Tangible asset tokenization transforms physical assets like real estate, art, or commodities into digital tokens on a blockchain, enabling enhanced liquidity, fractional ownership, and reduced transaction costs compared to traditional securities. Traditional securities, such as stocks and bonds, represent ownership or creditor relationships in companies but often face limitations in transferability and access for smaller investors. Discover how these innovative investment methods can redefine your portfolio strategy.

Why it is important

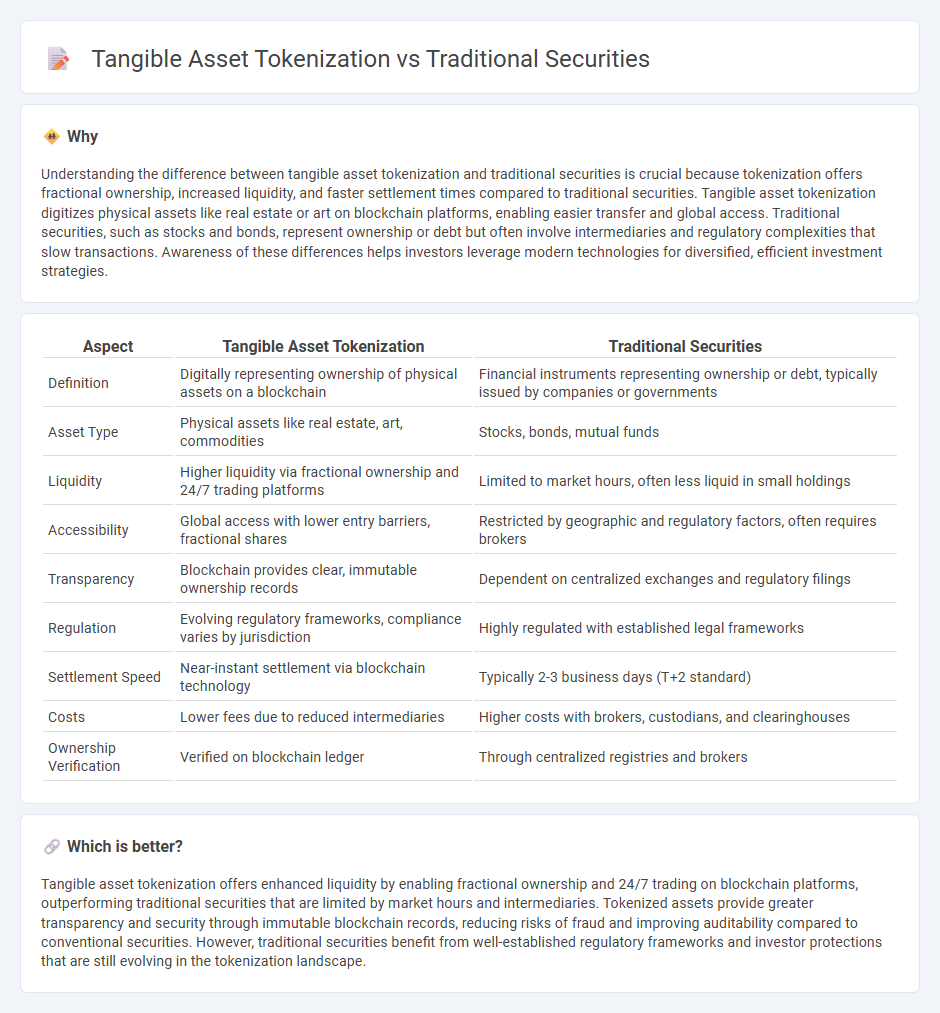

Understanding the difference between tangible asset tokenization and traditional securities is crucial because tokenization offers fractional ownership, increased liquidity, and faster settlement times compared to traditional securities. Tangible asset tokenization digitizes physical assets like real estate or art on blockchain platforms, enabling easier transfer and global access. Traditional securities, such as stocks and bonds, represent ownership or debt but often involve intermediaries and regulatory complexities that slow transactions. Awareness of these differences helps investors leverage modern technologies for diversified, efficient investment strategies.

