Rare streetwear flipping offers rapid returns through limited-edition drops and high demand within fashion communities, while comic book investing builds value over time based on rarity, condition, and historical significance. Both markets require expert knowledge to identify undervalued assets and predict trends but differ in liquidity and market cycles. Explore these investment strategies to determine which aligns best with your financial goals and risk tolerance.

Why it is important

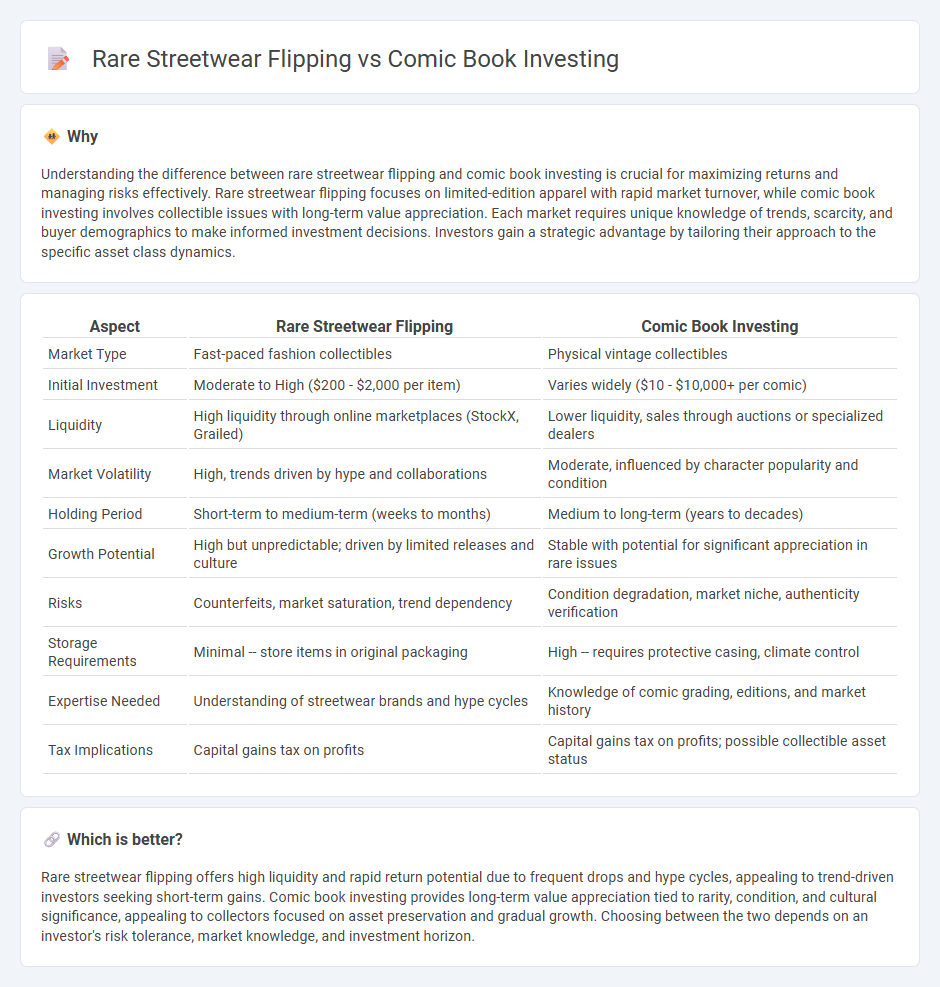

Understanding the difference between rare streetwear flipping and comic book investing is crucial for maximizing returns and managing risks effectively. Rare streetwear flipping focuses on limited-edition apparel with rapid market turnover, while comic book investing involves collectible issues with long-term value appreciation. Each market requires unique knowledge of trends, scarcity, and buyer demographics to make informed investment decisions. Investors gain a strategic advantage by tailoring their approach to the specific asset class dynamics.

Comparison Table

| Aspect | Rare Streetwear Flipping | Comic Book Investing |

|---|---|---|

| Market Type | Fast-paced fashion collectibles | Physical vintage collectibles |

| Initial Investment | Moderate to High ($200 - $2,000 per item) | Varies widely ($10 - $10,000+ per comic) |

| Liquidity | High liquidity through online marketplaces (StockX, Grailed) | Lower liquidity, sales through auctions or specialized dealers |

| Market Volatility | High, trends driven by hype and collaborations | Moderate, influenced by character popularity and condition |

| Holding Period | Short-term to medium-term (weeks to months) | Medium to long-term (years to decades) |

| Growth Potential | High but unpredictable; driven by limited releases and culture | Stable with potential for significant appreciation in rare issues |

| Risks | Counterfeits, market saturation, trend dependency | Condition degradation, market niche, authenticity verification |

| Storage Requirements | Minimal -- store items in original packaging | High -- requires protective casing, climate control |

| Expertise Needed | Understanding of streetwear brands and hype cycles | Knowledge of comic grading, editions, and market history |

| Tax Implications | Capital gains tax on profits | Capital gains tax on profits; possible collectible asset status |

Which is better?

Rare streetwear flipping offers high liquidity and rapid return potential due to frequent drops and hype cycles, appealing to trend-driven investors seeking short-term gains. Comic book investing provides long-term value appreciation tied to rarity, condition, and cultural significance, appealing to collectors focused on asset preservation and gradual growth. Choosing between the two depends on an investor's risk tolerance, market knowledge, and investment horizon.

Connection

Streetwear flipping and comic book investing both capitalize on scarcity and collector demand, driving up the value of limited-edition items. The investment strategy hinges on identifying rare pieces with cultural significance that appreciate over time due to their exclusivity. Market trends and community enthusiasm significantly influence price volatility in these niche asset classes.

Key Terms

**Comic Book Investing:**

Comic book investing offers long-term value appreciation driven by factors such as rarity, condition, and cultural significance, with classic titles like Action Comics #1 and Detective Comics #27 commanding premium prices. Graded copies certified by organizations like CGC enhance collectibility and price potential, while market trends show consistent growth supported by collector demand and pop culture influence. Explore how strategic comic book investing can diversify your portfolio and build tangible wealth.

Grading

Comic book investing thrives on meticulous grading standards established by CGC, which significantly influence market value by assessing condition, authenticity, and preservation. Rare streetwear flipping relies heavily on detailed verification processes, including brand authenticity, limited edition status, and condition grading, which directly impact resale prices and demand. Explore how mastering grading criteria within each niche can enhance your investment strategy.

First Appearance

First appearance comic books offer significant long-term investment potential due to their enduring cultural impact and rarity, particularly iconic issues like Action Comics #1 or Amazing Fantasy #15. Rare streetwear flipping capitalizes on limited drops and brand hype, driving quick profits but often faces volatility as trends shift rapidly. Explore how first appearances in both markets create unique value and investment strategies.

Source and External Links

I buy comics as an investment... - Comic book investing carries long-term risk due to changing demographics; it's potentially profitable if you pick the right books and time the sale correctly, but not a safe bet for holding comics for decades.

COMICSHEATINGUP - Informed Comic Book Speculation - This site provides weekly picks of promising new comics to speculate on, with insights on trending issues and variants that might increase in value.

CBSI Comics | Comic Book Speculation and Investing - Offers guides and analysis focused on uncovering undervalued comics and key issues, also covering special collectible topics and signing events that can affect investment value.

dowidth.com

dowidth.com