Investing in music royalties offers steady, passive income through rights to earnings from songs, whereas startups present high-growth potential but with increased risk and market volatility. Music royalties generate predictable cash flow tied to streaming, licensing, and broadcasting, while startups require active management and often face uncertain returns. Explore the detailed comparison to determine which investment suits your financial goals and risk appetite.

Why it is important

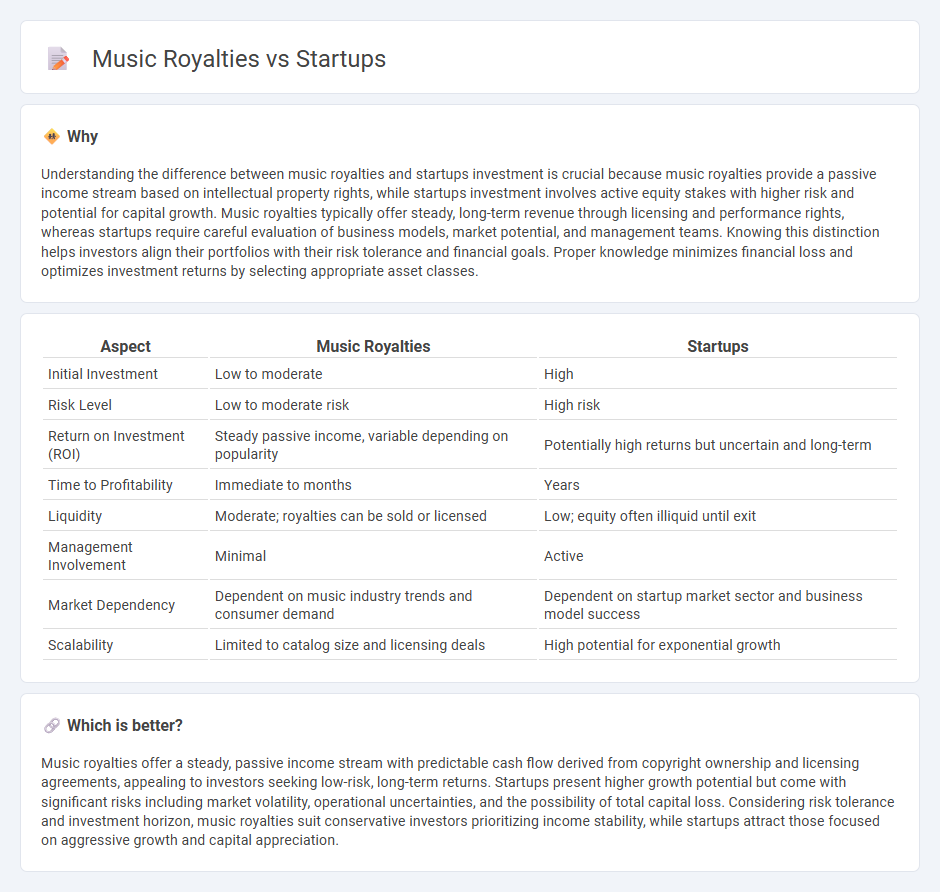

Understanding the difference between music royalties and startups investment is crucial because music royalties provide a passive income stream based on intellectual property rights, while startups investment involves active equity stakes with higher risk and potential for capital growth. Music royalties typically offer steady, long-term revenue through licensing and performance rights, whereas startups require careful evaluation of business models, market potential, and management teams. Knowing this distinction helps investors align their portfolios with their risk tolerance and financial goals. Proper knowledge minimizes financial loss and optimizes investment returns by selecting appropriate asset classes.

Comparison Table

| Aspect | Music Royalties | Startups |

|---|---|---|

| Initial Investment | Low to moderate | High |

| Risk Level | Low to moderate risk | High risk |

| Return on Investment (ROI) | Steady passive income, variable depending on popularity | Potentially high returns but uncertain and long-term |

| Time to Profitability | Immediate to months | Years |

| Liquidity | Moderate; royalties can be sold or licensed | Low; equity often illiquid until exit |

| Management Involvement | Minimal | Active |

| Market Dependency | Dependent on music industry trends and consumer demand | Dependent on startup market sector and business model success |

| Scalability | Limited to catalog size and licensing deals | High potential for exponential growth |

Which is better?

Music royalties offer a steady, passive income stream with predictable cash flow derived from copyright ownership and licensing agreements, appealing to investors seeking low-risk, long-term returns. Startups present higher growth potential but come with significant risks including market volatility, operational uncertainties, and the possibility of total capital loss. Considering risk tolerance and investment horizon, music royalties suit conservative investors prioritizing income stability, while startups attract those focused on aggressive growth and capital appreciation.

Connection

Music royalties provide a recurring revenue stream that startups in the music industry leverage to attract investors and sustain growth. Startups specializing in royalty tracking, licensing, and distribution use technology to optimize royalty collection and ensure transparent payments to artists. This intersection creates investment opportunities by combining innovative financial models with the stability of intellectual property income.

Key Terms

Equity

Startups often offer equity as a form of compensation or investment, allowing founders and early employees to share ownership and potential future profits. Music royalties represent ongoing revenue streams generated from the use of intellectual property, but typically do not confer ownership or equity stake in the underlying rights. Explore in-depth the strategic differences between equity investment in startups and revenue generation through music royalties.

Recurring Revenue

Startups often seek recurring revenue through subscription models to ensure predictable cash flow, similar to how music royalties generate continuous income from licensed works. Music royalties provide artists and rights holders with consistent earnings based on usage, streaming, and performance, creating a steady revenue stream akin to SaaS or membership-based startups. Explore how integrating recurring revenue strategies can enhance stability and growth in both startups and the music industry.

Intellectual Property

Startups often rely on intellectual property (IP) to secure competitive advantages, protecting innovations through patents, trademarks, and copyrights. Music royalties represent a specific form of IP monetization, where rights holders earn income from the use and distribution of their creative works. Explore how startups can leverage music royalties as a strategic asset to maximize revenue and IP value.

Source and External Links

Startup company - Wikipedia - A startup is a company or project by an entrepreneur to seek, develop, and validate a scalable business model, facing high uncertainty and often funded initially by founders, angel investors, or venture capital through several stages of funding.

Startups: 100 Best Startup Companies 2025: Jobs, Invest, Lists - Fundz - Many successful startups come from accelerators like Y Combinator, Techstars, and Seedcamp, which provide funding, mentorship, and resources to early-stage startups.

Google for Startups - Google for Startups supports startups worldwide by connecting them with people, products, programs, and spaces to help them grow and scale.

dowidth.com

dowidth.com