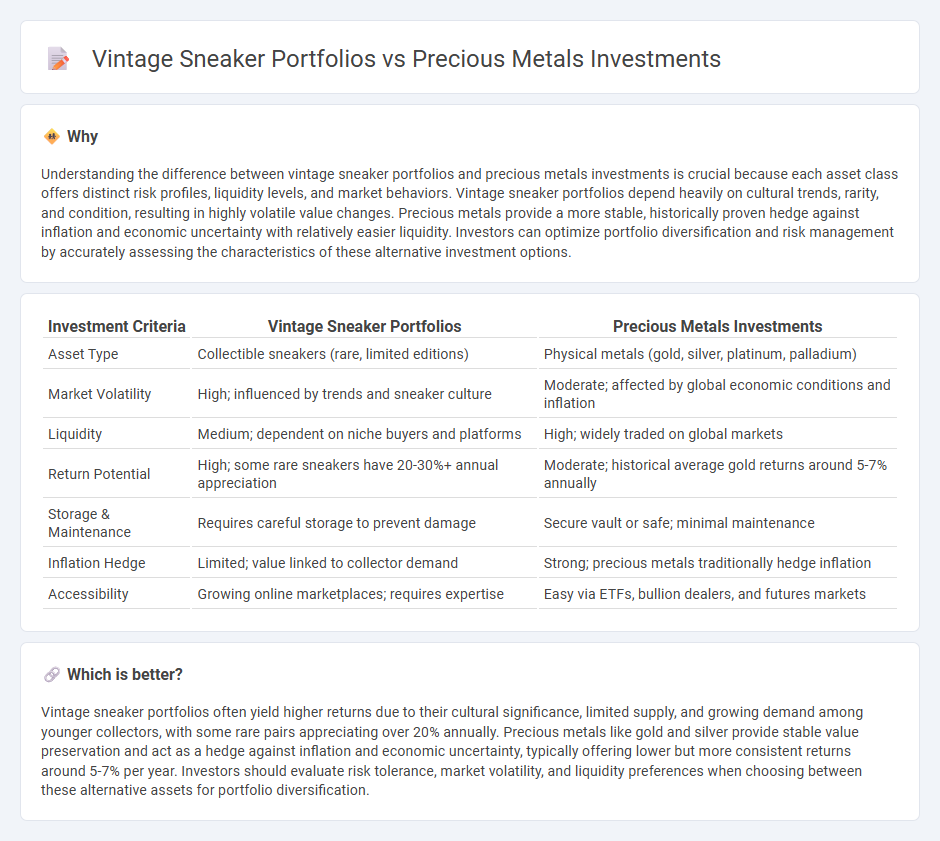

Understanding the difference between vintage sneaker portfolios and precious metals investments is crucial because each asset class offers distinct risk profiles, liquidity levels, and market behaviors. Vintage sneaker portfolios depend heavily on cultural trends, rarity, and condition, resulting in highly volatile value changes. Precious metals provide a more stable, historically proven hedge against inflation and economic uncertainty with relatively easier liquidity. Investors can optimize portfolio diversification and risk management by accurately assessing the characteristics of these alternative investment options.

Comparison Table

| Investment Criteria | Vintage Sneaker Portfolios | Precious Metals Investments |

|---|---|---|

| Asset Type | Collectible sneakers (rare, limited editions) | Physical metals (gold, silver, platinum, palladium) |

| Market Volatility | High; influenced by trends and sneaker culture | Moderate; affected by global economic conditions and inflation |

| Liquidity | Medium; dependent on niche buyers and platforms | High; widely traded on global markets |

| Return Potential | High; some rare sneakers have 20-30%+ annual appreciation | Moderate; historical average gold returns around 5-7% annually |

| Storage & Maintenance | Requires careful storage to prevent damage | Secure vault or safe; minimal maintenance |

| Inflation Hedge | Limited; value linked to collector demand | Strong; precious metals traditionally hedge inflation |

| Accessibility | Growing online marketplaces; requires expertise | Easy via ETFs, bullion dealers, and futures markets |

Which is better?

Vintage sneaker portfolios often yield higher returns due to their cultural significance, limited supply, and growing demand among younger collectors, with some rare pairs appreciating over 20% annually. Precious metals like gold and silver provide stable value preservation and act as a hedge against inflation and economic uncertainty, typically offering lower but more consistent returns around 5-7% per year. Investors should evaluate risk tolerance, market volatility, and liquidity preferences when choosing between these alternative assets for portfolio diversification.

Connection

Vintage sneaker portfolios and precious metals investments share a unique connection through their role as alternative assets offering portfolio diversification and inflation hedging. Both asset classes have demonstrated strong historical appreciation and are favored by investors seeking tangible, non-traditional stores of value outside of stocks and bonds. The scarcity and cultural significance of vintage sneakers mirror the finite supply and enduring worth of precious metals like gold and silver, making them complementary investment options in a balanced portfolio.

Key Terms

Liquidity

Precious metals such as gold and silver offer high liquidity due to their global market presence and standardized pricing, enabling quick conversion to cash. In contrast, vintage sneakers require niche expertise and a specialized buyer network, which can result in longer selling times and variable market demand. Explore the liquidity dynamics of both asset classes to optimize your investment strategy.

Authentication

Authentication plays a crucial role in both precious metals investments and vintage sneaker portfolios to ensure asset legitimacy and value preservation. Advanced technologies like blockchain and third-party certifications are commonly employed to verify authenticity and prevent counterfeit risks. Explore how authentication methods impact investment security and market confidence in these unique asset classes.

Market volatility

Precious metals like gold and silver often serve as stable hedges during times of high market volatility, preserving value amid economic uncertainty. Vintage sneaker portfolios, while offering potential for high returns, tend to be more susceptible to market trends and consumer demand fluctuations, making them a less predictable asset class. Explore deeper insights to understand which investment aligns best with your risk tolerance and financial goals.

Source and External Links

Seven things to consider when investing in precious metals - TD Bank - Investing in precious metals like gold, silver, and platinum is mainly to diversify portfolios with assets that don't correlate with stock and bond markets, offering stability during market downturns and inflation protection.

Investing in Precious Metals: A Guide for Beginners - Money - Precious metals investment options include physical bullion (coins, bars), mining stocks, mutual funds, and ETFs, with each carrying different risks, liquidity, and market factors affecting returns.

Why investors are drawn to precious metals - CBS News - Precious metals serve as a hedge against market volatility and economic uncertainty, with industrial uses enhancing their value; gold, silver, and platinum help preserve wealth and reduce investment risk compared to derivatives.

dowidth.com

dowidth.com