Wine futures offer investors the chance to purchase wine before it is bottled, potentially yielding high returns based on vintage quality and market demand. Agricultural farmland provides a tangible asset with income from crop production and land appreciation tied to food demand and commodity prices. Explore the benefits and risks of these unique investment options to determine which aligns with your portfolio goals.

Why it is important

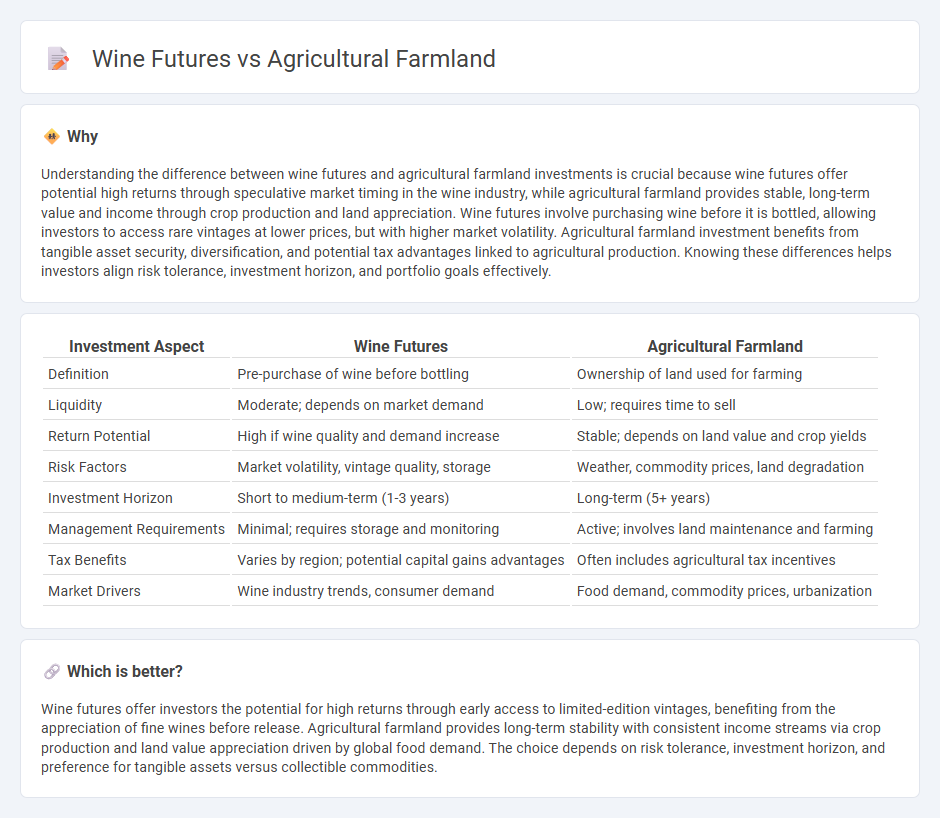

Understanding the difference between wine futures and agricultural farmland investments is crucial because wine futures offer potential high returns through speculative market timing in the wine industry, while agricultural farmland provides stable, long-term value and income through crop production and land appreciation. Wine futures involve purchasing wine before it is bottled, allowing investors to access rare vintages at lower prices, but with higher market volatility. Agricultural farmland investment benefits from tangible asset security, diversification, and potential tax advantages linked to agricultural production. Knowing these differences helps investors align risk tolerance, investment horizon, and portfolio goals effectively.

Comparison Table

| Investment Aspect | Wine Futures | Agricultural Farmland |

|---|---|---|

| Definition | Pre-purchase of wine before bottling | Ownership of land used for farming |

| Liquidity | Moderate; depends on market demand | Low; requires time to sell |

| Return Potential | High if wine quality and demand increase | Stable; depends on land value and crop yields |

| Risk Factors | Market volatility, vintage quality, storage | Weather, commodity prices, land degradation |

| Investment Horizon | Short to medium-term (1-3 years) | Long-term (5+ years) |

| Management Requirements | Minimal; requires storage and monitoring | Active; involves land maintenance and farming |

| Tax Benefits | Varies by region; potential capital gains advantages | Often includes agricultural tax incentives |

| Market Drivers | Wine industry trends, consumer demand | Food demand, commodity prices, urbanization |

Which is better?

Wine futures offer investors the potential for high returns through early access to limited-edition vintages, benefiting from the appreciation of fine wines before release. Agricultural farmland provides long-term stability with consistent income streams via crop production and land value appreciation driven by global food demand. The choice depends on risk tolerance, investment horizon, and preference for tangible assets versus collectible commodities.

Connection

Wine futures and agricultural farmland investments are interconnected through their shared reliance on agricultural production cycles and land value appreciation. Investing in wine futures involves purchasing wine before it is bottled, closely tied to vineyard crop yields and quality, which depend on farmland conditions and climatic factors. Farmland investment underpins wine futures by securing the essential natural resources and cultivation practices necessary for premium wine production and subsequent market valuation growth.

Key Terms

Asset Valuation

Agricultural farmland is valued based on soil quality, climate conditions, and long-term crop yield potential, making it a tangible asset with intrinsic worth. Wine futures derive their value from anticipated quality, vineyard reputation, and market demand for specific vintages, representing more speculative and market-driven assets. Explore the key differences in asset valuation strategies between these two investment types to enhance portfolio diversification.

Market Liquidity

Agricultural farmland offers tangible asset value with relatively stable long-term appreciation, but often experiences low market liquidity due to high entry costs and transaction complexities. Wine futures present higher market liquidity, enabling quicker trades and speculative opportunities, yet they carry risks tied to vintage quality fluctuations and storage concerns. Explore deeper insights into how liquidity impacts investment strategies in both agricultural farmland and wine futures markets.

Risk Diversification

Agricultural farmland investments provide tangible asset security with income from crop production, offering lower volatility compared to wine futures, which are more speculative and tied to market trends and vintage quality. Wine futures present higher liquidity potential but carry risks related to market demand fluctuations, climate impact, and storage costs. Explore detailed comparisons to optimize your portfolio's risk diversification strategy effectively.

Source and External Links

Farmland and Agriculture - This webpage discusses the importance of farmland for food production and economic stability, highlighting challenges such as urbanization and climate change affecting its sustainability.

Agricultural Land - This Wikipedia page provides information on the types and distribution of agricultural land globally, including arable land, permanent pastures, and permanent crops.

Why Save Farmland - This webpage emphasizes the importance of preserving farmland for food security, biodiversity, economic stability, and environmental resilience in the United States.

dowidth.com

dowidth.com