Wine investing offers potential high returns through appreciation of rare vintages and limited editions, driven by global demand in luxury markets. Timberland investing provides stable, long-term income via sustainable forestry and land value appreciation, benefiting from environmental and industrial trends. Explore the unique advantages and risks of wine and timberland investments to diversify your portfolio effectively.

Why it is important

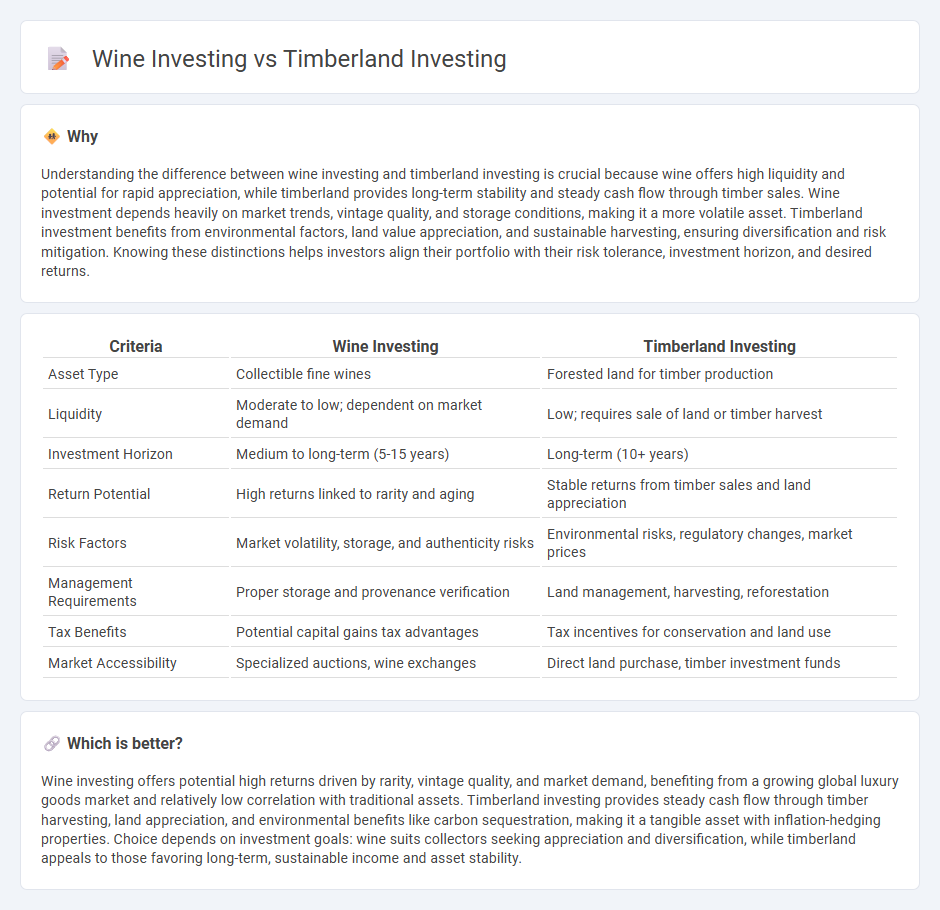

Understanding the difference between wine investing and timberland investing is crucial because wine offers high liquidity and potential for rapid appreciation, while timberland provides long-term stability and steady cash flow through timber sales. Wine investment depends heavily on market trends, vintage quality, and storage conditions, making it a more volatile asset. Timberland investment benefits from environmental factors, land value appreciation, and sustainable harvesting, ensuring diversification and risk mitigation. Knowing these distinctions helps investors align their portfolio with their risk tolerance, investment horizon, and desired returns.

Comparison Table

| Criteria | Wine Investing | Timberland Investing |

|---|---|---|

| Asset Type | Collectible fine wines | Forested land for timber production |

| Liquidity | Moderate to low; dependent on market demand | Low; requires sale of land or timber harvest |

| Investment Horizon | Medium to long-term (5-15 years) | Long-term (10+ years) |

| Return Potential | High returns linked to rarity and aging | Stable returns from timber sales and land appreciation |

| Risk Factors | Market volatility, storage, and authenticity risks | Environmental risks, regulatory changes, market prices |

| Management Requirements | Proper storage and provenance verification | Land management, harvesting, reforestation |

| Tax Benefits | Potential capital gains tax advantages | Tax incentives for conservation and land use |

| Market Accessibility | Specialized auctions, wine exchanges | Direct land purchase, timber investment funds |

Which is better?

Wine investing offers potential high returns driven by rarity, vintage quality, and market demand, benefiting from a growing global luxury goods market and relatively low correlation with traditional assets. Timberland investing provides steady cash flow through timber harvesting, land appreciation, and environmental benefits like carbon sequestration, making it a tangible asset with inflation-hedging properties. Choice depends on investment goals: wine suits collectors seeking appreciation and diversification, while timberland appeals to those favoring long-term, sustainable income and asset stability.

Connection

Wine investing and timberland investing both represent alternative asset classes that offer portfolio diversification and inflation hedging benefits due to their tangible nature and limited supply. These investments are linked through their reliance on natural resources, long-term growth potential, and sensitivity to global economic trends and climate conditions. Investors leverage the unique characteristics of wine and timberland assets to balance traditional stock and bond exposure with sustainable, physical commodities.

Key Terms

**Timberland Investing:**

Timberland investing offers stable long-term returns through the appreciation of forest land and sustainable timber harvesting, diversifying portfolios with assets uncorrelated to stock market volatility. Investors benefit from environmental incentives, carbon credits, and growing global demand for wood products, enhancing portfolio resilience. Explore the detailed benefits and risks of timberland investing to make informed decisions.

Sustainable Yield

Timberland investing offers sustainable yield through regular harvesting cycles that maintain forest health and carbon sequestration, making it a carbon-negative asset with stable long-term returns. Wine investing relies on vintage quality, rarity, and market trends, providing potential appreciation but with higher volatility and less predictable income. Explore the comparative benefits of timberland and wine investments for sustainable yield and portfolio diversification.

Land Valuation

Timberland investing involves purchasing forested land primarily valued for timber production, with key factors like soil quality, species mix, and sustainable growth rates influencing land valuation. Wine investing focuses on vineyard land where terroir elements such as soil composition, climate, and topography significantly affect grape quality and vineyard worth. Explore detailed comparisons of land valuation criteria to make informed decisions in timberland and wine investments.

Source and External Links

Timberland - Overview, How to Diversify, Benefits of Investing - Timberland investing involves putting money into managed tree plantations or natural forests, offering portfolio diversification and predictable biological growth as trees increase in value over time.

Timberland - J.P. Morgan Asset Management - Investing in timberland provides inflation protection, regular income from harvested logs, and low correlation with traditional asset classes, while sustainable forestry practices also deliver environmental benefits.

What's the Return on Timber Investments? - AcreTrader - Timberland returns typically range from 2% to 6% per quarter, generated through timber harvests, land resale, and potential non-timber income, with active management and local expertise key to maximizing performance.

dowidth.com

dowidth.com