Forestry investment offers tangible asset backing with potential for long-term capital appreciation and sustainable returns through timber growth, contrasting fixed income securities that provide predictable interest payments and lower volatility. Timberland assets often hedge against inflation and deliver environmental benefits, while fixed income focuses on preserving capital and steady income streams. Explore more to understand which investment suits your financial goals.

Why it is important

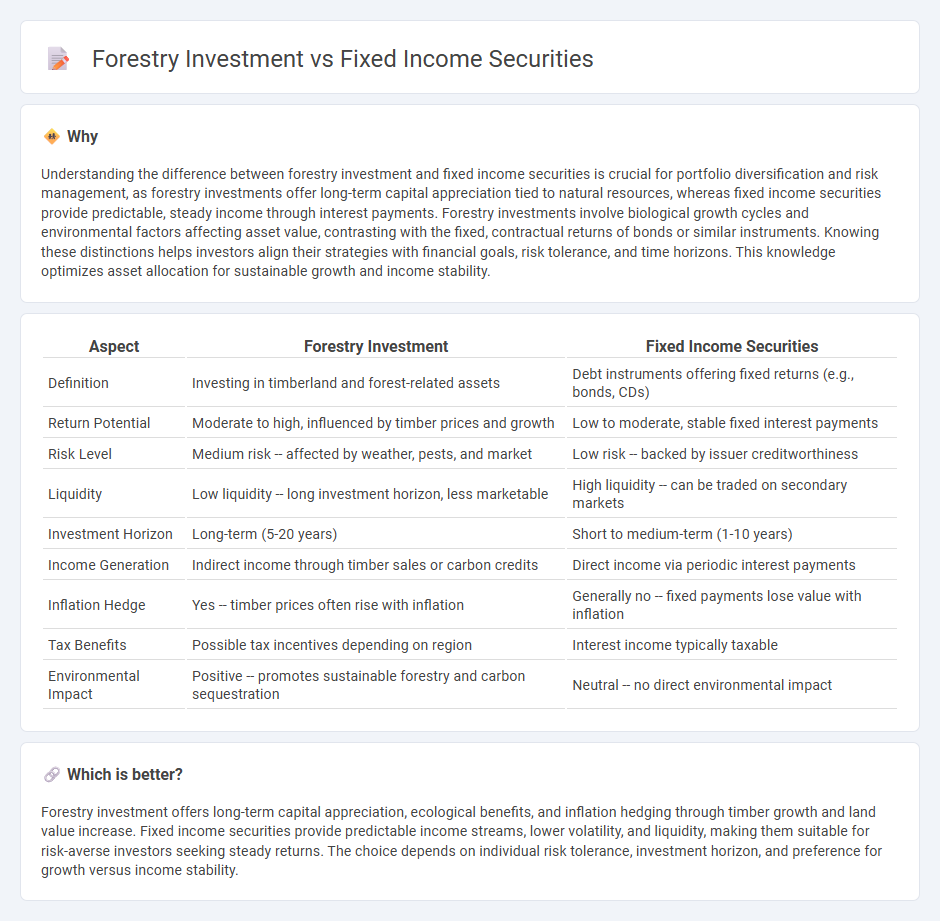

Understanding the difference between forestry investment and fixed income securities is crucial for portfolio diversification and risk management, as forestry investments offer long-term capital appreciation tied to natural resources, whereas fixed income securities provide predictable, steady income through interest payments. Forestry investments involve biological growth cycles and environmental factors affecting asset value, contrasting with the fixed, contractual returns of bonds or similar instruments. Knowing these distinctions helps investors align their strategies with financial goals, risk tolerance, and time horizons. This knowledge optimizes asset allocation for sustainable growth and income stability.

Comparison Table

| Aspect | Forestry Investment | Fixed Income Securities |

|---|---|---|

| Definition | Investing in timberland and forest-related assets | Debt instruments offering fixed returns (e.g., bonds, CDs) |

| Return Potential | Moderate to high, influenced by timber prices and growth | Low to moderate, stable fixed interest payments |

| Risk Level | Medium risk -- affected by weather, pests, and market | Low risk -- backed by issuer creditworthiness |

| Liquidity | Low liquidity -- long investment horizon, less marketable | High liquidity -- can be traded on secondary markets |

| Investment Horizon | Long-term (5-20 years) | Short to medium-term (1-10 years) |

| Income Generation | Indirect income through timber sales or carbon credits | Direct income via periodic interest payments |

| Inflation Hedge | Yes -- timber prices often rise with inflation | Generally no -- fixed payments lose value with inflation |

| Tax Benefits | Possible tax incentives depending on region | Interest income typically taxable |

| Environmental Impact | Positive -- promotes sustainable forestry and carbon sequestration | Neutral -- no direct environmental impact |

Which is better?

Forestry investment offers long-term capital appreciation, ecological benefits, and inflation hedging through timber growth and land value increase. Fixed income securities provide predictable income streams, lower volatility, and liquidity, making them suitable for risk-averse investors seeking steady returns. The choice depends on individual risk tolerance, investment horizon, and preference for growth versus income stability.

Connection

Forestry investment offers long-term, stable returns through timber assets, which complement fixed income securities by providing portfolio diversification and inflation hedging. Both asset classes generate predictable cash flows--forestry through timber sales and fixed income through interest payments--enhancing overall investment stability. Integrating forestry investment with fixed income securities reduces portfolio volatility and strengthens risk-adjusted returns over time.

Key Terms

Yield

Fixed income securities typically offer predictable yields through regular interest payments, with government and corporate bonds averaging around 2-5% annually depending on credit risk and maturity. Forestry investments yield returns primarily through timber growth and land appreciation, with long-term annual yields ranging from 4-10%, influenced by species, management practices, and market demand for wood products. Explore detailed comparisons of yield volatility, risk profiles, and tax advantages to determine which investment matches your portfolio goals.

Maturity

Fixed income securities typically have a defined maturity date, providing predictable returns and principal repayment at the end of the term, often ranging from short-term bonds (less than 3 years) to long-term bonds (up to 30 years or more). Forestry investments, in contrast, lack a fixed maturity, as their value depends on the growth cycle of trees, which can span decades, making them a longer-term and less liquid asset. Explore further to understand how maturity impacts risk profiles and liquidity in these investment types.

Biological Growth Rate

Fixed income securities offer predictable returns through interest payments, while forestry investments generate value primarily via biological growth rates of trees, which influence timber volume and quality over time. The biological growth rate in forestry can vary based on species, climate, and forest management practices, affecting the long-term yield and investment risk profile. Explore how understanding biological growth rates can enhance portfolio diversification by balancing stable income with natural asset appreciation.

Source and External Links

Fixed Income Securities | Definition + Examples - Fixed income securities are investment products where investors lend capital to governments or corporations for a fixed duration, receiving regular interest payments and the principal at maturity, focusing on capital preservation and steady income.

Definition and Examples of Fixed Income Securities - Fixed income securities, commonly bonds, are debt instruments issued by governments or corporations providing investors with periodic interest and principal repayment at maturity, offering predictable cash flows and portfolio diversification.

What are fixed-income securities? - Fixed-income securities include bonds, treasury bills, and other debt instruments that offer a secure, low-risk investment option with fixed periodic payments and return of principal, widely used by investors seeking stable income and diversification.

dowidth.com

dowidth.com