Social token investment represents a growing trend in the digital asset space, allowing holders to participate in community-driven projects and brand engagement through blockchain-based tokens. NFT investment focuses on acquiring unique digital assets such as art, collectibles, or virtual real estate with provable ownership and scarcity on the blockchain. Explore the distinct opportunities and risks associated with social token and NFT investments to make informed decisions.

Why it is important

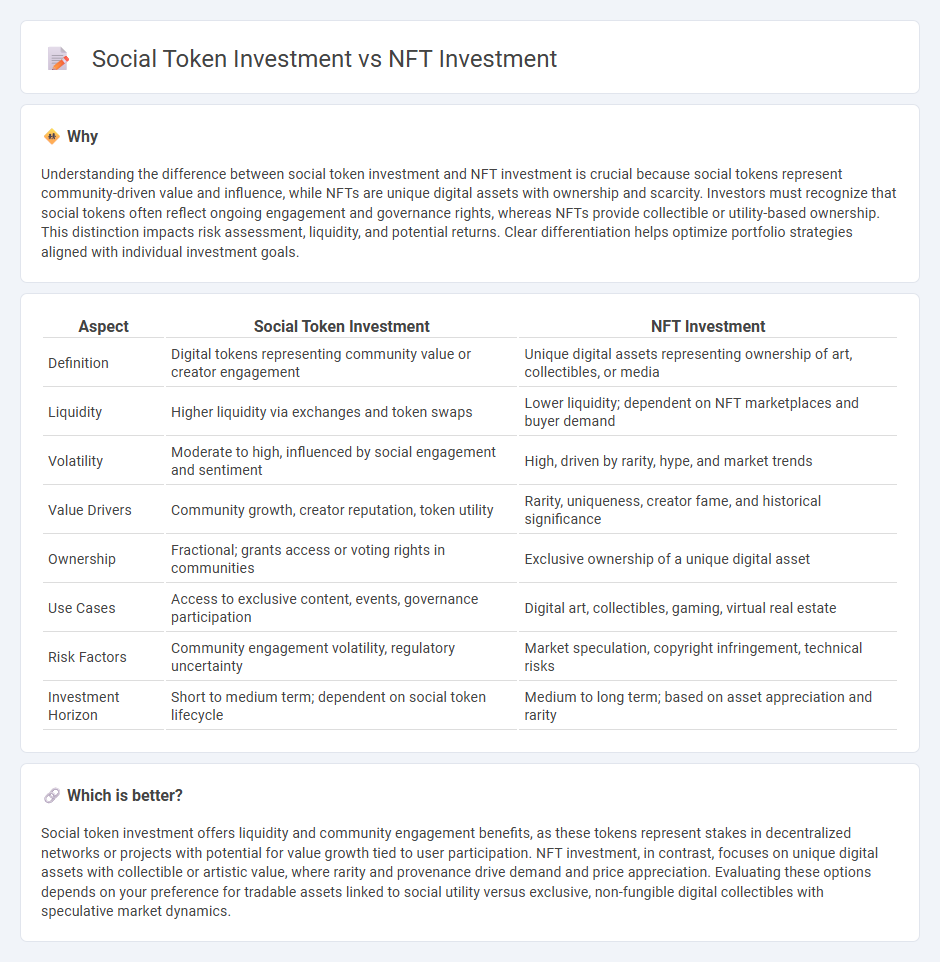

Understanding the difference between social token investment and NFT investment is crucial because social tokens represent community-driven value and influence, while NFTs are unique digital assets with ownership and scarcity. Investors must recognize that social tokens often reflect ongoing engagement and governance rights, whereas NFTs provide collectible or utility-based ownership. This distinction impacts risk assessment, liquidity, and potential returns. Clear differentiation helps optimize portfolio strategies aligned with individual investment goals.

Comparison Table

| Aspect | Social Token Investment | NFT Investment |

|---|---|---|

| Definition | Digital tokens representing community value or creator engagement | Unique digital assets representing ownership of art, collectibles, or media |

| Liquidity | Higher liquidity via exchanges and token swaps | Lower liquidity; dependent on NFT marketplaces and buyer demand |

| Volatility | Moderate to high, influenced by social engagement and sentiment | High, driven by rarity, hype, and market trends |

| Value Drivers | Community growth, creator reputation, token utility | Rarity, uniqueness, creator fame, and historical significance |

| Ownership | Fractional; grants access or voting rights in communities | Exclusive ownership of a unique digital asset |

| Use Cases | Access to exclusive content, events, governance participation | Digital art, collectibles, gaming, virtual real estate |

| Risk Factors | Community engagement volatility, regulatory uncertainty | Market speculation, copyright infringement, technical risks |

| Investment Horizon | Short to medium term; dependent on social token lifecycle | Medium to long term; based on asset appreciation and rarity |

Which is better?

Social token investment offers liquidity and community engagement benefits, as these tokens represent stakes in decentralized networks or projects with potential for value growth tied to user participation. NFT investment, in contrast, focuses on unique digital assets with collectible or artistic value, where rarity and provenance drive demand and price appreciation. Evaluating these options depends on your preference for tradable assets linked to social utility versus exclusive, non-fungible digital collectibles with speculative market dynamics.

Connection

Social token investment and NFT investment intersect through blockchain technology, enabling digital ownership and community-driven value exchange. Both leverage decentralized platforms to create unique, tradable assets that empower creators and investors with transparent, verifiable provenance. The convergence fosters innovative economic models where social tokens can represent fractionalized NFT stakes, enhancing liquidity and community engagement in digital ecosystems.

Key Terms

NFT investment:

NFT investment offers ownership of unique digital assets secured on the blockchain, providing rarity and provenance that traditional investments lack. Market trends show increasing demand for NFTs in art, gaming, and collectibles, making them a dynamic opportunity for portfolio diversification. Explore how NFT investment can enhance your digital asset strategy and capitalize on emerging blockchain technologies.

Ownership

NFT investment offers unique digital asset ownership with verifiable scarcity and provenance recorded on a blockchain. Social token investment represents fractional ownership or access within a community, enabling holders to influence governance or receive exclusive benefits. Explore the distinctions in ownership structures to make informed decisions about digital asset investments.

Rarity

NFT investments derive value primarily from the rarity and uniqueness of each token, often represented by exclusive digital art or collectibles verified on blockchain networks like Ethereum. Social tokens, while also leveraging scarcity, typically link to communal engagement and participation within a creator's ecosystem, granting holders special access or influence. Explore how the interplay of scarcity and utility shapes these investment opportunities to understand which aligns best with your portfolio goals.

Source and External Links

What is an NFT? How to trade and invest in NFTs? - NAGA - NFTs offer easy global access, secured and transparent ownership via blockchain, and potential portfolio diversification, but they lack regulation, can be highly volatile, incur transaction fees, and are not a traditional asset class, making them a risky investment.

NFT Financial Advisor | NFT Investment Platforms For Digital Assets - NFTs have revolutionized digital ownership across art, gaming, music, fashion, and virtual real estate, creating new investment opportunities by tokenizing unique digital assets and enabling secure ownership verification on blockchain platforms.

How to Buy an NFT: A Beginner's Guide - Business Insider - Investing in NFTs requires setting up a crypto wallet, funding it with cryptocurrency (often Ethereum), connecting to an NFT marketplace, and purchasing NFTs either through fixed prices or auctions, while exercising caution due to misinformation risks.

dowidth.com

dowidth.com