Sneaker flipping involves buying limited-edition sneakers and reselling them at a higher price, capitalizing on trends and scarcity in the sneaker market. ETF investing offers diversified exposure to stocks, bonds, or commodities with lower risk and long-term growth potential. Explore more about which investment strategy suits your financial goals and risk tolerance.

Why it is important

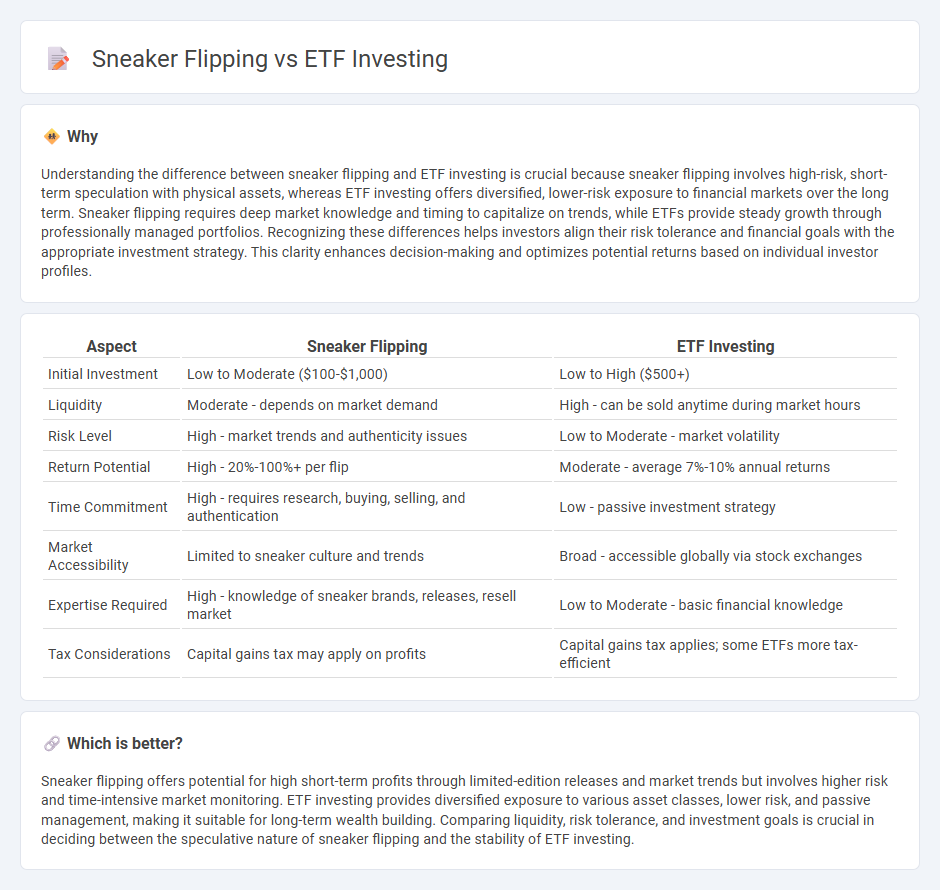

Understanding the difference between sneaker flipping and ETF investing is crucial because sneaker flipping involves high-risk, short-term speculation with physical assets, whereas ETF investing offers diversified, lower-risk exposure to financial markets over the long term. Sneaker flipping requires deep market knowledge and timing to capitalize on trends, while ETFs provide steady growth through professionally managed portfolios. Recognizing these differences helps investors align their risk tolerance and financial goals with the appropriate investment strategy. This clarity enhances decision-making and optimizes potential returns based on individual investor profiles.

Comparison Table

| Aspect | Sneaker Flipping | ETF Investing |

|---|---|---|

| Initial Investment | Low to Moderate ($100-$1,000) | Low to High ($500+) |

| Liquidity | Moderate - depends on market demand | High - can be sold anytime during market hours |

| Risk Level | High - market trends and authenticity issues | Low to Moderate - market volatility |

| Return Potential | High - 20%-100%+ per flip | Moderate - average 7%-10% annual returns |

| Time Commitment | High - requires research, buying, selling, and authentication | Low - passive investment strategy |

| Market Accessibility | Limited to sneaker culture and trends | Broad - accessible globally via stock exchanges |

| Expertise Required | High - knowledge of sneaker brands, releases, resell market | Low to Moderate - basic financial knowledge |

| Tax Considerations | Capital gains tax may apply on profits | Capital gains tax applies; some ETFs more tax-efficient |

Which is better?

Sneaker flipping offers potential for high short-term profits through limited-edition releases and market trends but involves higher risk and time-intensive market monitoring. ETF investing provides diversified exposure to various asset classes, lower risk, and passive management, making it suitable for long-term wealth building. Comparing liquidity, risk tolerance, and investment goals is crucial in deciding between the speculative nature of sneaker flipping and the stability of ETF investing.

Connection

Sneaker flipping and ETF investing both capitalize on market trends and timing to generate profit. Sneaker flipping involves buying limited-edition footwear at retail prices and reselling at a higher value, driven by scarcity and demand, while ETF investing leverages diversified portfolios to track market indices and achieve steady growth. Both strategies require analyzing market behavior, understanding value fluctuations, and balancing risk to maximize returns.

Key Terms

ETF Investing:

ETF investing offers diversified exposure to a broad range of assets, reducing risk compared to the volatile market of sneaker flipping. With ETFs, investors benefit from liquidity, lower fees, and the potential for steady market returns driven by underlying indexes. Explore more about how ETF investing can help build long-term wealth.

Diversification

ETF investing offers broad market diversification, spreading risk across multiple sectors and asset classes, which helps stabilize returns over time. Sneaker flipping concentrates investments in limited-edition footwear, exposing investors to high volatility and niche market demand fluctuations without broad diversification. Explore the advantages and risks of each approach to determine the best fit for your investment strategy.

Expense Ratio

ETF investing offers a low expense ratio, typically ranging from 0.03% to 0.50%, making it a cost-efficient choice for diversifying portfolios with minimal fees. Sneaker flipping incurs variable costs including acquisition price, authentication fees, and marketplace commissions, often resulting in higher and less predictable expenses. Explore detailed comparisons to understand which strategy aligns best with your financial goals.

Source and External Links

What is an ETF (Exchange-Traded Fund)? - ETFs are funds traded on exchanges that track specific indexes, offering investors diversification, lower costs, trading flexibility, and tax efficiency by holding a collection of stocks, bonds, or other securities in one fund, combining features of stocks and mutual funds.

The Best ETFs for July 2025 and How to Invest - ETFs provide an easy, low-cost way for both beginners and experts to diversify their portfolios through shares representing a collection of stocks, bonds, or commodities, making them generally less risky than individual stocks.

Investing in ETFs for beginners | iShares - BlackRock - ETFs track market indices or specific industries and allow investors to buy a broad market exposure with a single trade, accessible through online brokers or banks with options for one-time or regular investments.

dowidth.com

dowidth.com