Sports memorabilia funds offer investors tangible assets with historical significance, often appreciating through rarity and fan demand, while music rights funds generate steady income streams by licensing royalties from popular songs and catalogs. Both investment vehicles provide unique exposure to alternative markets but differ in liquidity, risk profile, and revenue consistency. Explore the nuances and potential returns of sports memorabilia versus music rights funds to identify the right fit for your portfolio.

Why it is important

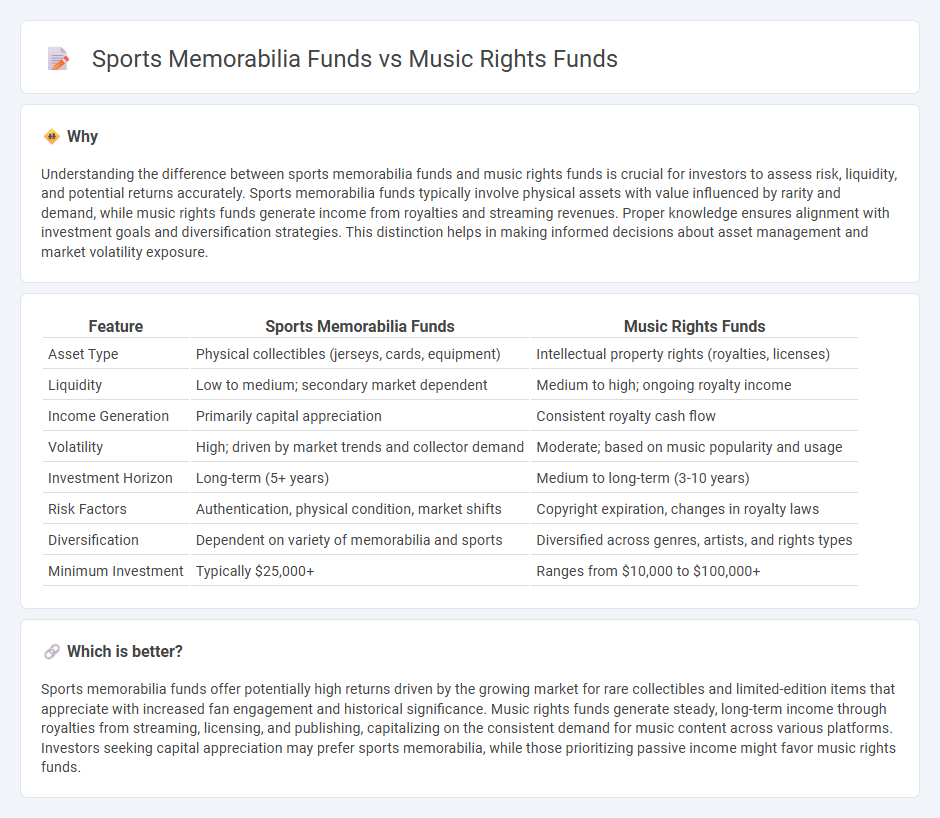

Understanding the difference between sports memorabilia funds and music rights funds is crucial for investors to assess risk, liquidity, and potential returns accurately. Sports memorabilia funds typically involve physical assets with value influenced by rarity and demand, while music rights funds generate income from royalties and streaming revenues. Proper knowledge ensures alignment with investment goals and diversification strategies. This distinction helps in making informed decisions about asset management and market volatility exposure.

Comparison Table

| Feature | Sports Memorabilia Funds | Music Rights Funds |

|---|---|---|

| Asset Type | Physical collectibles (jerseys, cards, equipment) | Intellectual property rights (royalties, licenses) |

| Liquidity | Low to medium; secondary market dependent | Medium to high; ongoing royalty income |

| Income Generation | Primarily capital appreciation | Consistent royalty cash flow |

| Volatility | High; driven by market trends and collector demand | Moderate; based on music popularity and usage |

| Investment Horizon | Long-term (5+ years) | Medium to long-term (3-10 years) |

| Risk Factors | Authentication, physical condition, market shifts | Copyright expiration, changes in royalty laws |

| Diversification | Dependent on variety of memorabilia and sports | Diversified across genres, artists, and rights types |

| Minimum Investment | Typically $25,000+ | Ranges from $10,000 to $100,000+ |

Which is better?

Sports memorabilia funds offer potentially high returns driven by the growing market for rare collectibles and limited-edition items that appreciate with increased fan engagement and historical significance. Music rights funds generate steady, long-term income through royalties from streaming, licensing, and publishing, capitalizing on the consistent demand for music content across various platforms. Investors seeking capital appreciation may prefer sports memorabilia, while those prioritizing passive income might favor music rights funds.

Connection

Sports memorabilia funds and music rights funds both capitalize on the growing alternative investment market by monetizing cultural assets with strong fan bases. These funds generate returns through appreciation in the value of collectible items or royalty income streams, leveraging the emotional and historical significance of sports and music. Institutional investors seek diversification and inflation hedges by including these niche assets in their portfolios.

Key Terms

**Music Rights Funds:**

Music rights funds offer investors a unique opportunity to earn passive income through royalties generated by copyrights on songs, albums, and artist catalogs, often providing stable and inflation-hedged returns. These funds leverage intellectual property assets, delivering cash flows from streaming, licensing, and synchronization deals, making them an innovative asset class in the alternative investments landscape. Explore how music rights funds can diversify your portfolio and capitalize on the growing global music industry.

Royalties

Music rights funds primarily generate returns through royalties collected from streaming, licensing, and public performances of songs, providing investors with ongoing passive income linked to popular catalogs. Sports memorabilia funds, while occasionally benefiting from licensing royalties, mainly rely on the appreciation of physical assets like signed jerseys or rare collectibles. Explore detailed insights on how royalties influence the investment dynamics between music rights and sports memorabilia funds.

Licensing

Music rights funds primarily generate revenue through licensing agreements that allow various media platforms to use compositions and recordings, ensuring consistent royalty payments to investors. Sports memorabilia funds focus less on licensing and more on the appreciation and resale value of collectibles, with limited licensing opportunities tied to branding and endorsements. Explore the distinct licensing mechanisms that define these investment vehicles for a deeper understanding.

Source and External Links

Music Royalty Funds: A New Way to Invest - Music royalty funds invest in existing music rights generating income by purchasing catalogs from artists, publishers, or estates, offering investors exposure to steady royalty income without direct involvement in the music industry.

A Comprehensive Guide to Music Investment Funds - Key players in music rights funds include Hipgnosis Songs Fund, Harbourview Equity, KKR, and Dundee Venture Capital, which manage billions and own catalogs with thousands of songs from major artists such as The Weeknd, Paul McCartney, and Shakira.

Key Players in Music Royalty Investments - Besides major funds like Hipgnosis and Primary Wave Music, institutional investors such as Blackstone are investing nearly $1 billion in music rights; smaller individual investors can also participate through marketplaces like Royalty Exchange, allowing access to diversified music royalty portfolios with transparency and historical earnings data.

dowidth.com

dowidth.com