Crypto staking involves locking cryptocurrencies to support blockchain operations and earn rewards, often yielding higher returns but with increased volatility. Dividend stocks provide regular income through company profit distributions, offering more stability and less risk compared to staking. Explore the advantages and risks of each investment strategy to determine which suits your financial goals best.

Why it is important

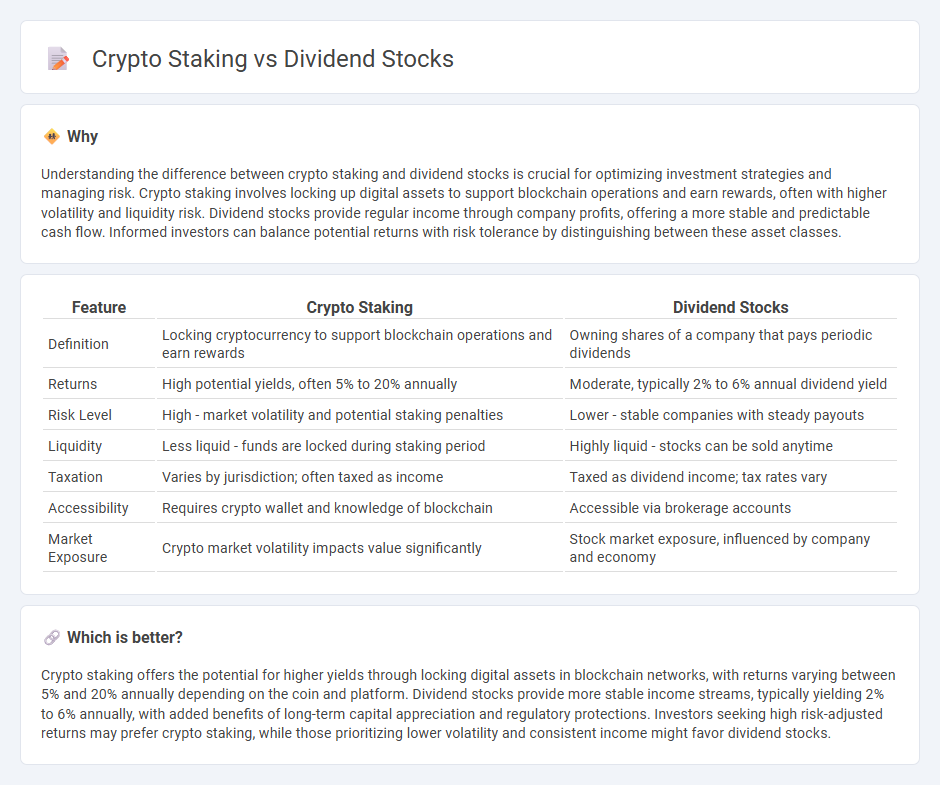

Understanding the difference between crypto staking and dividend stocks is crucial for optimizing investment strategies and managing risk. Crypto staking involves locking up digital assets to support blockchain operations and earn rewards, often with higher volatility and liquidity risk. Dividend stocks provide regular income through company profits, offering a more stable and predictable cash flow. Informed investors can balance potential returns with risk tolerance by distinguishing between these asset classes.

Comparison Table

| Feature | Crypto Staking | Dividend Stocks |

|---|---|---|

| Definition | Locking cryptocurrency to support blockchain operations and earn rewards | Owning shares of a company that pays periodic dividends |

| Returns | High potential yields, often 5% to 20% annually | Moderate, typically 2% to 6% annual dividend yield |

| Risk Level | High - market volatility and potential staking penalties | Lower - stable companies with steady payouts |

| Liquidity | Less liquid - funds are locked during staking period | Highly liquid - stocks can be sold anytime |

| Taxation | Varies by jurisdiction; often taxed as income | Taxed as dividend income; tax rates vary |

| Accessibility | Requires crypto wallet and knowledge of blockchain | Accessible via brokerage accounts |

| Market Exposure | Crypto market volatility impacts value significantly | Stock market exposure, influenced by company and economy |

Which is better?

Crypto staking offers the potential for higher yields through locking digital assets in blockchain networks, with returns varying between 5% and 20% annually depending on the coin and platform. Dividend stocks provide more stable income streams, typically yielding 2% to 6% annually, with added benefits of long-term capital appreciation and regulatory protections. Investors seeking high risk-adjusted returns may prefer crypto staking, while those prioritizing lower volatility and consistent income might favor dividend stocks.

Connection

Crypto staking and dividend stocks are connected through their shared goal of generating passive income by holding assets. Both methods involve locking capital--staking cryptocurrencies in blockchain networks or owning dividend-paying stocks--to earn regular rewards or payments. This strategy appeals to investors seeking consistent returns without frequent trading or active management.

Key Terms

Yield

Dividend stocks typically offer consistent yields through regular payouts, averaging 2% to 6% annually depending on the sector and company stability. Crypto staking yields are often higher, ranging from 5% to 20%, but come with increased market volatility and regulatory risks. Explore detailed comparisons to determine which yield strategy aligns best with your investment goals.

Volatility

Dividend stocks typically offer lower volatility and more stable returns, providing consistent income through regular dividend payments. Crypto staking involves locking up cryptocurrency assets to earn rewards, but it exposes investors to higher price fluctuations and market uncertainty. Explore the detailed risks and benefits of each investment method to make informed financial decisions.

Liquidity

Dividend stocks provide regular income and higher liquidity due to established stock exchanges allowing easy buying and selling within trading hours. Crypto staking offers potential rewards but often requires locking tokens for a fixed period, reducing liquidity compared to traditional dividends. Explore the trade-offs between liquidity and returns to determine which aligns better with your investment strategy.

Source and External Links

The 10 Best US Dividend Stocks - Leading US dividend stocks include ExxonMobil, Johnson & Johnson, Merck, PepsiCo, ConocoPhillips, Medtronic, and Lockheed Martin, with Medtronic offering a 3.21% yield and 46 consecutive years of dividend increases, and Lockheed Martin providing a 2.68% yield backed by a wide economic moat and stable defense contracts.

12 Best Oil and Gas Dividend Stocks to Buy Now - BP p.l.c. stands out with a high 6.13% dividend yield, a commitment to annual dividend growth of at least 4%, and active share buyback programs, alongside ongoing cost reduction efforts to bolster profitability.

Top Dividend Stocks To Consider - July 20th - Chevron, UnitedHealth Group, and ExxonMobil are highlighted as top dividend stocks to watch due to their high trading volumes and consistent profit distributions to shareholders.

dowidth.com

dowidth.com