Secondaries in venture capital involve purchasing existing stakes from early investors, providing liquidity without relying on initial public offerings. Crowdfunding enables startups to raise capital from a broad base of individual investors, often through online platforms, democratizing early-stage investment. Explore the advantages and challenges of each method to optimize your investment strategy.

Why it is important

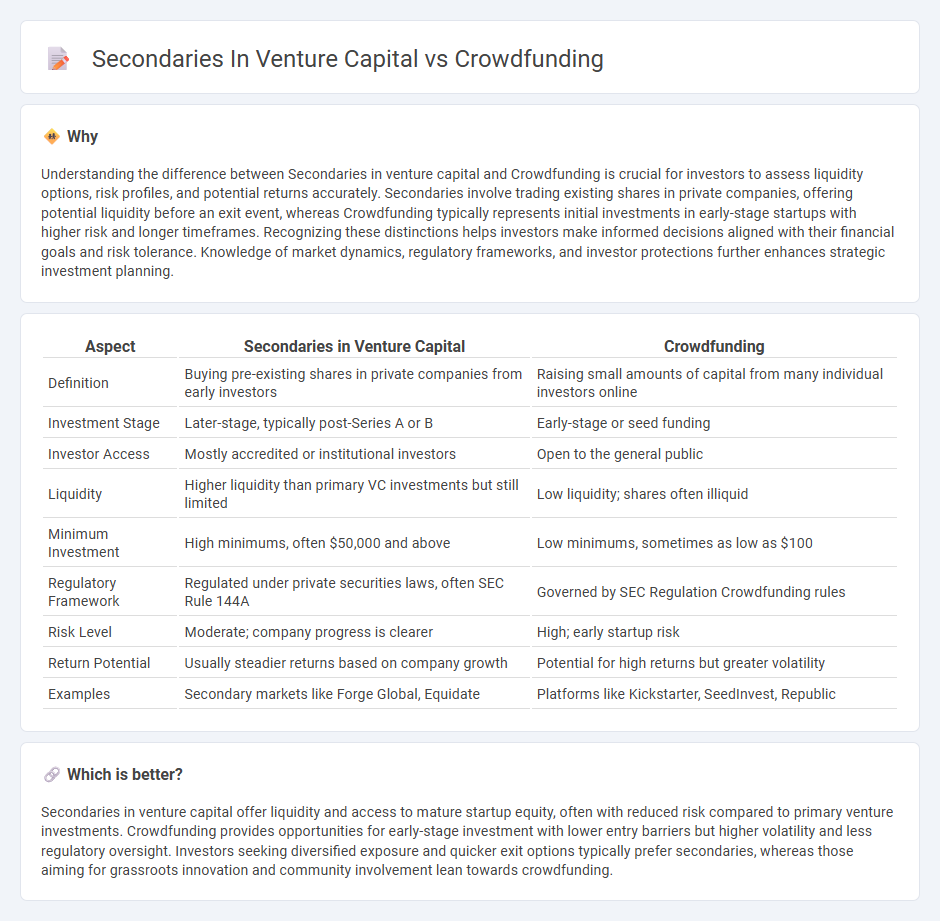

Understanding the difference between Secondaries in venture capital and Crowdfunding is crucial for investors to assess liquidity options, risk profiles, and potential returns accurately. Secondaries involve trading existing shares in private companies, offering potential liquidity before an exit event, whereas Crowdfunding typically represents initial investments in early-stage startups with higher risk and longer timeframes. Recognizing these distinctions helps investors make informed decisions aligned with their financial goals and risk tolerance. Knowledge of market dynamics, regulatory frameworks, and investor protections further enhances strategic investment planning.

Comparison Table

| Aspect | Secondaries in Venture Capital | Crowdfunding |

|---|---|---|

| Definition | Buying pre-existing shares in private companies from early investors | Raising small amounts of capital from many individual investors online |

| Investment Stage | Later-stage, typically post-Series A or B | Early-stage or seed funding |

| Investor Access | Mostly accredited or institutional investors | Open to the general public |

| Liquidity | Higher liquidity than primary VC investments but still limited | Low liquidity; shares often illiquid |

| Minimum Investment | High minimums, often $50,000 and above | Low minimums, sometimes as low as $100 |

| Regulatory Framework | Regulated under private securities laws, often SEC Rule 144A | Governed by SEC Regulation Crowdfunding rules |

| Risk Level | Moderate; company progress is clearer | High; early startup risk |

| Return Potential | Usually steadier returns based on company growth | Potential for high returns but greater volatility |

| Examples | Secondary markets like Forge Global, Equidate | Platforms like Kickstarter, SeedInvest, Republic |

Which is better?

Secondaries in venture capital offer liquidity and access to mature startup equity, often with reduced risk compared to primary venture investments. Crowdfunding provides opportunities for early-stage investment with lower entry barriers but higher volatility and less regulatory oversight. Investors seeking diversified exposure and quicker exit options typically prefer secondaries, whereas those aiming for grassroots innovation and community involvement lean towards crowdfunding.

Connection

Secondaries in venture capital and crowdfunding intersect as both provide alternative liquidity mechanisms for investors in private companies. Venture capital secondaries enable the buying and selling of pre-existing shares, offering liquidity to early investors, while crowdfunding platforms allow a broader range of participants to invest in startups at initial funding stages. This connection enhances market efficiency by enabling continuous capital flow and diversified investor participation throughout a company's growth lifecycle.

Key Terms

Equity Ownership

Equity ownership in venture capital varies significantly between crowdfunding platforms and secondary market transactions. Crowdfunding allows early-stage investors to acquire fractional equity directly in startups, often resulting in highly diluted shares but greater access to emerging companies. Explore the nuances of equity stakes in both methods to make informed investment decisions.

Liquidity

Liquidity in venture capital significantly differs between crowdfunding and secondaries, with crowdfunding offering initial access to early-stage investments but limited liquidity due to longer lock-up periods. Secondaries provide enhanced liquidity options by enabling investors to buy and sell existing shares in the market, often accelerating return timelines and improving portfolio flexibility. Explore these dynamics further to understand how liquidity impacts your venture capital investment strategy.

Investor Access

Crowdfunding platforms democratize venture capital investing by allowing retail investors to participate in early-stage funding rounds, often with lower minimum investments compared to traditional venture capital secondaries. Secondary markets provide liquidity by enabling investors to buy and sell pre-existing shares in private companies, granting access to more mature investments with reduced risk profiles. Explore the nuances of investor access in crowdfunding and secondaries to optimize your venture capital strategy.

Source and External Links

Crowdfunding (Wikipedia) - Crowdfunding is the practice of funding a project or venture by raising money from a large number of people, typically via the internet, bypassing traditional financial intermediaries.

What is crowdfunding? Here are four types to know (Stripe) - Crowdfunding enables startups and projects to raise funds collectively from a broad online audience rather than relying on a small group of traditional investors.

Small Business Financing: A Resource Guide: Crowdfunding (Library of Congress) - Crowdfunding uses online platforms to gather small contributions from many individuals, often through donation, reward, equity, or peer-to-peer lending models.

dowidth.com

dowidth.com