Comparison Table

| Aspect | Tangible Asset Tokenization | Traditional Securities |

|---|---|---|

| Definition | Digitally representing ownership of physical assets on a blockchain | Financial instruments representing ownership or debt, typically issued by companies or governments |

| Asset Type | Physical assets like real estate, art, commodities | Stocks, bonds, mutual funds |

| Liquidity | Higher liquidity via fractional ownership and 24/7 trading platforms | Limited to market hours, often less liquid in small holdings |

| Accessibility | Global access with lower entry barriers, fractional shares | Restricted by geographic and regulatory factors, often requires brokers |

| Transparency | Blockchain provides clear, immutable ownership records | Dependent on centralized exchanges and regulatory filings |

| Regulation | Evolving regulatory frameworks, compliance varies by jurisdiction | Highly regulated with established legal frameworks |

| Settlement Speed | Near-instant settlement via blockchain technology | Typically 2-3 business days (T+2 standard) |

| Costs | Lower fees due to reduced intermediaries | Higher costs with brokers, custodians, and clearinghouses |

| Ownership Verification | Verified on blockchain ledger | Through centralized registries and brokers |

Which is better?

Tangible asset tokenization offers enhanced liquidity by enabling fractional ownership and 24/7 trading on blockchain platforms, outperforming traditional securities that are limited by market hours and intermediaries. Tokenized assets provide greater transparency and security through immutable blockchain records, reducing risks of fraud and improving auditability compared to conventional securities. However, traditional securities benefit from well-established regulatory frameworks and investor protections that are still evolving in the tokenization landscape.

Connection

Tangible asset tokenization transforms physical assets like real estate, art, or commodities into digital tokens, enabling fractional ownership and enhanced liquidity through blockchain technology. Traditional securities represent ownership or creditor relationships in companies or debt instruments but often face liquidity and accessibility limitations. By integrating tangible asset tokenization with traditional securities frameworks, investors gain improved transparency, efficiency, and new avenues for diversification and capital raising.

Key Terms

Ownership Structure

Traditional securities represent ownership through centralized entities and require intermediaries such as brokers or custodians, often leading to longer settlement times and less liquidity. Tangible asset tokenization leverages blockchain technology to create fractional ownership via digital tokens, enabling real-time transfers, increased transparency, and broader investor access. Explore the transformative impact of tokenization on ownership structures and investment opportunities.

Liquidity

Traditional securities often face liquidity constraints due to lengthy settlement processes and limited trading hours. Tangible asset tokenization enhances liquidity by enabling fractional ownership and 24/7 trading on blockchain platforms, reducing settlement times from days to minutes. Explore how tokenization revolutionizes liquidity in asset markets.

Custody

Traditional securities require centralized custody through regulated financial institutions, which involves complex compliance and security measures. Tangible asset tokenization leverages blockchain technology to enable decentralized, transparent custody solutions, reducing intermediaries and enhancing accessibility. Discover how innovative custody models in tokenization transform asset security and management.

Source and External Links

How to set up Traditional Securities - Class Support - Traditional securities are financial instruments like bonds, debentures, bills of exchange, and promissory notes that are not issued at significant discounts, bear no deferred interest, and are not capital indexed, with gains taxed as ordinary income rather than capital gains.

What Are Different Types of Investment Securities? - Charles Schwab - Traditional securities broadly include equity securities such as stocks and fixed income securities such as bonds, notes, and money market instruments used by corporations or governments to raise capital.

Traditional securities - Sygnum Bank - Traditional securities encompass a broad range of assets including global equities, bonds, ETFs, and ETPs, which can be integrated with digital asset holdings via regulated platforms offering consolidated access and liquidity.

dowidth.com

dowidth.com