NFT domain names represent unique digital assets secured on blockchain technology, offering liquidity and ease of transfer compared to traditional startup equity, which involves ownership shares subject to dilution and regulatory requirements. While startup equity provides potential dividends and voting rights, NFT domain names capitalize on digital scarcity and brand value in emerging Web3 economies. Explore the nuanced benefits and risks of both to optimize your investment strategy.

Why it is important

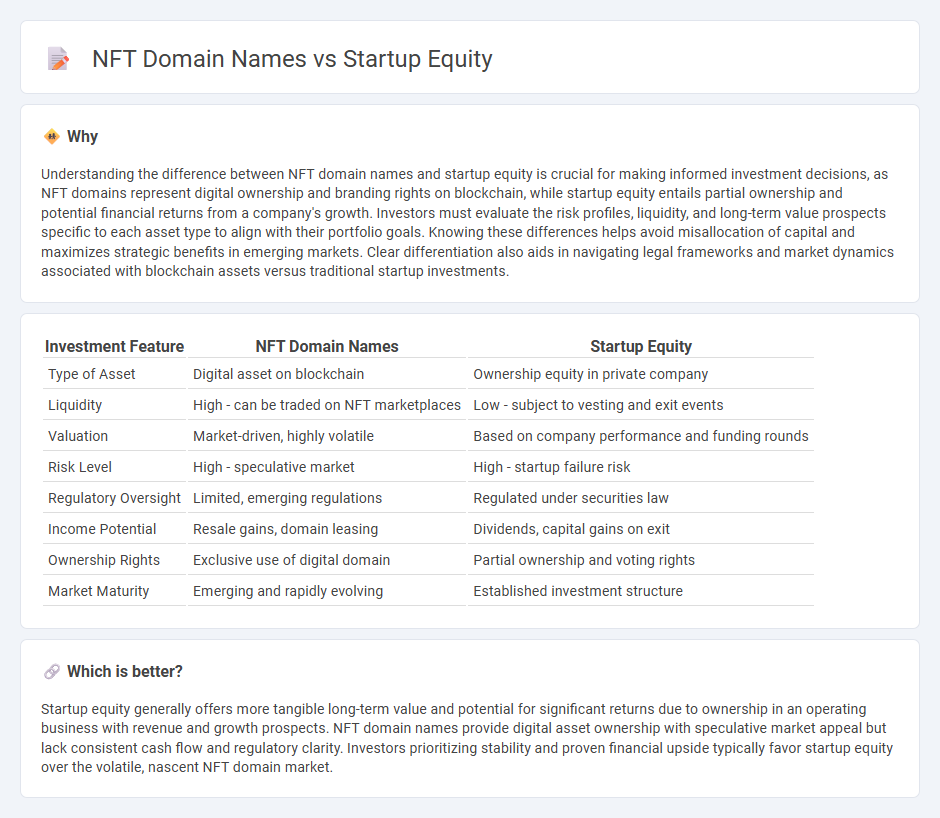

Understanding the difference between NFT domain names and startup equity is crucial for making informed investment decisions, as NFT domains represent digital ownership and branding rights on blockchain, while startup equity entails partial ownership and potential financial returns from a company's growth. Investors must evaluate the risk profiles, liquidity, and long-term value prospects specific to each asset type to align with their portfolio goals. Knowing these differences helps avoid misallocation of capital and maximizes strategic benefits in emerging markets. Clear differentiation also aids in navigating legal frameworks and market dynamics associated with blockchain assets versus traditional startup investments.

Comparison Table

| Investment Feature | NFT Domain Names | Startup Equity |

|---|---|---|

| Type of Asset | Digital asset on blockchain | Ownership equity in private company |

| Liquidity | High - can be traded on NFT marketplaces | Low - subject to vesting and exit events |

| Valuation | Market-driven, highly volatile | Based on company performance and funding rounds |

| Risk Level | High - speculative market | High - startup failure risk |

| Regulatory Oversight | Limited, emerging regulations | Regulated under securities law |

| Income Potential | Resale gains, domain leasing | Dividends, capital gains on exit |

| Ownership Rights | Exclusive use of digital domain | Partial ownership and voting rights |

| Market Maturity | Emerging and rapidly evolving | Established investment structure |

Which is better?

Startup equity generally offers more tangible long-term value and potential for significant returns due to ownership in an operating business with revenue and growth prospects. NFT domain names provide digital asset ownership with speculative market appeal but lack consistent cash flow and regulatory clarity. Investors prioritizing stability and proven financial upside typically favor startup equity over the volatile, nascent NFT domain market.

Connection

NFT domain names represent unique blockchain-based digital assets that can enhance startup equity by providing verifiable ownership and branding opportunities. Startups leveraging NFT domains can attract investors by showcasing innovative intellectual property tied to blockchain technology, thereby increasing perceived valuation. Integrating NFT domains within startup portfolios aligns with emerging trends in digital asset investment, potentially boosting liquidity and market exposure.

Key Terms

Ownership

Startup equity grants investors or founders partial ownership and profit-sharing rights within a company, often accompanied by voting power and potential financial returns. In contrast, NFT domain names represent digital assets secured on blockchain technology, providing unique, transferable ownership of web addresses without equity in an underlying business. Explore how these distinct ownership models impact value creation and control by learning more about startup equity and NFT domain rights.

Liquidity

Startup equity often lacks liquidity due to lengthy vesting schedules and restricted trading options, typically locking value for years. NFT domain names provide immediate liquidity through decentralized marketplaces, enabling instant buying, selling, or leasing without intermediaries. Explore how liquidity considerations can influence your investment strategy in emerging digital assets.

Intellectual Property

Startup equity represents ownership in a company, granting shareholders rights to profits and control tied to the business's growth and innovation. NFT domain names function as unique digital assets on the blockchain, offering verifiable ownership and potential commercial value specifically linked to online identity and branding. Explore how these distinct forms of intellectual property influence startup strategies and digital asset management.

Source and External Links

Managing startup equity: Answers to key questions - Explains how startup equity represents ownership in a company and how it is distributed among founders, investors, and employees based on roles, company stage, and risk taken.

How to split equity among startup cofounders - Highlights the complexity and importance of equitable equity allocation among cofounders, suggesting several methods like equal splits, weighted contributions, and performance-based structures.

A Guide to Startup Equity Compensation - Details how startups use equity as compensation to attract and retain talent when cash is limited, with employees receiving a stake that may pay off in future events like an acquisition or IPO.

dowidth.com

dowidth.com