Fractionalized art investment allows multiple investors to own shares of valuable artworks, offering liquidity and diversification unlike traditional investment in classic watches, which generally require a higher capital outlay and involve ownership of a single, physical asset. Classic watches often appreciate based on brand heritage, rarity, and condition, while fractionalized art leverages blockchain technology to enable easier access and tradeability of expensive pieces. Explore the advantages and challenges of both investment types to determine which aligns best with your financial goals.

Why it is important

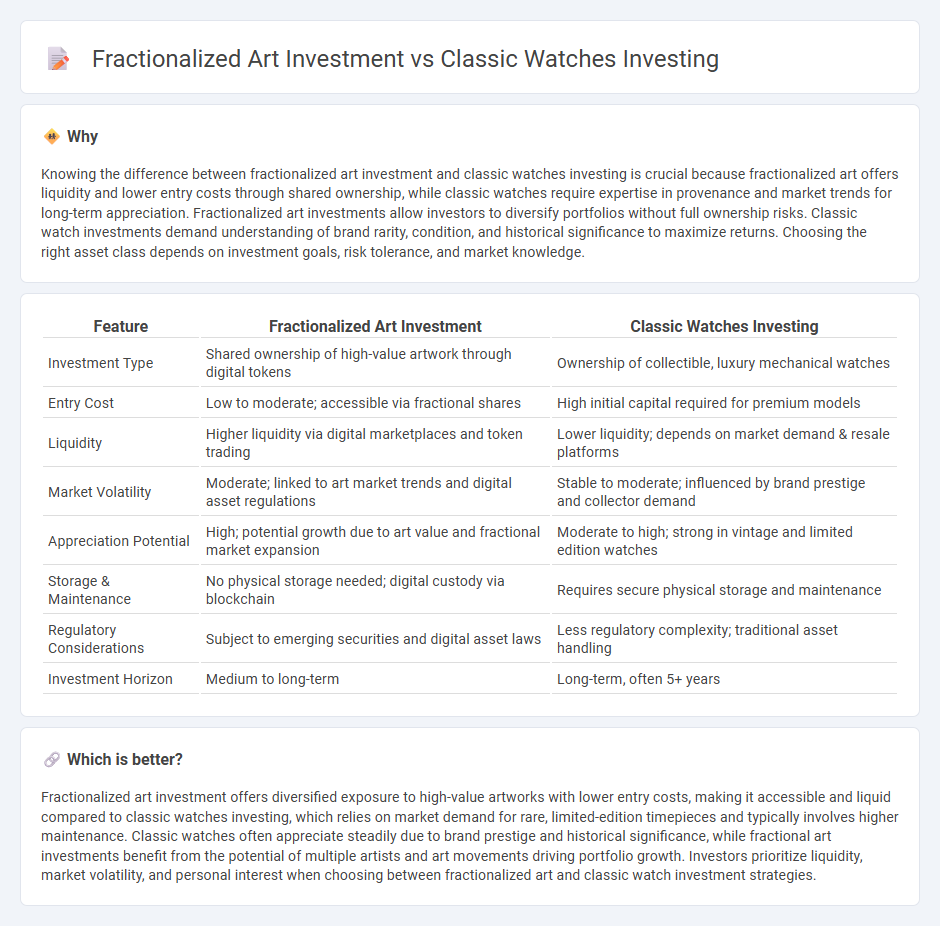

Knowing the difference between fractionalized art investment and classic watches investing is crucial because fractionalized art offers liquidity and lower entry costs through shared ownership, while classic watches require expertise in provenance and market trends for long-term appreciation. Fractionalized art investments allow investors to diversify portfolios without full ownership risks. Classic watch investments demand understanding of brand rarity, condition, and historical significance to maximize returns. Choosing the right asset class depends on investment goals, risk tolerance, and market knowledge.

Comparison Table

| Feature | Fractionalized Art Investment | Classic Watches Investing |

|---|---|---|

| Investment Type | Shared ownership of high-value artwork through digital tokens | Ownership of collectible, luxury mechanical watches |

| Entry Cost | Low to moderate; accessible via fractional shares | High initial capital required for premium models |

| Liquidity | Higher liquidity via digital marketplaces and token trading | Lower liquidity; depends on market demand & resale platforms |

| Market Volatility | Moderate; linked to art market trends and digital asset regulations | Stable to moderate; influenced by brand prestige and collector demand |

| Appreciation Potential | High; potential growth due to art value and fractional market expansion | Moderate to high; strong in vintage and limited edition watches |

| Storage & Maintenance | No physical storage needed; digital custody via blockchain | Requires secure physical storage and maintenance |

| Regulatory Considerations | Subject to emerging securities and digital asset laws | Less regulatory complexity; traditional asset handling |

| Investment Horizon | Medium to long-term | Long-term, often 5+ years |

Which is better?

Fractionalized art investment offers diversified exposure to high-value artworks with lower entry costs, making it accessible and liquid compared to classic watches investing, which relies on market demand for rare, limited-edition timepieces and typically involves higher maintenance. Classic watches often appreciate steadily due to brand prestige and historical significance, while fractional art investments benefit from the potential of multiple artists and art movements driving portfolio growth. Investors prioritize liquidity, market volatility, and personal interest when choosing between fractionalized art and classic watch investment strategies.

Connection

Fractionalized art investment and classic watches investing both offer accessible entry points into luxury asset markets by enabling shared ownership and liquidity. They appeal to investors seeking diversification through tangible, appreciating assets with historical and aesthetic value. Market trends show growing interest in fractional ownership models, which democratize high-value collectibles while maintaining potential for capital gains.

Key Terms

Classic watches investing:

Classic watch investing offers a tangible asset with a proven history of value appreciation, especially models from renowned brands like Rolex, Patek Philippe, and Audemars Piguet, which often see annual returns of 5-15%. Unlike fractionalized art investment that involves digital shares of art pieces, classic watches provide direct ownership and liquidity through auction houses and specialized dealers. Explore detailed market trends and expert tips to maximize your returns in classic watch investing.

Provenance

Classic watches investing relies heavily on detailed provenance records that authenticate the timepiece's history, maker, and previous ownership, ensuring value retention and appreciation. Fractionalized art investment also depends on provenance to verify artwork authenticity and ownership rights, enhancing investor confidence and market liquidity. Explore how provenance impacts both investment types to make informed decisions in luxury asset markets.

Rarity

Classic watch investing centers on acquiring rare timepieces from renowned brands like Rolex and Patek Philippe, whose limited production and historical significance drive their high market value. Fractionalized art investment allows multiple investors to own shares of exclusive, rare artworks, diversifying risks while accessing masterpieces typically reserved for elite collectors. Explore how rarity influences both markets and discover the distinct advantages of each investment type.

Source and External Links

How to Invest in Vintage Watches: A Complete Guide - Vintage watches can appreciate significantly in value and serve as a tangible asset for portfolio diversification, with new fractional investing models allowing smaller investors to partake in these luxury assets.

The Beginner's Guide to Watch Investing: How to Get Started - Kubera - Investing in watches can be done via physical timepieces, stocks in brands like Swatch Group or Richemont, or watch investing funds that pool capital to buy and sell watches, offering diversification and professional management.

Best Investment Watches: Top Timepieces for Value Growth - Iconic vintage models such as the Rolex Submariner Ref. 1680 are highlighted as top investment choices for their historical significance, limited availability, and strong appreciation potential in the collector market.

dowidth.com

dowidth.com