Investing in wine offers the potential for substantial returns through the appreciation of rare and vintage bottles, appealing to collectors and connoisseurs who value tangible assets. Gold investing provides a hedge against inflation and economic uncertainty, with its longstanding reputation as a stable, liquid store of value in global markets. Explore the unique benefits and risks of wine and gold investing to diversify your portfolio effectively.

Why it is important

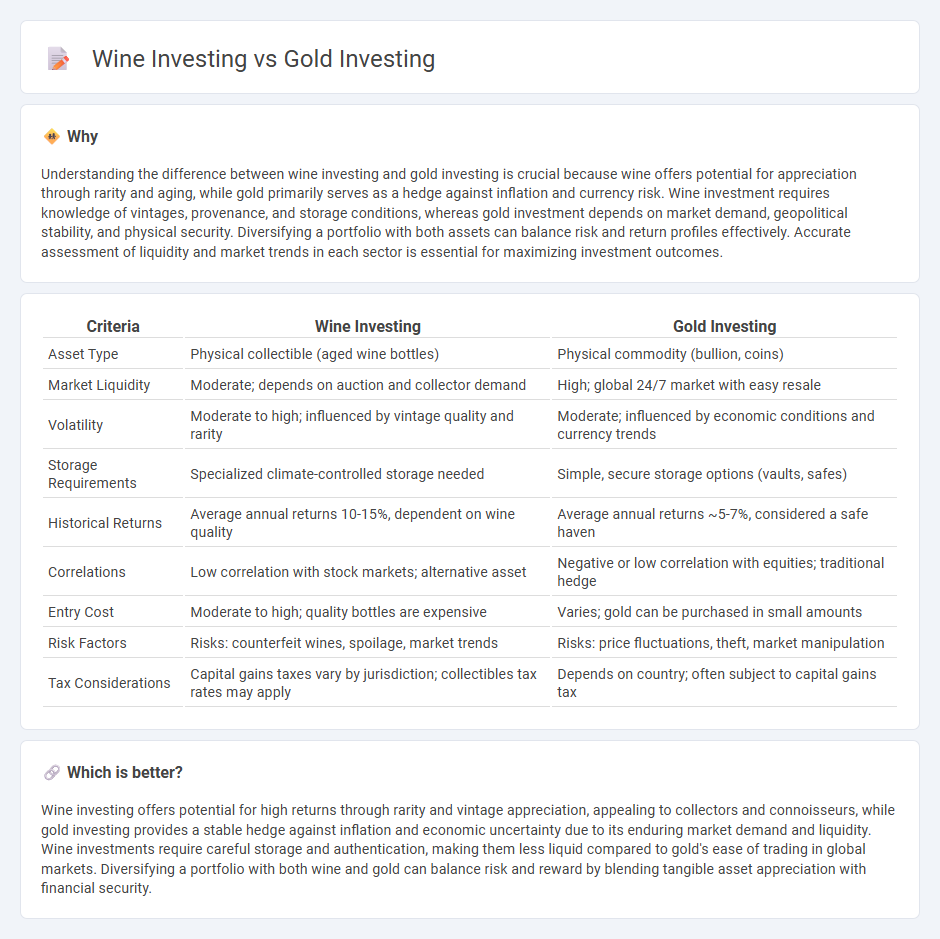

Understanding the difference between wine investing and gold investing is crucial because wine offers potential for appreciation through rarity and aging, while gold primarily serves as a hedge against inflation and currency risk. Wine investment requires knowledge of vintages, provenance, and storage conditions, whereas gold investment depends on market demand, geopolitical stability, and physical security. Diversifying a portfolio with both assets can balance risk and return profiles effectively. Accurate assessment of liquidity and market trends in each sector is essential for maximizing investment outcomes.

Comparison Table

| Criteria | Wine Investing | Gold Investing |

|---|---|---|

| Asset Type | Physical collectible (aged wine bottles) | Physical commodity (bullion, coins) |

| Market Liquidity | Moderate; depends on auction and collector demand | High; global 24/7 market with easy resale |

| Volatility | Moderate to high; influenced by vintage quality and rarity | Moderate; influenced by economic conditions and currency trends |

| Storage Requirements | Specialized climate-controlled storage needed | Simple, secure storage options (vaults, safes) |

| Historical Returns | Average annual returns 10-15%, dependent on wine quality | Average annual returns ~5-7%, considered a safe haven |

| Correlations | Low correlation with stock markets; alternative asset | Negative or low correlation with equities; traditional hedge |

| Entry Cost | Moderate to high; quality bottles are expensive | Varies; gold can be purchased in small amounts |

| Risk Factors | Risks: counterfeit wines, spoilage, market trends | Risks: price fluctuations, theft, market manipulation |

| Tax Considerations | Capital gains taxes vary by jurisdiction; collectibles tax rates may apply | Depends on country; often subject to capital gains tax |

Which is better?

Wine investing offers potential for high returns through rarity and vintage appreciation, appealing to collectors and connoisseurs, while gold investing provides a stable hedge against inflation and economic uncertainty due to its enduring market demand and liquidity. Wine investments require careful storage and authentication, making them less liquid compared to gold's ease of trading in global markets. Diversifying a portfolio with both wine and gold can balance risk and reward by blending tangible asset appreciation with financial security.

Connection

Wine investing and gold investing both serve as alternative assets that hedge against inflation and market volatility. Each offers tangible value with limited supply: fine wine appreciates as rare vintages mature, while gold maintains intrinsic worth as a precious metal with global demand. Investors diversify portfolios by blending wine's collectible appeal and gold's liquidity, balancing risk and enhancing long-term wealth preservation.

Key Terms

Liquidity

Gold investing offers high liquidity due to its widespread market presence and ease of buying and selling through various platforms including exchanges and dealers. Wine investing, while potentially lucrative, typically has lower liquidity because it involves specialized markets and longer holding periods before resale. Explore the nuances of liquidity differences to determine which investment suits your financial goals.

Storage

Gold requires secure, insured storage often facilitated by professional vault services, ensuring protection against theft and environmental damage. Wine investment demands climate-controlled cellars with precise temperature and humidity management to preserve quality and value over time. Explore comprehensive strategies to optimize storage for both asset types and maximize investment returns.

Valuation

Gold investing offers a relatively stable valuation influenced by global economic factors and inflation trends, maintaining liquidity and universal acceptance. Wine investing, particularly fine wine, relies on rarity, vintage quality, and provenance, often yielding higher but more volatile returns tied to market demand and collector interest. Explore detailed comparisons to understand which investment matches your portfolio strategy better.

Source and External Links

How to Buy Gold to Diversify Your Portfolio | Charles Schwab - Gold investing can diversify your portfolio through physical gold (bars and coins), gold mining stocks, or gold ETFs, offering a hedge against systemic risk due to gold's low correlation with traditional assets.

How to buy gold: 2 ways to invest in gold | Fidelity - The two main approaches are physical gold ownership and financial investments such as gold ETFs, mutual funds, and gold stocks, with ETFs providing a simpler way to invest without holding the metal physically.

An Introduction to Gold Investment | The Royal Mint - You can invest in gold via physical coins and bars of varying sizes or through digital trading platforms, with physical gold requiring secure storage which can be at home or with a custodian like The Royal Mint's vault.

dowidth.com

dowidth.com