Royalty stream investing offers consistent income through rights to future revenue from intellectual property or natural resources, while commodities investing involves trading physical goods like gold, oil, or agricultural products with price volatility influenced by market demand and geopolitical factors. Royalty streams provide predictable cash flow with lower exposure to market fluctuations, whereas commodities trading carries potential high returns coupled with significant risk due to price swings. Explore the advantages and strategic differences between royalty stream investing and commodities investing to enhance your portfolio diversification.

Why it is important

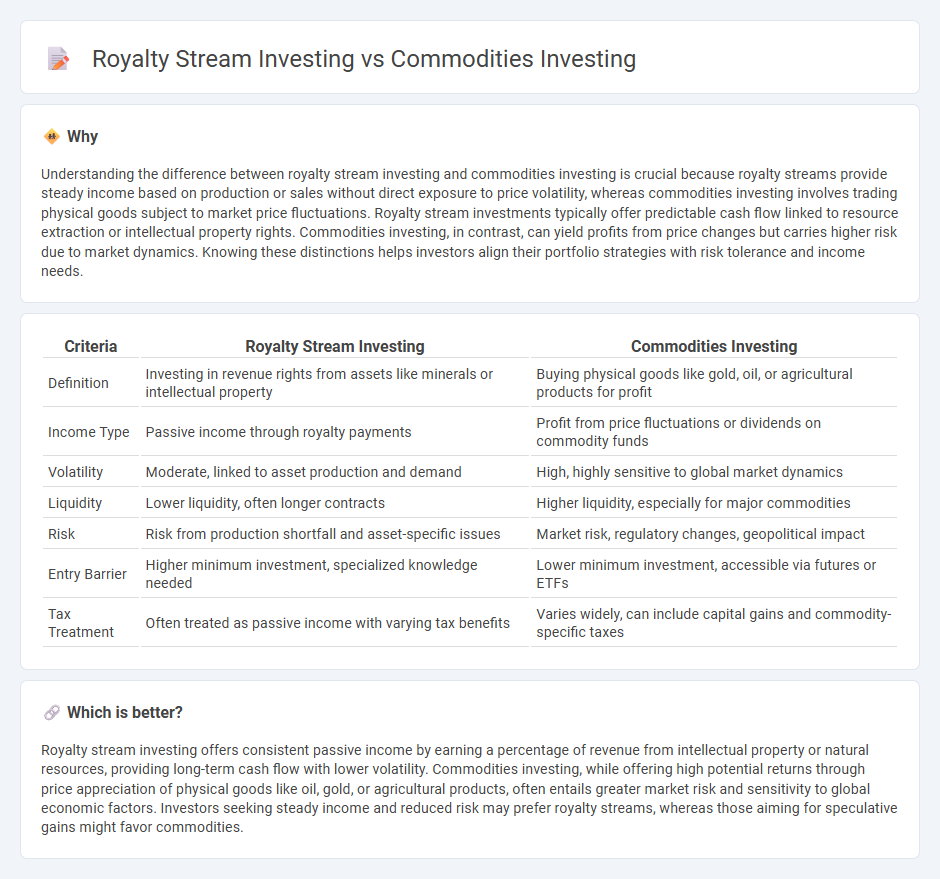

Understanding the difference between royalty stream investing and commodities investing is crucial because royalty streams provide steady income based on production or sales without direct exposure to price volatility, whereas commodities investing involves trading physical goods subject to market price fluctuations. Royalty stream investments typically offer predictable cash flow linked to resource extraction or intellectual property rights. Commodities investing, in contrast, can yield profits from price changes but carries higher risk due to market dynamics. Knowing these distinctions helps investors align their portfolio strategies with risk tolerance and income needs.

Comparison Table

| Criteria | Royalty Stream Investing | Commodities Investing |

|---|---|---|

| Definition | Investing in revenue rights from assets like minerals or intellectual property | Buying physical goods like gold, oil, or agricultural products for profit |

| Income Type | Passive income through royalty payments | Profit from price fluctuations or dividends on commodity funds |

| Volatility | Moderate, linked to asset production and demand | High, highly sensitive to global market dynamics |

| Liquidity | Lower liquidity, often longer contracts | Higher liquidity, especially for major commodities |

| Risk | Risk from production shortfall and asset-specific issues | Market risk, regulatory changes, geopolitical impact |

| Entry Barrier | Higher minimum investment, specialized knowledge needed | Lower minimum investment, accessible via futures or ETFs |

| Tax Treatment | Often treated as passive income with varying tax benefits | Varies widely, can include capital gains and commodity-specific taxes |

Which is better?

Royalty stream investing offers consistent passive income by earning a percentage of revenue from intellectual property or natural resources, providing long-term cash flow with lower volatility. Commodities investing, while offering high potential returns through price appreciation of physical goods like oil, gold, or agricultural products, often entails greater market risk and sensitivity to global economic factors. Investors seeking steady income and reduced risk may prefer royalty streams, whereas those aiming for speculative gains might favor commodities.

Connection

Royalty stream investing and commodities investing are connected through their reliance on natural resource extraction, where royalty streams provide investors with a percentage of revenue from commodity production without direct ownership. Both investment types benefit from fluctuations in commodity prices, making their returns sensitive to global supply and demand dynamics. Diversifying a portfolio with royalties and commodities offers exposure to tangible assets linked to energy, metals, and agricultural products.

Key Terms

Underlying Asset

Commodities investing involves direct exposure to physical goods like oil, metals, or agricultural products whose prices fluctuate based on supply and demand dynamics in global markets. Royalty stream investing provides income derived from rights to extract resources or intellectual property without ownership of the underlying assets, offering more predictable cash flow tied to production volumes or sales. Explore the distinct risk profiles and revenue models by delving deeper into the strategic advantages of each investment type.

Revenue Source

Commodities investing relies on the direct ownership or contracts tied to physical goods such as oil, gold, or agricultural products, exposing investors to market price fluctuations and supply-demand dynamics. Royalty stream investing centers on securing a percentage of revenue generated by specific projects or assets without ownership, providing steady income linked to production or sales milestones. Explore the nuances of each revenue source model to determine which investment aligns with your financial goals.

Risk Exposure

Commodities investing exposes investors to market volatility driven by supply-demand imbalances, geopolitical tensions, and currency fluctuations, resulting in high price risk and unpredictable returns. Royalty stream investing offers more stable cash flows tied to production or revenue from underlying assets, mitigating downside risk but subject to operational and commodity price risks. Explore detailed strategies to balance risk exposure in commodities and royalty stream portfolios for optimized investment outcomes.

Source and External Links

Commodity investing and its role in a portfolio - Vanguard - Commodity investing involves commodity futures contracts and can provide portfolio diversification and protection against inflation, with systematic approaches to incorporate commodities based on inflation and economic conditions.

Futures and Commodities - FINRA - Commodities investing can be done through direct physical ownership, commodity futures, or funds such as ETFs; commodity futures are derivative contracts obliging purchase or sale of a commodity at a future date and are commonly used by commercial users and sophisticated investors.

Understanding Commodities - PIMCO - Commodities are valued for providing inflation hedging, diversification, and return potential; indices like the Bloomberg Commodity Index and S&P GSCI track commodities through futures contracts as benchmarks for investors.

dowidth.com

dowidth.com